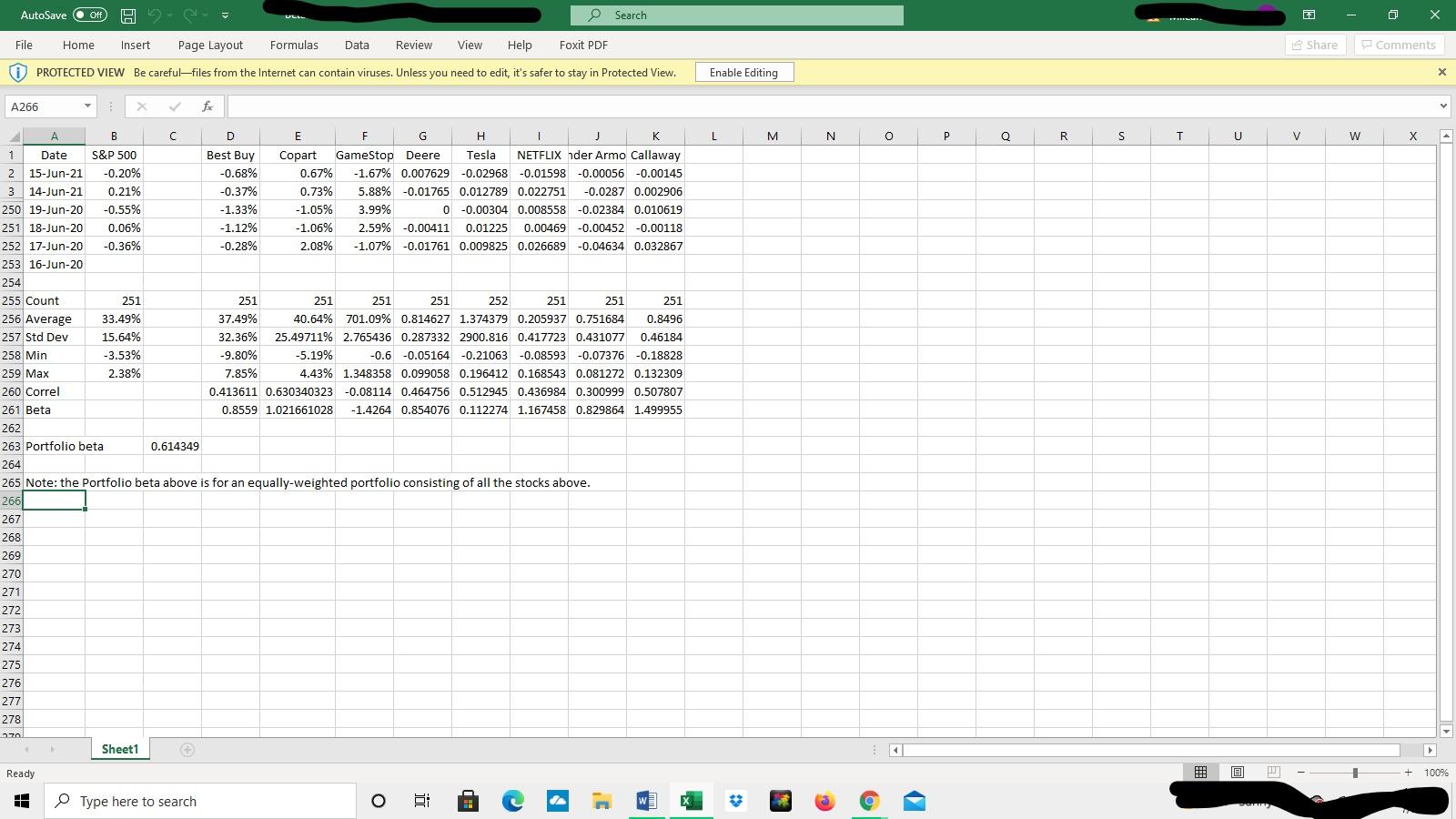

Question: The portfolio beta calculated is 0.61. Explain how the calculated beta would change if Under Armour were dropped from the portfolio and we recalculated beta.

- The portfolio beta calculated is 0.61. Explain how the calculated beta would change if Under Armour were dropped from the portfolio and we recalculated beta.

- Assume that the risk-free interest rate is currently -1% and the market risk (rM) is 9%. Show calculations for the required return (ri) on Under Armours stock.

- Explain how Under Armour's required return in b would change if the risk-free rate rose to 1%

- Explain how Under Armour's required return in b would change if the market risk (rM) dropped to 6%.

AutoSave Off H. O Search 0 x File Home Insert Page Layout Formulas Data Review View Help Foxit PDF 3 Share Comments O PROTECTED VIEW Be carefulfiles from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing x A266 X fic L M N o P Q R S T U V W A A B C D E F G H 1 J K 1 Date S&P 500 Best Buy Copart GameStop Deere Tesla NETFLIX nder Armo Callaway 2 15-Jun-21 -0.20% -0.68% 0.67% -1.67% 0.007629 -0.02968 -0.01598 -0.00056 -0.00145 3 14-Jun-21 0.21% -0.37% 0.73% 5.88% -0.01765 0.012789 0.022751 -0.0287 0.002906 250 19-Jun-20 -0.55% -1.33% - 1.05% 3.99% 0 -0.00304 0.008558 -0.02384 0.010619 251 18-Jun-20 0.06% - 1.12% -1.06% 2.59% -0.00411 0.01225 0.00469 -0.00452 -0.00118 252 17-Jun-20 -0.36% -0.28% 2.08% -1.07% -0.01761 0.009825 0.026689 -0.04634 0.032867 253 16-Jun-20 254 255 Count 251 251 251 251 251 252 251 251 251 256 Average 33.49% 37.49% 40.64% 701.09% 0.814627 1.374379 0.205937 0.751684 0.8496 257 Std Dev 15.64% 32.36% 25.49711% 2.765436 0.287332 2900.816 0.417723 0.431077 0.46184 258 Min -3.53% -9.80% -5.19% -0.6 -0.05164 -0.21063 -0.08593 -0.07376 -0.18828 259 Max 2.38% 7.85% 4.43% 1.348358 0.099058 0.196412 0.168543 0.081272 0.132309 260 Correl 0.413611 0.630340323 -0.08114 0.464756 0.512945 0.436984 0.300999 0.507807 261 Beta 0.8559 1.021661028 -1.4264 0.854076 0.112274 1.167458 0.829864 1.499955 262 263 Portfolio beta 0.614349 264 265 Note: the Portfolio beta above is for an equally-weighted portfolio consisting of all the stocks above. 266 267 268 269 270 271 272 273 274 275 276 277 278 Sheet1 Ready @ HT + 100% HH Type here to search o int w C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts