Question: The options for the last sentence are: Increase, Decrease; significant, insignificant 4. The calculation of the cost of preferred stock Firms that carry preferred stock

The options for the last sentence are: Increase, Decrease; significant, insignificant

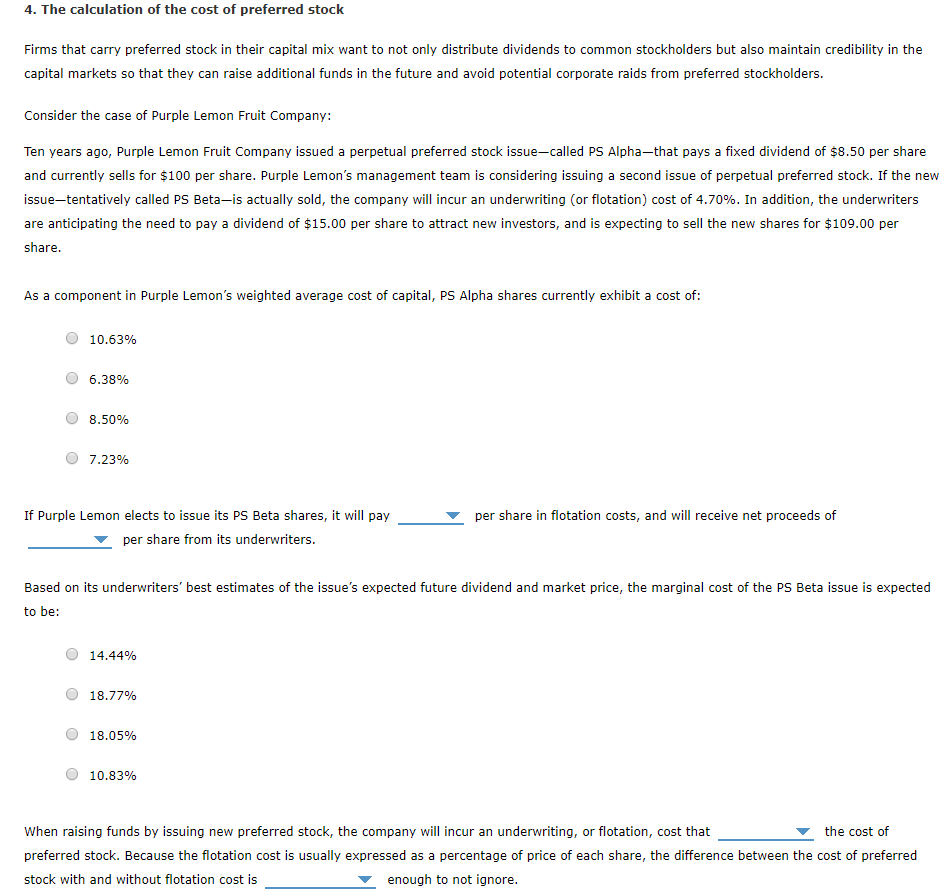

4. The calculation of the cost of preferred stock Firms that carry preferred stock in their capital mix want to not only distribute dividends to common stockholders but also maintain credibility in the capital markets so that they can raise additional funds in the future and avoid potential corporate raids from preferred stockholders. Consider the case of Purple Lemon Fruit Company: Ten years ago, Purple Lemon Fruit Company issued a perpetual preferred stock issue-called PS Alpha-that pays a fixed dividend of $8.50 per share and currently sells for $100 per share. Purple Lemon's management team is considering issuing a second issue of perpetual preferred stock. If the new issue-tentatively called PS Beta-is actually sold, the company will incur an underwriting (or flotation) cost of 4.70%. In addition, the underwriters are anticipating the need to pay a dividend of $15.00 per share to attract new investors, and is expecting to sell the new shares for $109.00 per share. As a component in Purple Lemon's weighted average cost of capital, PS Alpha shares currently exhibit a cost of: 10.63% O 6.38% 8.50% O 7.23% per share in flotation costs, and will receive net proceeds of If Purple Lemon elects to issue its PS Beta shares, it will pay per share from its underwriters. Based on its underwriters' best estimates of the issue's expected future dividend and market price, the marginal cost of the PS Beta issue is expected to be: 14.44% 18.77% 18.05% 10.83% When raising funds by issuing new preferred stock, the company will incur an underwriting, or flotation, cost that the cost of preferred stock. Because the flotation cost is usually expressed as a percentage of price of each share, the difference between the cost of preferred stock with and without flotation cost is enough to not ignore

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts