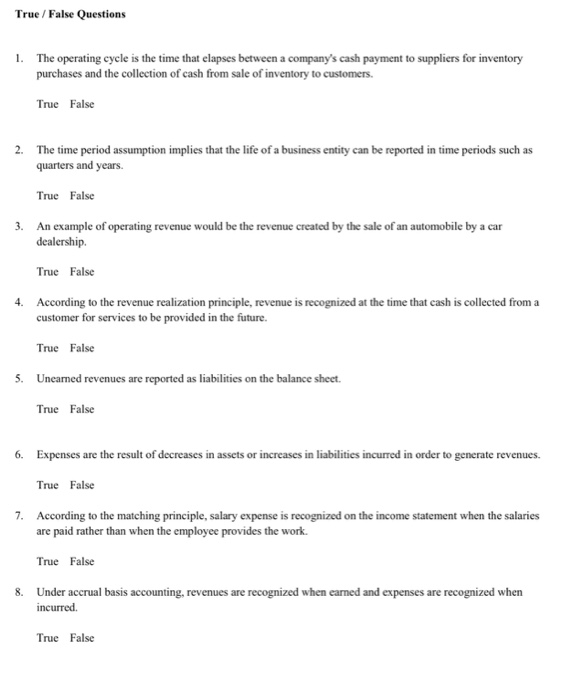

Question: The operating cycle is the time that elapses between a company's cash payment to suppliers foe inventory purchases and the collection of cash from sale

The operating cycle is the time that elapses between a company's cash payment to suppliers foe inventory purchases and the collection of cash from sale of inventory to customers. The time period assumption implies that the life of a business entity can be reported in time periods such as quarters and years. An example of operating revenue would be the revenue created by the sale of an automobile by a car dealership. According to the revenue realization principle, revenue is recognized at the time that cash is collected from a customer for services to be provided in the future. Unearned revenues arc reported as liabilities on the balance sheet. Expenses arc the result of decreases in assets or increases in liabilities incurred in order to generate revenues. According to the matching principle, salary expense is recognized on the income statement when the salaries arc paid rather than when the employee provides the wort. Under accrual basis accounting, revenues arc recognized when earned and expenses are recognized when incurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts