Question: The Persistent company, which started operations in 2017, reported 2020 profit before income tax of P2, 000, 000. There were no differences between taxable

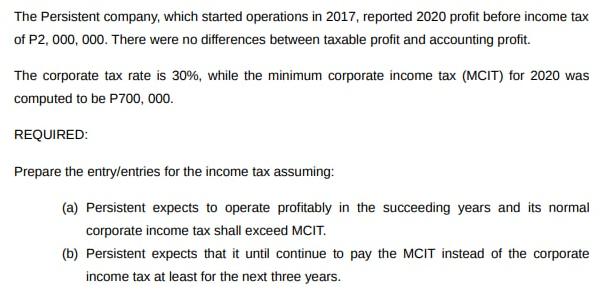

The Persistent company, which started operations in 2017, reported 2020 profit before income tax of P2, 000, 000. There were no differences between taxable profit and accounting profit. The corporate tax rate is 30%, while the minimum corporate income tax (MCIT) for 2020 was computed to be P700, 000. REQUIRED: Prepare the entry/entries for the income tax assuming: (a) Persistent expects to operate profitably in the succeeding years and its normal corporate income tax shall exceed MCIT. (b) Persistent expects that it until continue to pay the MCIT instead of the corporate income tax at least for the next three years.

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

a If Persistent expects to operate profitably in the succeeding years and its normal corporate i... View full answer

Get step-by-step solutions from verified subject matter experts