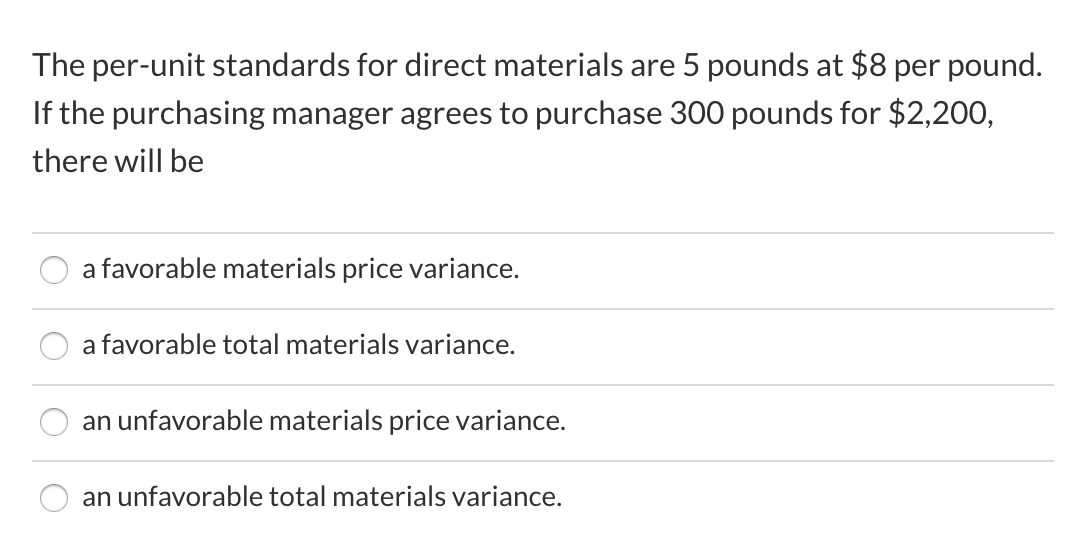

Question: The per-unit standards for direct materials are 5 pounds at $8 per pound. If the purchasing manager agrees to purchase 300 pounds for $2,200, there

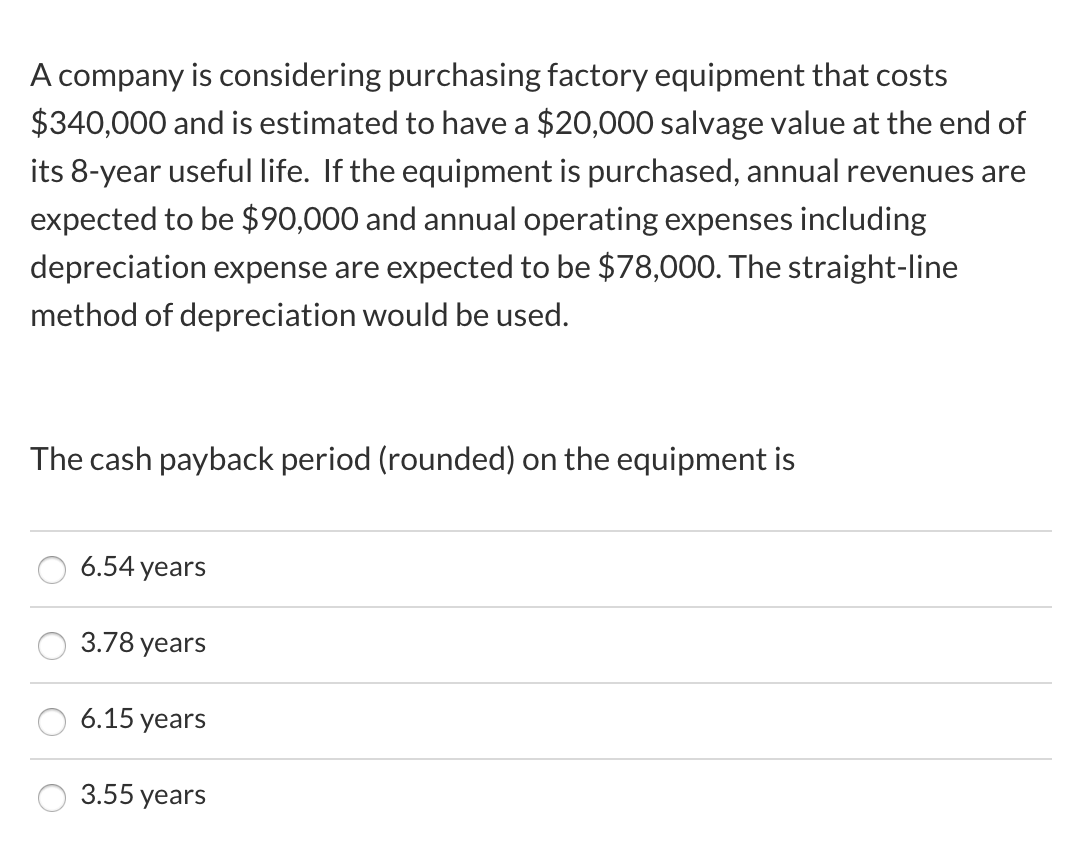

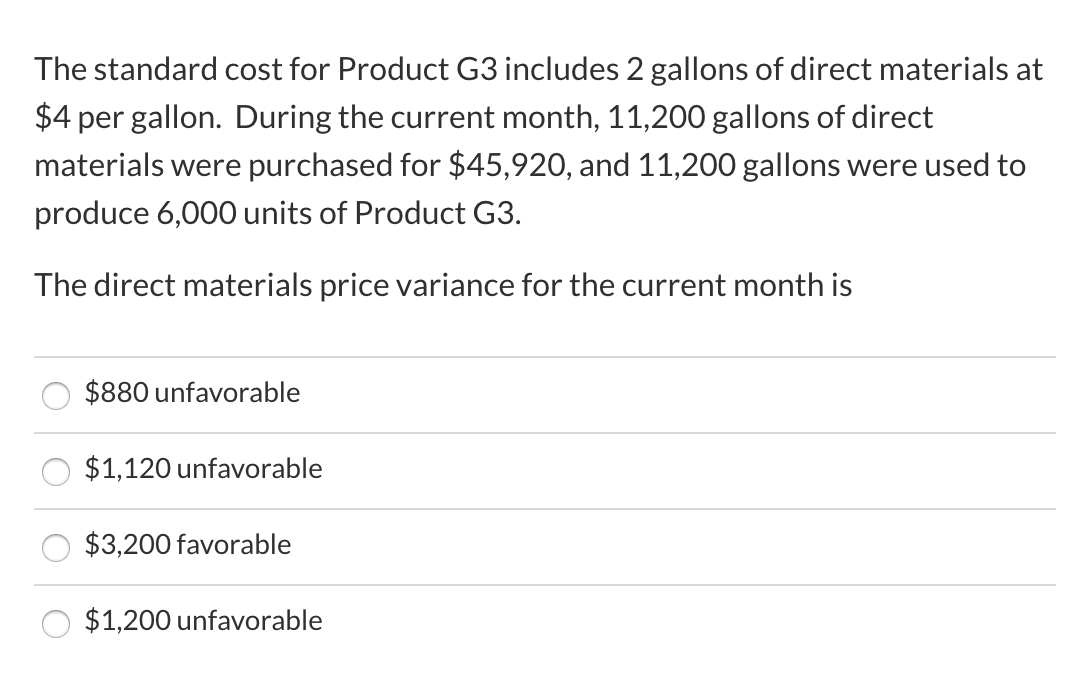

The per-unit standards for direct materials are 5 pounds at $8 per pound. If the purchasing manager agrees to purchase 300 pounds for $2,200, there will be a favorable materials price variance. a favorable total materials variance. an unfavorable materials price variance. an unfavorable total materials variance. A company is considering purchasing factory equipment that costs $340,000 and is estimated to have a $20,000 salvage value at the end of its 8-year useful life. If the equipment is purchased, annual revenues are expected to be $90,000 and annual operating expenses including depreciation expense are expected to be $78,000. The straight-line method of depreciation would be used. The cash payback period (rounded) on the equipment is 6.54 years 3.78 years 6.15 years 3.55 years The standard cost for Product G3 includes 2 gallons of direct materials at $4 per gallon. During the current month, 11,200 gallons of direct materials were purchased for $45,920, and 11,200 gallons were used to produce 6,000 units of Product G3. The direct materials price variance for the current month is $880 unfavorable $1,120 unfavorable $3,200 favorable $1,200 unfavorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts