Question: . The NPV method com pares the present value of cash inflows ina project with the present values cash outflows of the project. The value

.

.

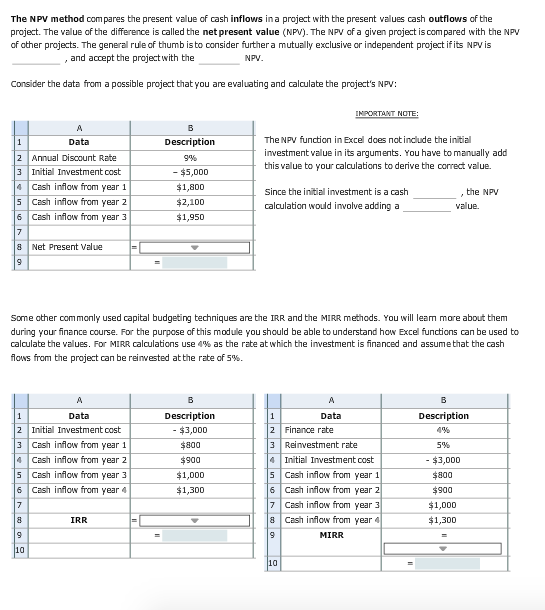

The NPV method com pares the present value of cash inflows ina project with the present values cash outflows of the project. The value of the difference is called the net present value (NPV). The NPV of a given project is com pared with the NPV of other projects. The general rule of thumb is to consider further a mutually exclusive or independent project if its NPV is , and accept the project with the NPV Consider the data from a possible project that you are evaluating and calculate the project's NPV: The NPV function in Excel does notinclude the initial Description Data investment value in its arguments. You have to manually add 2 Annual Discount Rate 9% this value to your calculations to derive the correct value. 3 Initia Investment cost - $5,000 cash inflow from year 1 $1,800 Since the initial investment is a cash the NPV 5 Cash inflow from year 2 $2,100 calculation would involve adding a alue 6 Cash inflow from year 3 $1,950 8 Net Present Value Some other com monly used capital budgeting techniques are the IRR and the MIRR methads. You will leam more about them during your finance course. For the purpose of this module you should be able to understand how Excel functions can be used to calculate the values. For MIRR calculations use 4% as the rate at which the investment is financed and assume that the cash lows from the project can be reinvested at the rate of 5%. Description Description Data Data 2 Initia Investment cost 2 Finance rate $3,000 4% 3 I cash inflow from year 1 4 Cash inflow from year 2 3 Reinwestment rate $800 596 Initia Investment cost 900 - $3,000 5 Cash inflow from year 3 5 I cash inflow from year 1 $1,000 $800 6 Cash inflow from year 6 | Cash inflow from year 2 7 Cash inflow from year 3 8 Cash inflow from year $1,300 900 $1,000 IRR $1,300 MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts