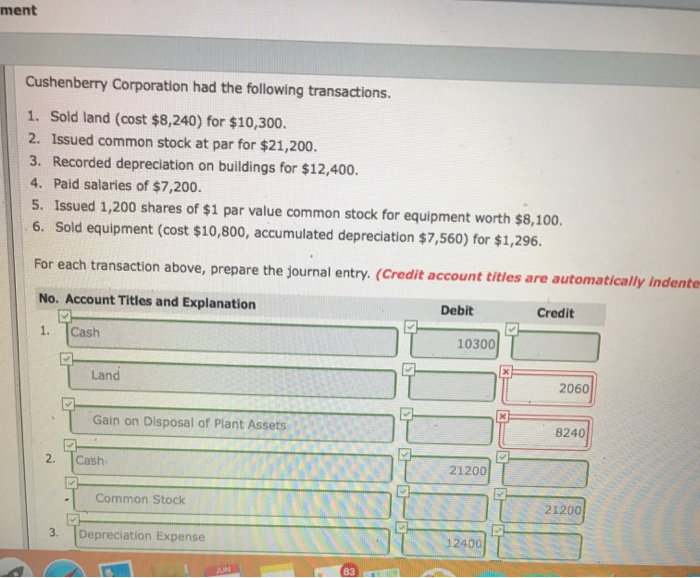

Question: the one in red is wrong and need to be fixed. ment Cushenberry Corporation had the following transactions. 1. Sold land (cost $8,240) for $10,300.

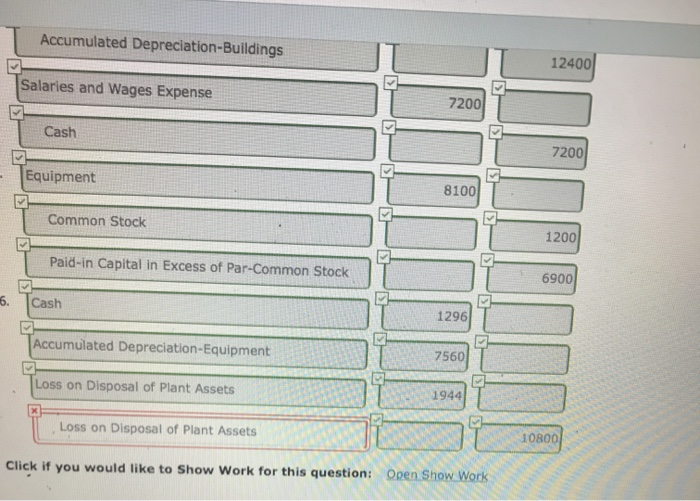

ment Cushenberry Corporation had the following transactions. 1. Sold land (cost $8,240) for $10,300. 2. Issued common stock at par for $21,200. 3. Recorded depreciation on buildings for $12,400. 4. Paid salaries of $7,200. 5. Issued 1,200 shares of $1 par value common stock for equipment worth $8,100 6. Sold equipment (cost $10,800, accumulated depreciation $7,560) for $1,296. For each transaction above, prepare the journal entry. (Credit account titles are automatically indente No. Account Titles and Explanation Debit Credit Cash 1. 10300 Land 2060 Gain on Disposal of Plant Assets 8240 2. Cash 21200 Common Stock 21200 Depreciation Expense 12400 92 JUN Accumulated Depreciation-Buildings 12400 Salaries and Wages Expense 7200 Cash 7200 Equipment 8100 Common Stock 1200 Paid-in Capital in Excess of Par-Common Stock 6900 Cash 6. 1296 Accumulated Depreciation- Equipment 7560 Loss on Disposal of Plant Assets 1944 10800 Loss on Disposal of Plant Assets Open Show Work Click if you would like to Show Work for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts