Question: The primary difference between a forward contract and a futures contract is the Select one: O a Time of delivery O b. Type of commodity

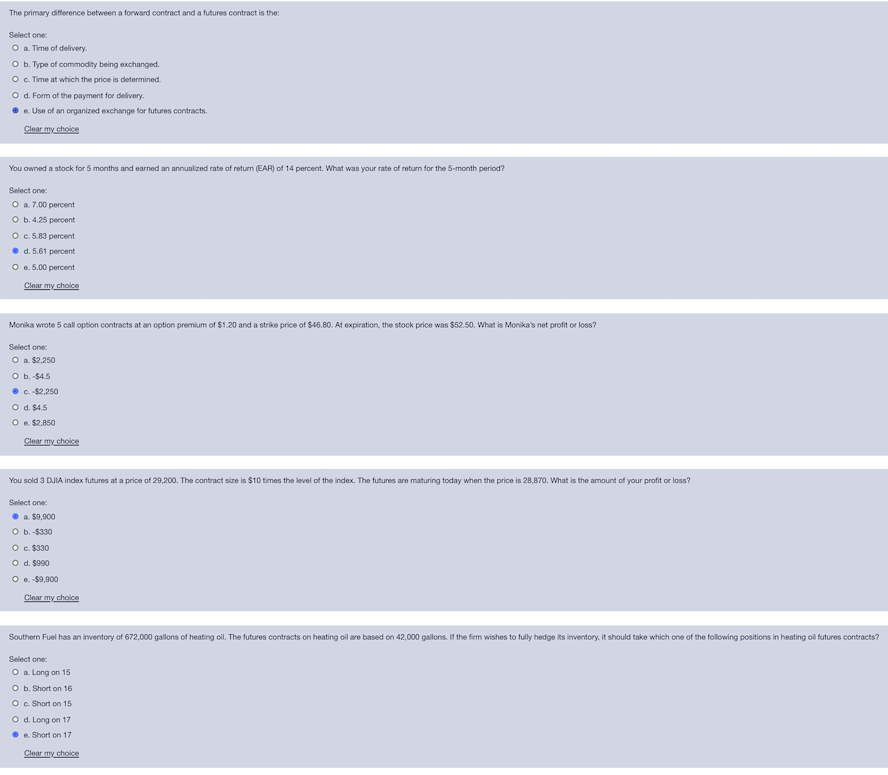

The primary difference between a forward contract and a futures contract is the Select one: O a Time of delivery O b. Type of commodity being exchanged. O c. Time at which the price is determined. O d. Form of the payment for delivery e. Use of an organized exchange for futures contracts Clear my choice You owned a stock for 5 months and earned an annualized rate of return (EAR) of 14 percent. What was your rate of return for the 5-month period? Select one: O a 7.00 percent O b. 4.25 percent O c. 5.83 percent d. 5.61 percent O e. 5.00 percent Clear my choice Monika wrote 5 call option contracts at an option premium of $1.20 and a strike price of $46.80. At expiration, the stock price was $52.50. What is Monika's net profit or loss? Select one: O a $2,250 O b.-$4.5 c. $2,250 O d. $45 O e. $2,850 Clear my choice You sold 3 DJIA index futures at a price of 29,200. The contract size is $10 times the level of the index. The futures are maturing today when the price is 28,870. What is the amount of your profit or loss? Select one: a $9,900 O b. -$330 O c. $330 O d. $990 O e. -$9.900 Clear my choice Southern Fuel has an inventory of 672,000 gallons of heating oil. The futures contracts on heating oil are based on 42,000 gallons. If the firm wishes to fully hedge its inventory, it should take which one of the following positions in heating oil futures contracts? Select one: O a Long on 15 O b. Short on 16 O c. Short on 15 O d. Long on 17 e. Short on 17 Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts