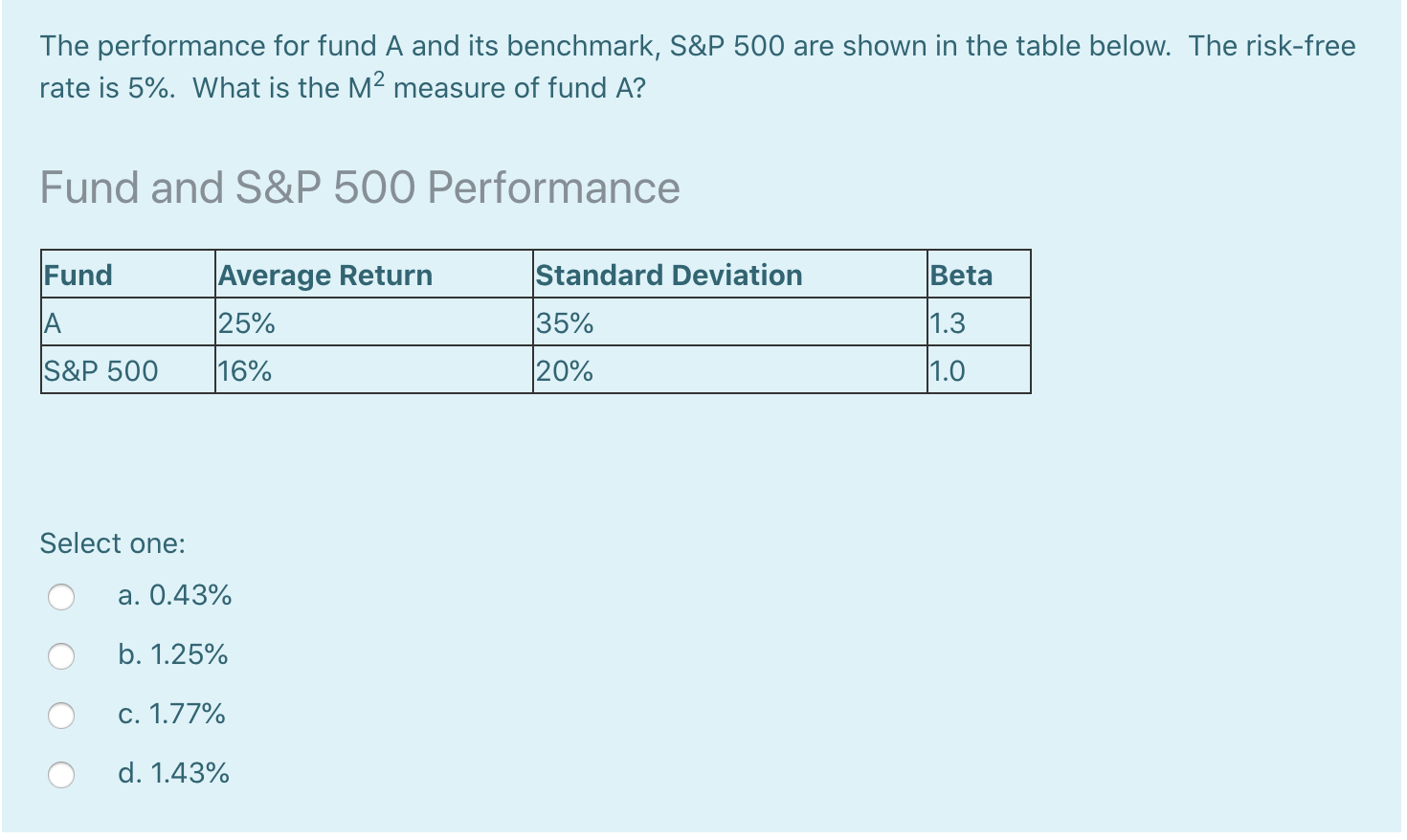

Question: The performance for fund A and its benchmark, S&P 500 are shown in the table below. The risk-free rate is 5%. What is the M2

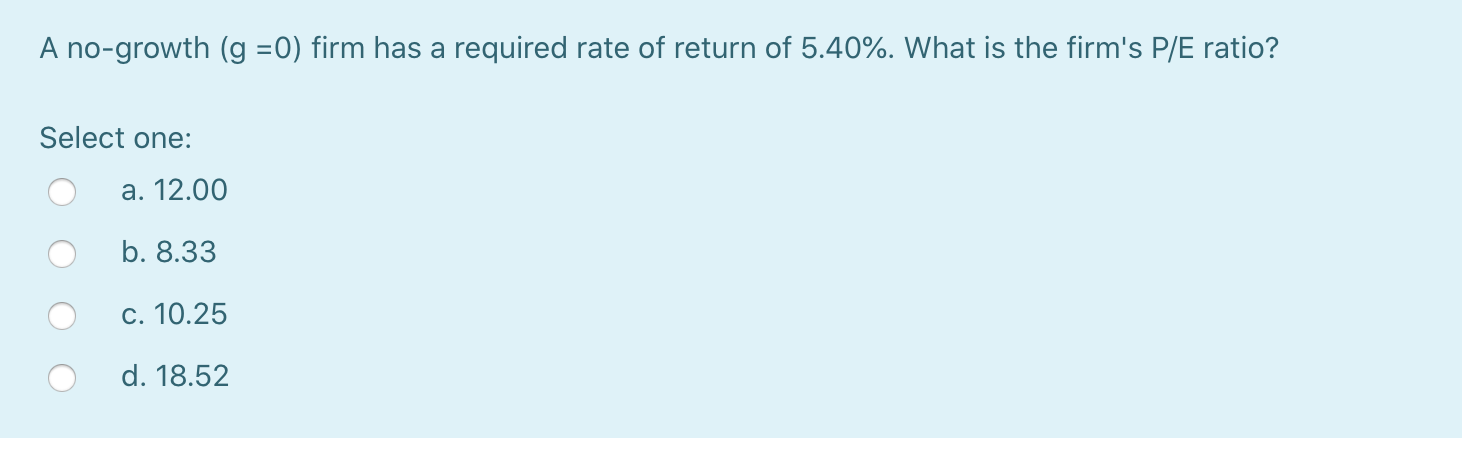

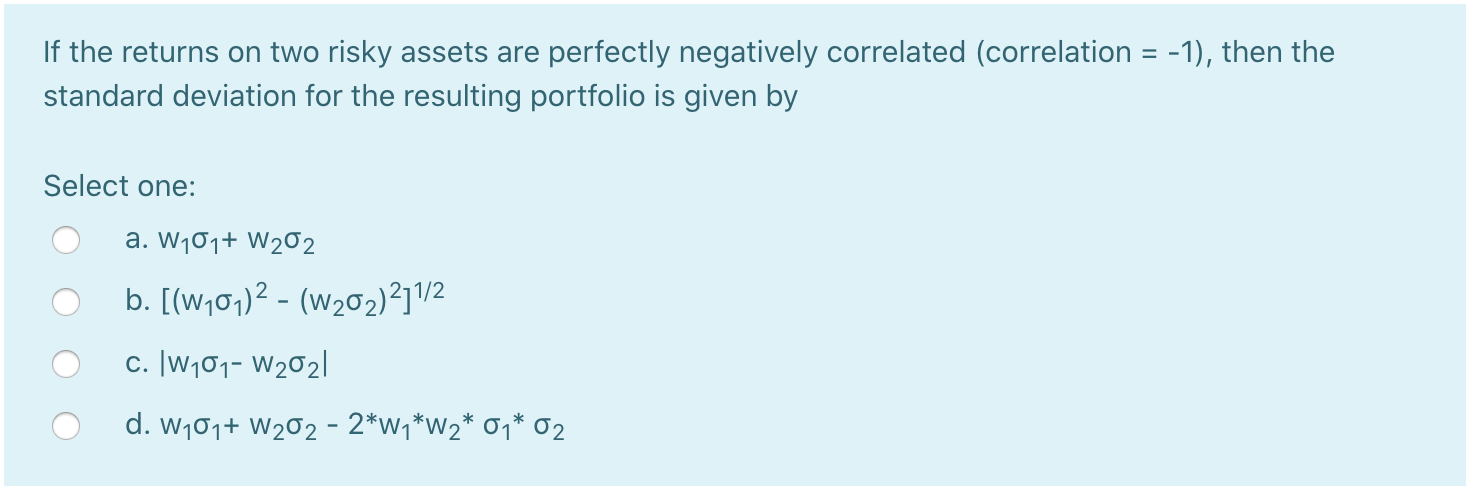

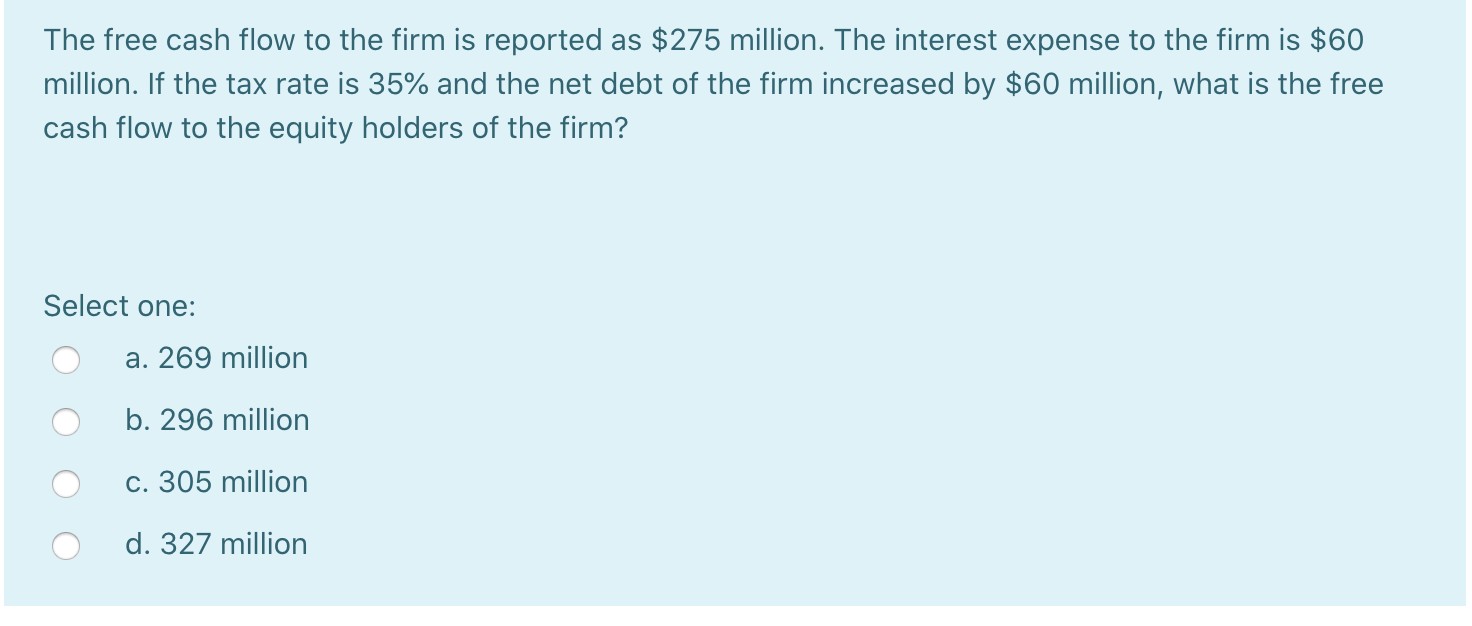

The performance for fund A and its benchmark, S&P 500 are shown in the table below. The risk-free rate is 5%. What is the M2 measure of fund A? Fund and S&P 500 Performance Fund Standard Deviation Beta Average Return 25% A 35% 1.3 S&P 500 16% 20% 1.0 Select one: a. 0.43% b. 1.25% c. 1.77% d. 1.43% A no-growth (g =0) firm has a required rate of return of 5.40%. What is the firm's P/E ratio? Select one: a. 12.00 b. 8.33 c. 10.25 d. 18.52 If the returns on two risky assets are perfectly negatively correlated (correlation = -1), then the standard deviation for the resulting portfolio is given by Select one: a. W101+ W202 b. [(W201)2-(W202)21/2 c. W101-W2021 d. W101+ W202 - 2*w7*w2* 09* 02 The free cash flow to the firm is reported as $275 million. The interest expense to the firm is $60 million. If the tax rate is 35% and the net debt of the firm increased by $60 million, what is the free cash flow to the equity holders of the firm? Select one: a. 269 million b. 296 million c. 305 million d. 327 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts