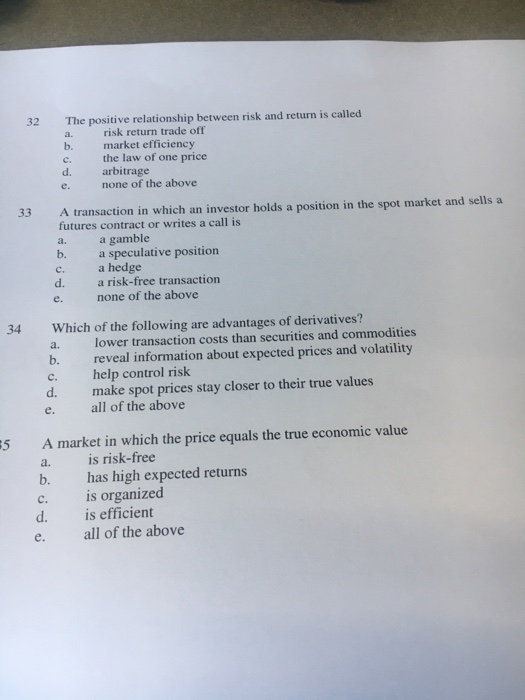

Question: The positive relationship between risk and return is called a. b. c. d. e. 32 risk return trade off market efficiency the law of one

The positive relationship between risk and return is called a. b. c. d. e. 32 risk return trade off market efficiency the law of one price arbitrage none of the above 33 A transaction in which an investor holds a position in the spot market and sells a futures contract or writes a call is a. b. a speculative position a gamble a hedge a risk-free transaction none of the above c. d. e. 34 Which of the following are advantages of derivatives? a. lower transaction costs than securities and commodities b. reveal information about expected prices and volatility c. help control risk d. make spot prices stay closer to their true values all of the above e. A market in which the price equals the true economic value a. is risk-free b. has high expected returns c. is organized d. s efficient e. all of the above 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts