Question: The number in brackets behind the problem number is the number of points allocated to that problem. For each of the following problems consider an

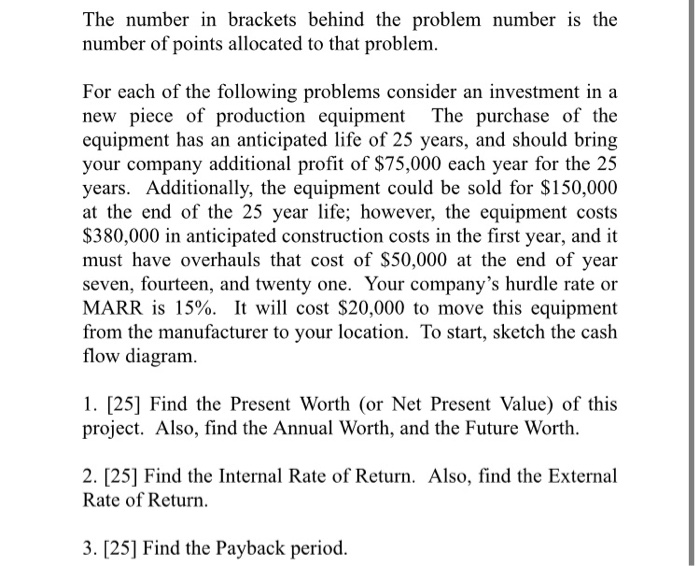

The number in brackets behind the problem number is the number of points allocated to that problem. For each of the following problems consider an investment in a new piece of production equipment The purchase of the equipment has an anticipated life of 25 years, and should bring your company additional profit of $75,000 each year for the 25 years. Additionally, the equipment could be sold for $150,000 at the end of the 25 year life; however, the equipment costs $380,000 in anticipated construction costs in the first year, and it must have overhauls that cost of $50,000 at the end of year seven, fourteen, and twenty one. Your company's hurdle rate or MARR is 15%. It will cost $20,000 to move this equipment from the manufacturer to your location. To start, sketch the cash flow diagram. 1. [25] Find the Present Worth (or Net Present Value) of this project. Also, find the Annual Worth, and the Future Worth. 2. [25] Find the Internal Rate of Return. Also, find the External Rate of Return. 3. [25] Find the Payback period. The number in brackets behind the problem number is the number of points allocated to that problem. For each of the following problems consider an investment in a new piece of production equipment The purchase of the equipment has an anticipated life of 25 years, and should bring your company additional profit of $75,000 each year for the 25 years. Additionally, the equipment could be sold for $150,000 at the end of the 25 year life; however, the equipment costs $380,000 in anticipated construction costs in the first year, and it must have overhauls that cost of $50,000 at the end of year seven, fourteen, and twenty one. Your company's hurdle rate or MARR is 15%. It will cost $20,000 to move this equipment from the manufacturer to your location. To start, sketch the cash flow diagram. 1. [25] Find the Present Worth (or Net Present Value) of this project. Also, find the Annual Worth, and the Future Worth. 2. [25] Find the Internal Rate of Return. Also, find the External Rate of Return. 3. [25] Find the Payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts