Question: The objective is to create a pro forma ( cash flow projection ) for a multifamily valuation based on the following set of assumptions. Assumptions:

The objective is to create a pro forma cash flow projection for a multifamily valuation based on the following set of assumptions.

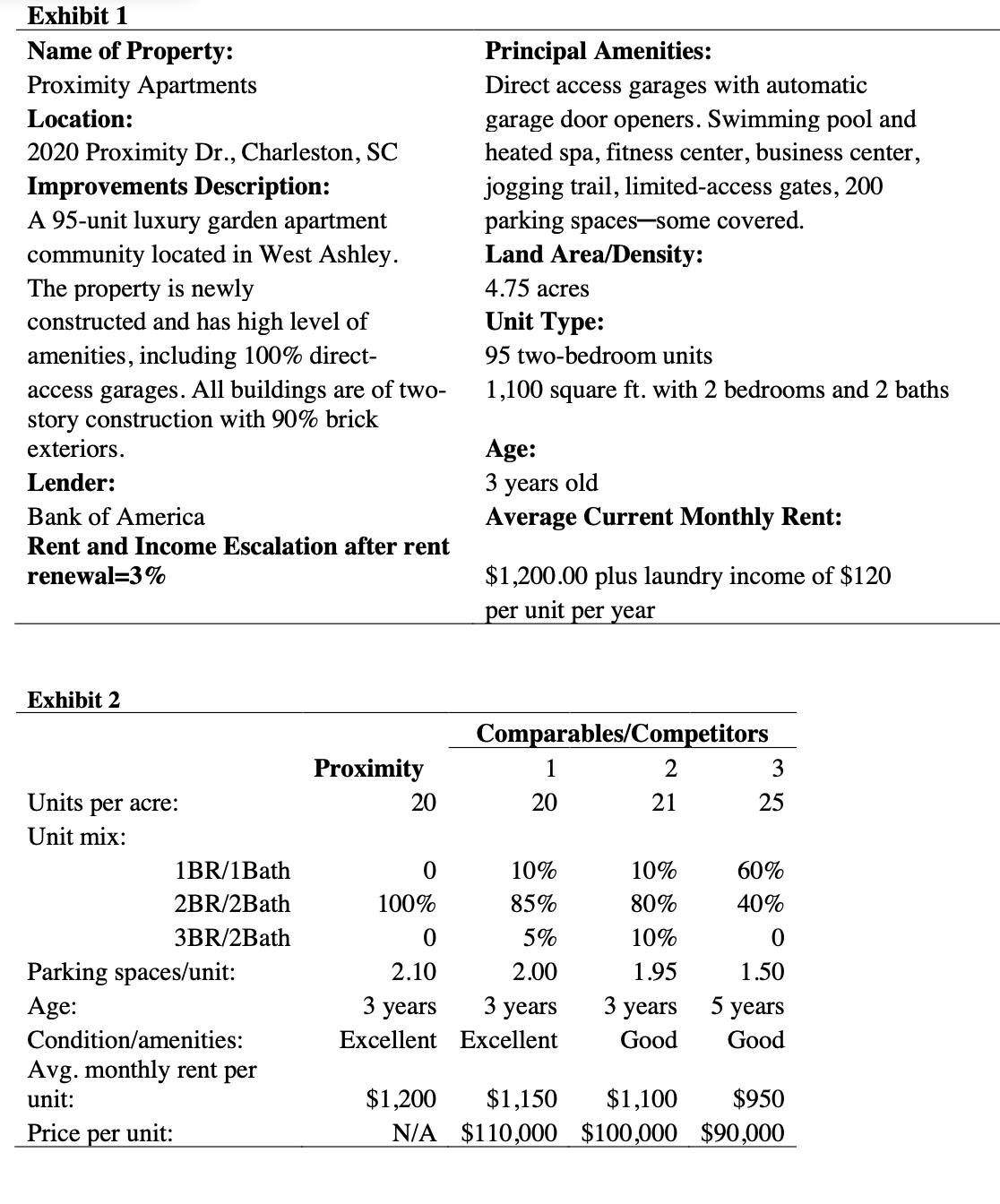

Assumptions: Proximity Apartments is a luxury apartment complex that is being appraised for the purpose of

btaining financing by an investor who has contracted to purchase the property. The bank has had

its own staff appraisers estimate the value of the property but wants an independent appraiser to

also provide an estimate using a "limited appraisal" that focuses on the income approach. The

property interests to be appraised will be the leased fee estate.

The bank has provided Exhibit which summarizes information about the property. You as the

independent appraiser have confirmed the expected rent per unit with the present owner, and you

have also done an analysis of comparable apartment properties that is summarized in Exhibit

Proximity Apartments consists entirely of twobedroom units. A competitive analysis indicates

that Proximity is very similar to comparables and even though they each have some oneand

threebedroom units. It appears that owners of apartment buildings with a greater proportion of

twobedroom units are able to get higher average monthly rent per unit. Comparable is more

densely developed with onebedroom apartments, and its parking ratios are lower than all others.

It appears that the average rent for Proximity is reasonable relative to the competition. In addition

to rent, other cash flows may be realized from laundry facilities. Comparable sold for $

per unit, and comparable which is most like Proximity Apartments, sold for $ per unit.

Although you are not doing a formal sales comparison approach, you note that a price of $

per unit would suggest a value of Proximity Apartments of $$

You have determined that the number of units per acre usually set by zoning is currently the

maximum allowable. This may be important if zoning laws have changed and now allow

development of or more units per acre. The average number of parking spaces per unit,

or spaces, seems reasonable relative to the comnetition. and the appraiser has determined that

the amenity package is appropriate relative to re Project Fall pdf the competition is currently

offering in the way of exercise and recreation facilities, TV cablesatellite services, highspeed

internet connectivity, washerdryer hookups, and so on

Onsite expenses will include salaries for onsite personnel who maintain and "make units ready"

for tenants in the community. An operating risk that must be considered by apartment investors is

the relatively short nature of lease maturities, the potential tenant turnover, and downtime due to

vacancies. Experience in large metropolitan areas indicates that as many as percent of

apartments in a given property may turn over each year. In making cash flow projections, analysts

must consider turnoverrelated losses in revenue because of vacancies, in conjunction with

recurring repairs and maintenance expenses involved in making units ready for new tenants. For

Proximity Apartments they are included in repair and maintenance expense. A management fee

for oversight of all leasing, rent collection, tenant relations, and so on and office expenses for

payroll, insurance, tax property and other bookkeeping services necessary for operations have also

been estimated. These items should be validated from payment records and oror the appropriate

agency vendors.

Vacancy is expected to be percent of potential income, and credit loss due to tenants who default

on their lease is expected to be an additional percent of potential income.

The property is to be valued using an percent discount rate and assuming the property will be

sold after ten years. The resale price will be estimated by using a percent terminal

capitalization rate applied to year NOI. The rate reflects lower growth expectations after year

Selling costs when the property is sold will be percent of the sale price.

Rents are expected to be $ when leases are renewed after two years from now Hint: note

that now imply year and increase at the expected inflation rate of percent per year thereafter.

Additional revenue of $ per unit is expected from the laundry machines that are included in a

laundry area of the apartment complex. This revenue takes effect in the first year and will also

increase at percent per year.

Contrary to most other property types, tenants occupying apartment properties usually sign leases

with maturities of either or months. Furthermore, tenants usually pay for their own utilities,

insurance, and so on which usually relieves the investor of making payments for these items and

recovering expenses from

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock