Question: The polynomial models for the forward rate and yield curves are not very realistic and were used near merely for illustration. A popular model

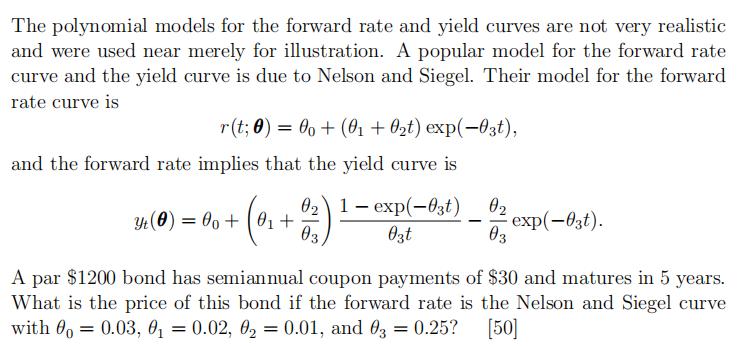

The polynomial models for the forward rate and yield curves are not very realistic and were used near merely for illustration. A popular model for the forward rate curve and the yield curve is due to Nelson and Siegel. Their model for the forward rate curve is r(t; 0) = 00+ (01 +0t) exp(-03t), and the forward rate implies that the yield curve is 01- exp(-03t) 03t yt (0) 00+01+ = (0 + 01/23) - 0 03 exp(-03t). A par $1200 bond has semiannual coupon payments of $30 and matures in 5 years. What is the price of this bond if the forward rate is the Nelson and Siegel curve with = 0.03, 0 = 0.02, 0 = 0.01, and 03 = 0.25? [50]

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

To calculate the price of the bond using the Nelson and Siegel model well need to use the given para... View full answer

Get step-by-step solutions from verified subject matter experts