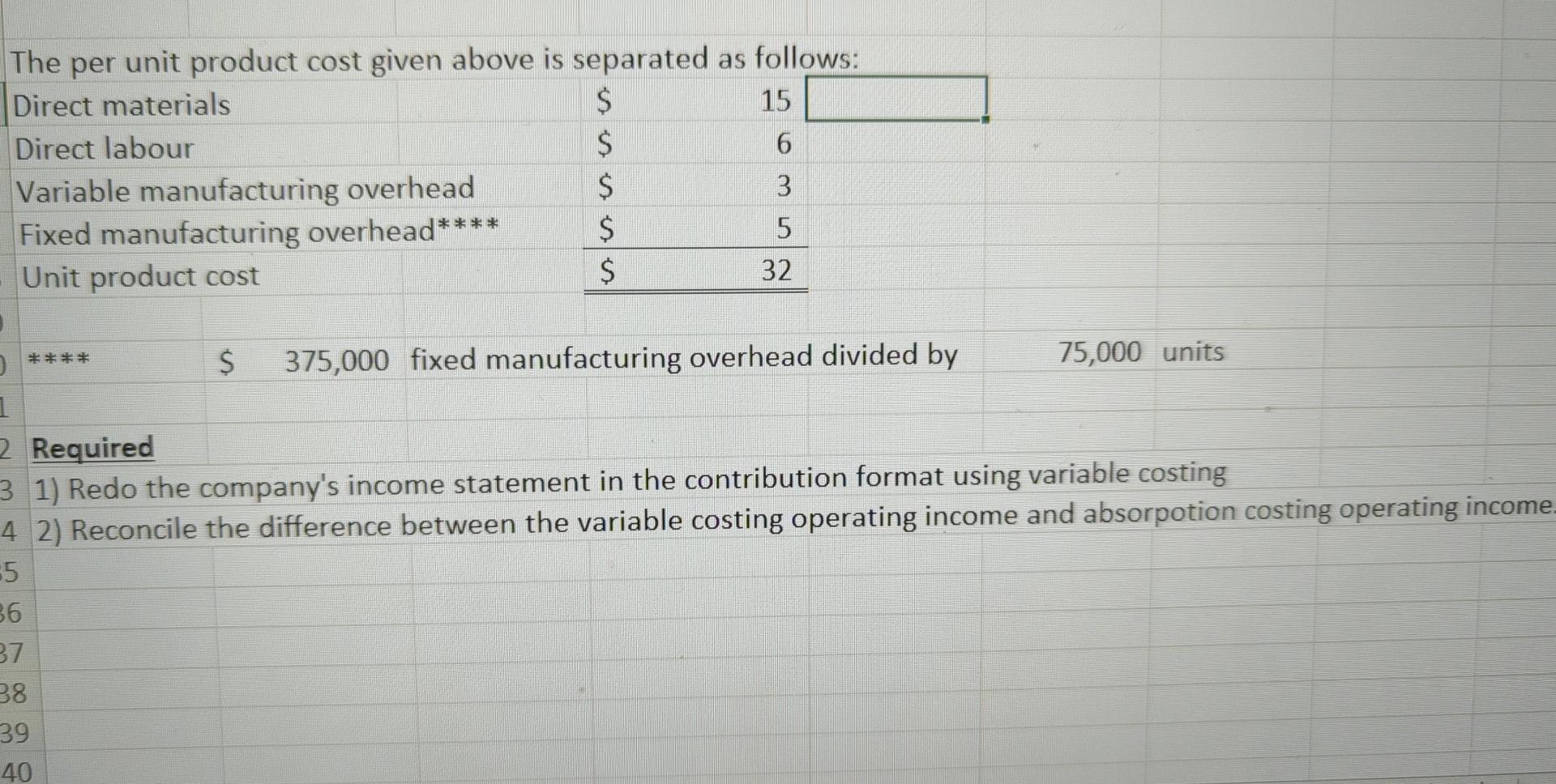

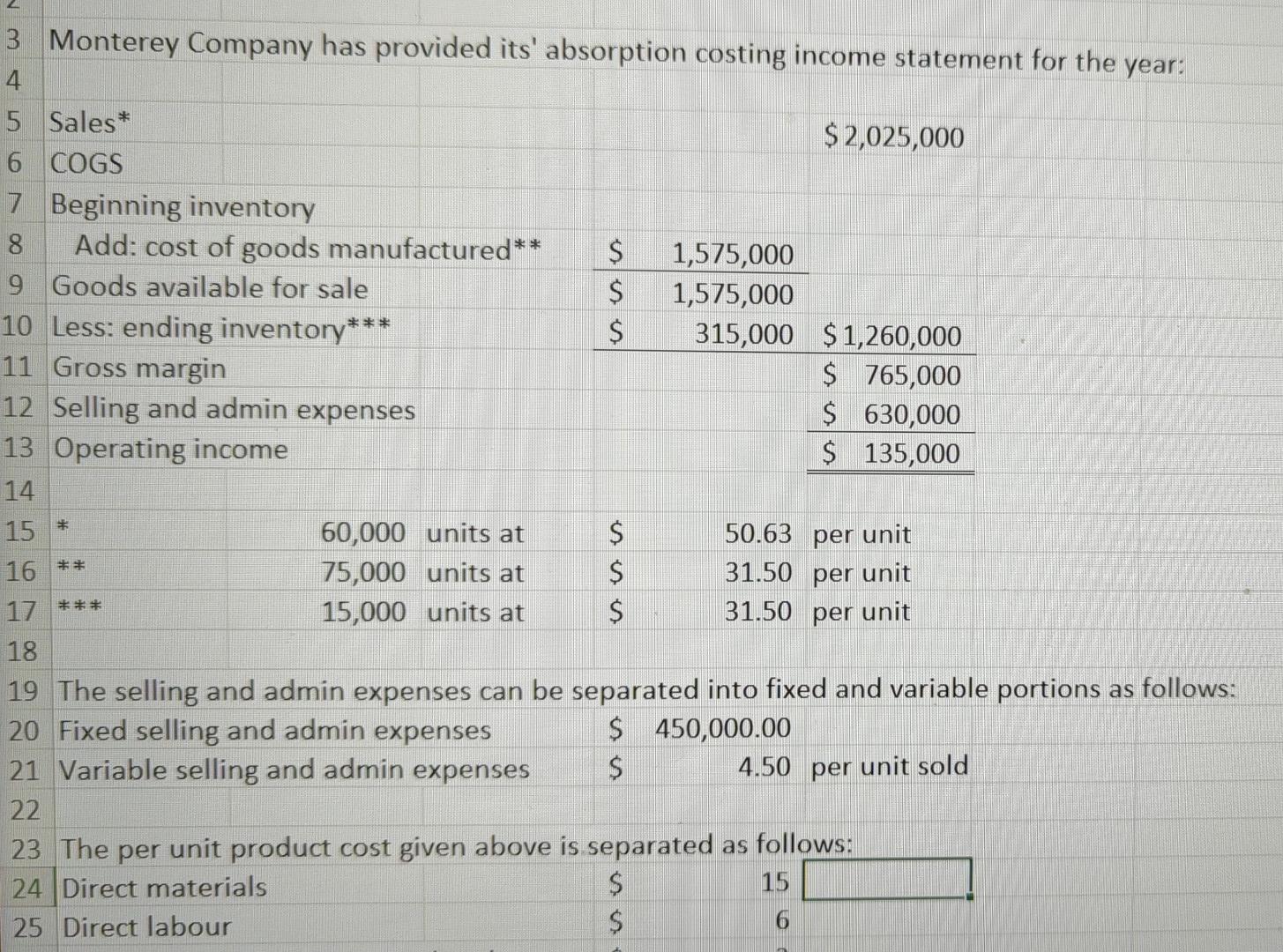

Question: The per unit product cost given above is separated as follows: Direct materials $ 15 Direct labour $ 6 Variable manufacturing overhead $ 3 Fixed

The per unit product cost given above is separated as follows: Direct materials $ 15 Direct labour $ 6 Variable manufacturing overhead $ 3 Fixed manufacturing overhead**** $ 5 Unit product cost $ 32 $ 375,000 fixed manufacturing overhead divided by 75,000 units 1 2 Required 3 1) Redo the company's income statement in the contribution format using variable costing 4 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income. 5 36 B7 38 39 40 3 Monterey Company has provided its' absorption costing income statement for the year: 4 5 Sales* $ 2,025,000 6 COGS 7 Beginning inventory 8 Add: cost of goods manufactured** $ 1,575,000 9 Goods available for sale $ 1,575,000 10 Less: ending inventory** $ 315,000 $1,260,000 11 Gross margin $ 765,000 12 Selling and admin expenses $ 630,000 13 Operating income $ 135,000 14 15 * 60,000 units at $ 50.63 per unit 75,000 units at $ 31.50 per unit 15,000 units at $ 31.50 per unit 18 19 The selling and admin expenses can be separated into fixed and variable portions as follows: 20 Fixed selling and admin expenses $ 450,000.00 21 Variable selling and admin expenses $ 4.50 per unit sold 22 23 The per unit product cost given above is separated as follows: 24 Direct materials $ 15 25 Direct labour $ 6 16 ** 17 *** The per unit product cost given above is separated as follows: Direct materials $ 15 Direct labour $ 6 Variable manufacturing overhead $ 3 Fixed manufacturing overhead**** $ 5 Unit product cost $ 32 $ 375,000 fixed manufacturing overhead divided by 75,000 units 1 2 Required 3 1) Redo the company's income statement in the contribution format using variable costing 4 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income. 5 36 B7 38 39 40 3 Monterey Company has provided its' absorption costing income statement for the year: 4 5 Sales* $ 2,025,000 6 COGS 7 Beginning inventory 8 Add: cost of goods manufactured** $ 1,575,000 9 Goods available for sale $ 1,575,000 10 Less: ending inventory** $ 315,000 $1,260,000 11 Gross margin $ 765,000 12 Selling and admin expenses $ 630,000 13 Operating income $ 135,000 14 15 * 60,000 units at $ 50.63 per unit 75,000 units at $ 31.50 per unit 15,000 units at $ 31.50 per unit 18 19 The selling and admin expenses can be separated into fixed and variable portions as follows: 20 Fixed selling and admin expenses $ 450,000.00 21 Variable selling and admin expenses $ 4.50 per unit sold 22 23 The per unit product cost given above is separated as follows: 24 Direct materials $ 15 25 Direct labour $ 6 16 ** 17 ***

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock