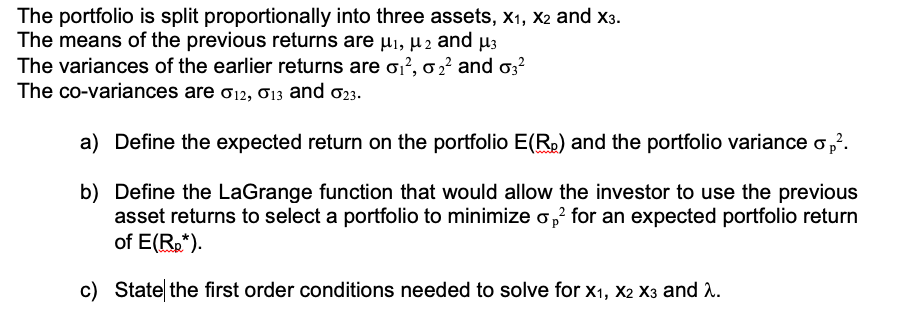

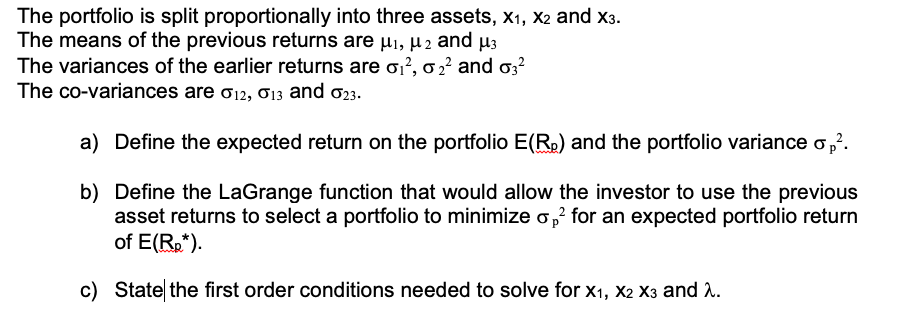

Question: The portfolio is split proportionally into three assets, X1, X2 and X3. The means of the previous returns are Ji, H2 and 3 The variances

The portfolio is split proportionally into three assets, X1, X2 and X3. The means of the previous returns are Ji, H2 and 3 The variances of the earlier returns are o12, o 2 and 632 The co-variances are 612, 613 and 623. a) Define the expected return on the portfolio E(R.) and the portfolio variance op?. b) Define the LaGrange function that would allow the investor to use the previous asset returns to select a portfolio to minimize op for an expected portfolio return of E(R.*). c) State the first order conditions needed to solve for X1, X2 X3 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts