Question: The Plastics Division of Minock Manufacturing currently earns $2.86 million and has divisional assets of $26 million. The division manager is considering the acquisition

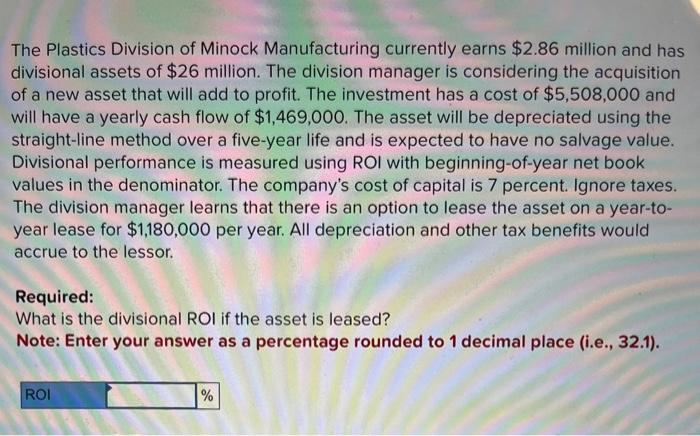

The Plastics Division of Minock Manufacturing currently earns $2.86 million and has divisional assets of $26 million. The division manager is considering the acquisition of a new asset that will add to profit. The investment has a cost of $5,508,000 and will have a yearly cash flow of $1,469,000. The asset will be depreciated using the straight-line method over a five-year life and is expected to have no salvage value. Divisional performance is measured using ROI with beginning-of-year net book values in the denominator. The company's cost of capital is 7 percent. Ignore taxes. The division manager learns that there is an option to lease the asset on a year-to- year lease for $1,180,000 per year. All depreciation and other tax benefits would accrue to the lessor. Required: What is the divisional ROI if the asset is leased? Note: Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1). ROI %

Step by Step Solution

There are 3 Steps involved in it

To calculate the divisional Return on Investment ROI if the asset is leased well follow these steps ... View full answer

Get step-by-step solutions from verified subject matter experts