Question: the part thats blank please (after write off) On December 31 of Swift Company's first year, $67,000 of accounts receivable was not yet collected. Swift

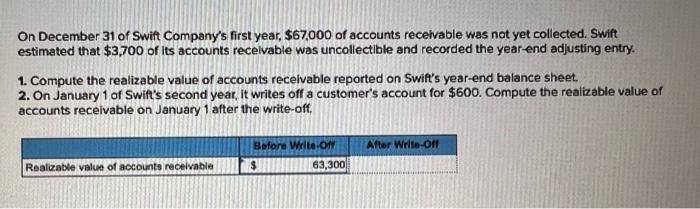

On December 31 of Swift Company's first year, $67,000 of accounts receivable was not yet collected. Swift estimated that $3,700 of its accounts recelvable was uncollectlble and recorded the year-end adjusting entry. 1. Compute the realizable value of accounts recelvable reported on Swift's year-end balance sheet. 2. On January 1 of Swift's second year, it writes off a customer's account for $600. Compute the realizable value of accounts receivable on January 1 after the write-off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts