Question: The objective is to predict a stock's daily high using historical data. The data used is the stock's open and the market's open data. The

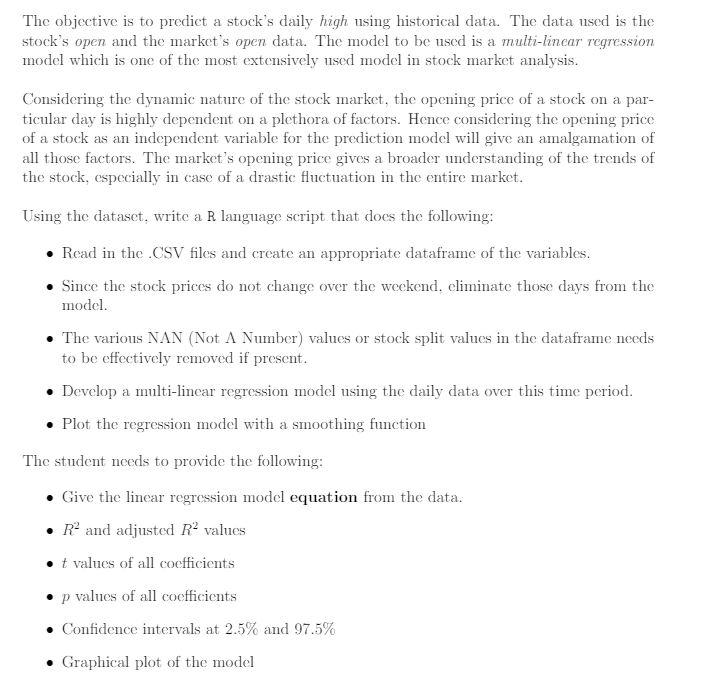

The objective is to predict a stock's daily high using historical data. The data used is the stock's open and the market's open data. The model to be used is a multi-lincar tegression model which is one of the most extensively used model in stock market analysis. Considering the dynamic nature of the stock market, the opening price of a stock on a particular day is highly dependent on a plethora of factors. Hence considering the opening price of a stock as an independent variable for the prediction model will give an amalgamation of all those factors. The market's opening price gives a broader understanding of the trends of the stock, especially in case of a drastic fluctuation in the entire market. Using the dataset, write a R language script that does the following: - Read in the CSV files and create an appropriate dataframe of the variables. - Since the stock prices do not change over the weekend, eliminate those days from the model. - The various NAN (Not A Number) values or stock split values in the dataframe needs to be effectively removed if present. - Develop a multi-linear regression model using the daily data over this time period. - Plot the regression model with a smoothing function The student needs to provide the following: - Give the linear regression model equation from the data. - R2 and adjusted R2 values - t values of all coefficients - p values of all coefficients - Confidence intervals at 2.5% and 97.5% - Graphical plot of the model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts