Question: The options for the first dropdown box next to the blue line are: A: Project X B: Project Y The options for the second dropdown

The options for the first dropdown box next to the blue line are:

A: Project X

B: Project Y

The options for the second dropdown box below the orange line are:

A: Project X

B: Project Y

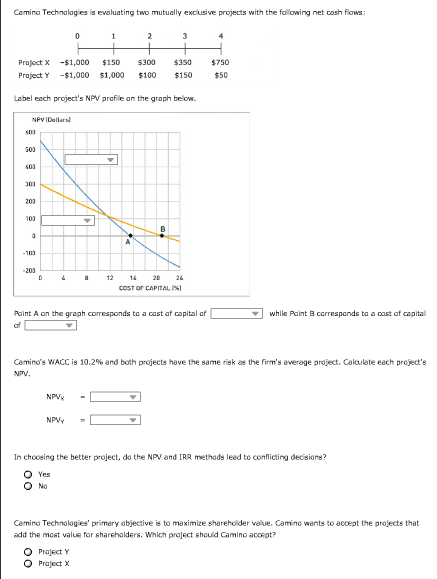

The options for the drop down box following: "Point A on the graph corresponds to a cost of capitol of _______" are:

A: 21.25%

B: 15.63%

C: 13.92%

D: 23.47%

E: 18.83%

The options for the next drop down box following: "While point B corresponds to a cost of capitol of _______" are:

A: 15.63%

B: 13.92%

C: 24.47%

D: 21.25%

E: 18.83%

The options in the dropdown box for NPVx are:

A: $140.81

B:$135.77

C:$153.23

D:$191.70

E:$172.24

The options for NPVy are:

A: $141.41

B:$152.23

C:$152.85

D:$135.77

E:$130.20

Camina Technalagies is evaluating two mutually excusive projects with the fal lowing net cash faws Project x$1,000 150 $300 30 $750 Project Y-$1,000 $1,000 $100 $150 50 Label each project's NPV profile an the graph below NPV IDallars 103 203 D12 20 24 COST OF CAPITAL while Paint B correspends ta a oast af capital Paint A on the graph corresponds to a cast af capital of of Camino's WACC is 10.2% and both projects have the same risk as the firm's average project. Calculate each project's NPVK NPVY In choosing the better project, do the NPV and IRR methods lead to conflicting decisions? Yes O No Camino Technolog es' primary abjective is to maximize shareholder vaue. Camino wants to accept the projects that add the most value for sharchaders. Which praject should Camino accept? O PrajectY O Prajectx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts