Question: The only question I have is on question C , so the answer states that the market predicts a higher YTM, therefore the rate of

The only question I have is on question C , so the answer states that the market predicts a higher YTM, therefore the rate of return is higher . However , this doesn't make any sense , doesn't lower price means lower rate of return , considering the current price of the 3-year bond does change, and if our expected YTM is lower than the market expected YTM , then the market have a lower price for year 2(this is a fact calculated at section b ) , therefore its rate of return is of course lower, for a zero-coupon bond.

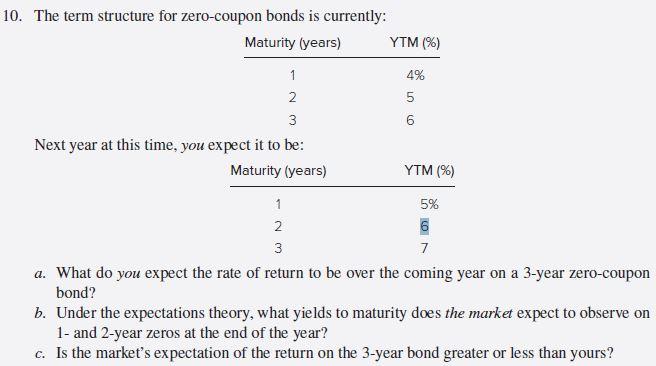

10. The term structure for zero-coupon bonds is currently: Maturity (years) YTM (%) 6 1 4% 2 5 3 Next year at this time, you expect it to be: Maturity (years) YTM (%) 1 5% 2. 6 3 7 a. What do you expect the rate of return to be over the coming year on a 3-year zero-coupon bond? b. Under the expectations theory, what yields to maturity does the market expect to observe on 1- and 2-year zeros at the end of the year? c. Is the market's expectation of the return on the 3-year bond greater or less than yours? w N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts