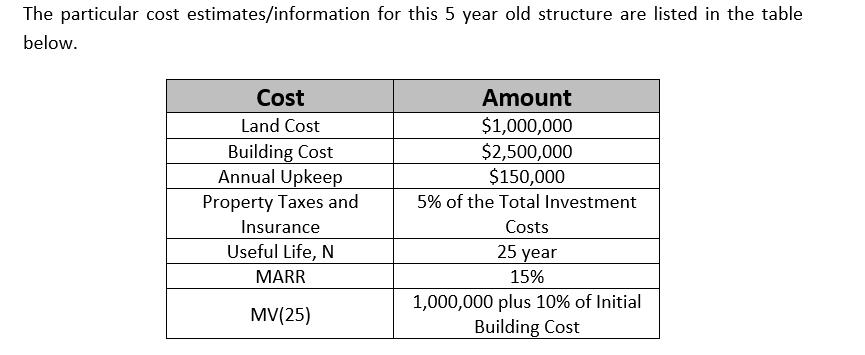

Question: The particular cost estimates/information for this 5 year old structure are listed in the table below. Cost Land Cost Building Cost Annual Upkeep Property

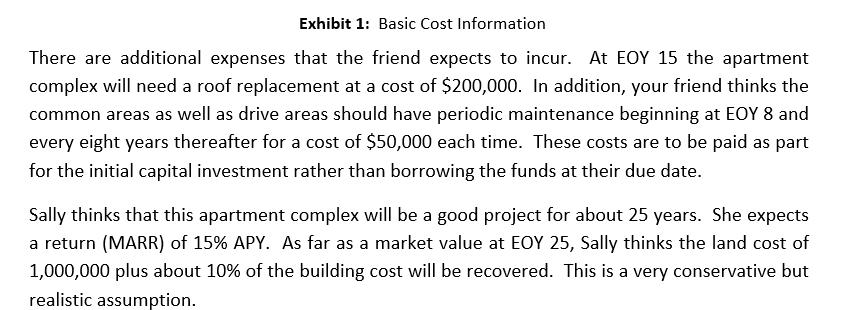

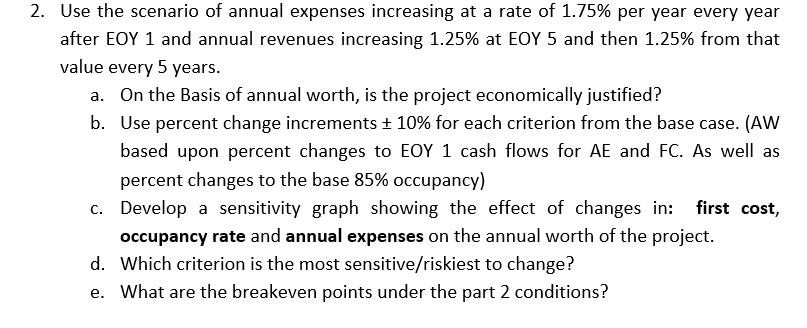

The particular cost estimates/information for this 5 year old structure are listed in the table below. Cost Land Cost Building Cost Annual Upkeep Property Taxes and Insurance Useful Life, N MARR MV(25) Amount $1,000,000 $2,500,000 $150,000 5% of the Total Investment Costs 25 year 15% 1,000,000 plus 10% of Initial Building Cost Exhibit 1: Basic Cost Information There are additional expenses that the friend expects to incur. At EOY 15 the apartment complex will need a roof replacement at a cost of $200,000. In addition, your friend thinks the common areas as well as drive areas should have periodic maintenance beginning at EOY 8 and every eight years thereafter for a cost of $50,000 each time. These costs are to be paid as part for the initial capital investment rather than borrowing the funds at their due date. Sally thinks that this apartment complex will be a good project for about 25 years. She expects a return (MARR) of 15% APY. As far as a market value at EOY 25, Sally thinks the land cost of 1,000,000 plus about 10% of the building cost will be recovered. This is a very conservative but realistic assumption. 2. Use the scenario of annual expenses increasing at a rate of 1.75% per year every year after EOY 1 and annual revenues increasing 1.25% at EOY 5 and then 1.25% from that value every 5 years. a. On the Basis of annual worth, is the project economically justified? b. Use percent change increments 10% for each criterion from the base case. (AW based upon percent changes to EOY 1 cash flows for AE and FC. As well as percent changes to the base 85% occupancy) c. Develop a sensitivity graph showing the effect of changes in: first cost, occupancy rate and annual expenses on the annual worth of the project. d. Which criterion is the most sensitive/riskiest to change? e. What are the breakeven points under the part 2 conditions?

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Question 1 What is the total initial cost of the project Answer The to... View full answer

Get step-by-step solutions from verified subject matter experts