Question: The office was buzzing due to the fact that Amazon.com had announced its quarterly results just a few days before. The positive news had led

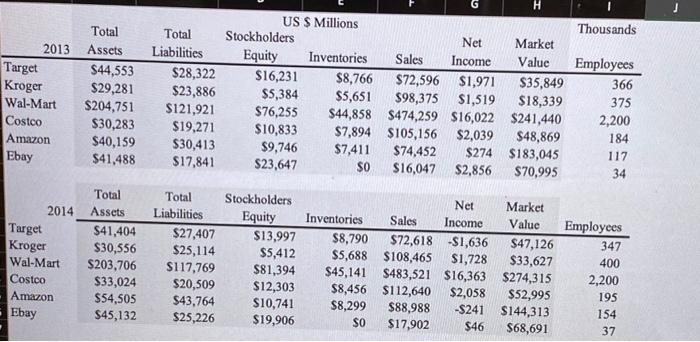

The office was buzzing due to the fact that Amazon.com had announced its quarterly results just a few days before. The positive news had led to a surge in Amazon's market value, which had jumped to more than $246 billion. By this metric, Amazon was now worth more than Wal-Mart' (see Exhibit 1). Even more impressive, this good news went beyond Amazon's online retailing arm. "Amazon said its Amazon Web Services cloud-computing business saw revenues jump 81 per cent, 16 points higher than Wall Street expected, to $1.8 billion."6 The presentation Kelsey was expected to make was related to Amazon's rise. Indeed, Kelsey thought the task was designed to be a test of her abilities. She suspected that her performance would influence the way her manager would treat her for some time to come, so it was important to do well. KELSEY'S MANAGERS' QUESTIONS A hand-written note provided Kelsey with an address for a file (see Exhibit 2). This file contained highlights from two years' worth of annual reports for six major companies, termed "retailers." Kelsey's manager had scribbled four questions onto the note below the file address, and Kelsey realized that she was expected to provide answers to these questions when she met with her manager in the late afternoon. The questions were these: Do the accounts give an accurate view of the company's performance? What can we say about the business plans of these "retailers"? Which has been/is the most successful of these companies? Which of them would you recommend investing in, going forward? . . . Thousands 2013 Target Kroger Wal-Mart Costco Amazon Ebay Total Assets $44,553 $29,281 $204,751 $30,283 $40,159 $41,488 Total Liabilities $28,322 $23,886 $121,921 $19,271 $30,413 $17,841 H US S Millions Stockholders Net Market Equity Inventories Sales Income Value $16,231 $8,766 $72,596 $1,971 $35,849 $5,384 $5,651 $98,375 $1,519 $18,339 $76,255 $44,858 $474,259 $16,022 $241,440 $10,833 $7,894 $105,156 $2,039 $48,869 $9,746 $7,411 $74,452 $274 $183,045 $23,647 $0 $16,047 $2,856 $70,995 Employees 366 375 2,200 184 117 34 2014 Target Kroger Wal-Mart Costco Amazon Ebay Total Assets $41,404 $30,556 $203,706 $33,024 $54,505 $45,132 Total Liabilities $27,407 $25,114 $117,769 $20,509 $43,764 $25,226 Stockholders Equity $13,997 $5,412 $81,394 $12,303 $10,741 $19,906 Net Market Inventories Sales Income Value $8,790 $72,618 -$1,636 $47,126 $5,688 $108,465 $1,728 $33,627 $45,141 $483,521 $16,363 $274,315 $8,456 $112,640 $2,058 $52,995 $8,299 $88,988 -S241 $144,313 SO $17,902 $46 $68,691 Employees 347 400 2,200 195 154 37 The office was buzzing due to the fact that Amazon.com had announced its quarterly results just a few days before. The positive news had led to a surge in Amazon's market value, which had jumped to more than $246 billion. By this metric, Amazon was now worth more than Wal-Mart' (see Exhibit 1). Even more impressive, this good news went beyond Amazon's online retailing arm. "Amazon said its Amazon Web Services cloud-computing business saw revenues jump 81 per cent, 16 points higher than Wall Street expected, to $1.8 billion."6 The presentation Kelsey was expected to make was related to Amazon's rise. Indeed, Kelsey thought the task was designed to be a test of her abilities. She suspected that her performance would influence the way her manager would treat her for some time to come, so it was important to do well. KELSEY'S MANAGERS' QUESTIONS A hand-written note provided Kelsey with an address for a file (see Exhibit 2). This file contained highlights from two years' worth of annual reports for six major companies, termed "retailers." Kelsey's manager had scribbled four questions onto the note below the file address, and Kelsey realized that she was expected to provide answers to these questions when she met with her manager in the late afternoon. The questions were these: Do the accounts give an accurate view of the company's performance? What can we say about the business plans of these "retailers"? Which has been/is the most successful of these companies? Which of them would you recommend investing in, going forward? . . . Thousands 2013 Target Kroger Wal-Mart Costco Amazon Ebay Total Assets $44,553 $29,281 $204,751 $30,283 $40,159 $41,488 Total Liabilities $28,322 $23,886 $121,921 $19,271 $30,413 $17,841 H US S Millions Stockholders Net Market Equity Inventories Sales Income Value $16,231 $8,766 $72,596 $1,971 $35,849 $5,384 $5,651 $98,375 $1,519 $18,339 $76,255 $44,858 $474,259 $16,022 $241,440 $10,833 $7,894 $105,156 $2,039 $48,869 $9,746 $7,411 $74,452 $274 $183,045 $23,647 $0 $16,047 $2,856 $70,995 Employees 366 375 2,200 184 117 34 2014 Target Kroger Wal-Mart Costco Amazon Ebay Total Assets $41,404 $30,556 $203,706 $33,024 $54,505 $45,132 Total Liabilities $27,407 $25,114 $117,769 $20,509 $43,764 $25,226 Stockholders Equity $13,997 $5,412 $81,394 $12,303 $10,741 $19,906 Net Market Inventories Sales Income Value $8,790 $72,618 -$1,636 $47,126 $5,688 $108,465 $1,728 $33,627 $45,141 $483,521 $16,363 $274,315 $8,456 $112,640 $2,058 $52,995 $8,299 $88,988 -S241 $144,313 SO $17,902 $46 $68,691 Employees 347 400 2,200 195 154 37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts