Question: the pictures are the same question SRV Co, had a beginning balance in Accounts Receivable of S100,000 and a beginning credit balance in the Allowance

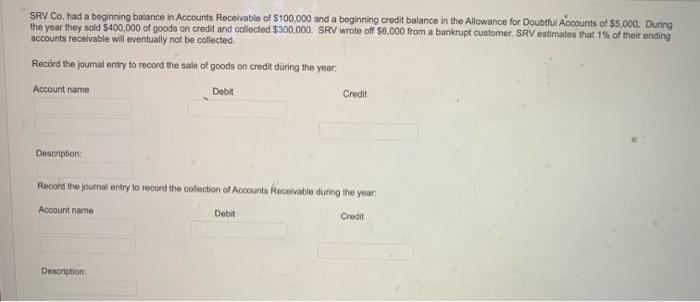

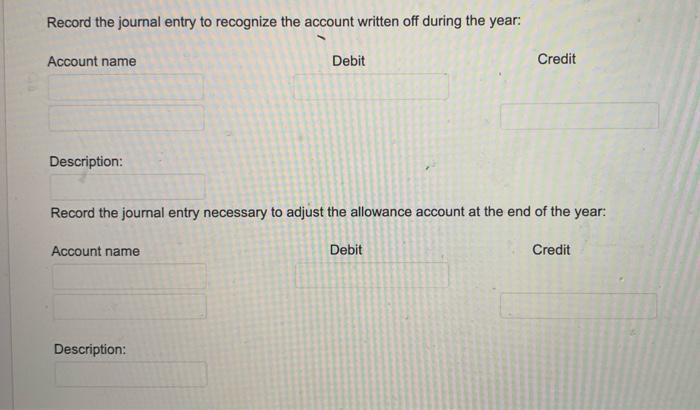

SRV Co, had a beginning balance in Accounts Receivable of S100,000 and a beginning credit balance in the Allowance for Doubtful Accounts of $5.000. During the year they sold $400,000 of goods on credit and collected $300,000. SRV wrote off $6,000 from a bankrupt customer. SRV estimates that 1% of their ending accounts recevable will eventually not be collected Record the joumal entry to record the sale of goods on credit during the year. Account name Debt Credit Description: Record the journal entry to record the collection of Accounts Receivable during the year Account name Debit Credit Description: Record the journal entry to recognize the account written off during the year: Account name Debit Credit Description: Record the journal entry necessary to adjust the allowance account at the end of the year: Account name Debit Credit Description

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts