Question: The principle difference between a merchandising and a manufacturing income statement is the A) cost of goods sold section. B) extraordinary item section. C) operating

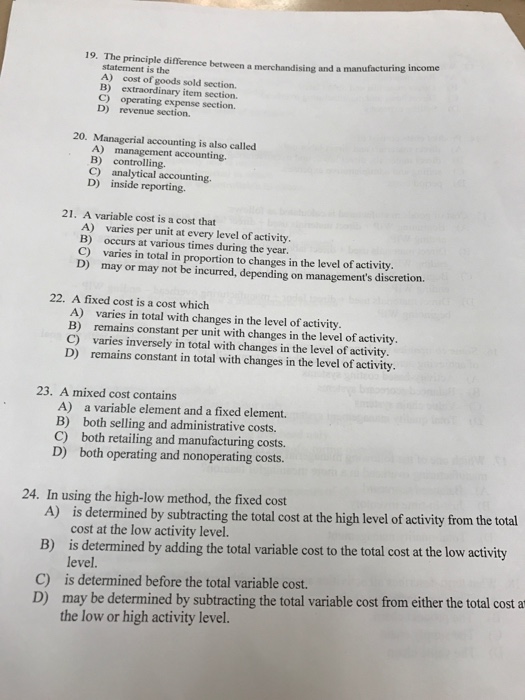

The principle difference between a merchandising and a manufacturing income statement is the A) cost of goods sold section. B) extraordinary item section. C) operating expense section. D) revenue section. Managerial accounting is also called A) management accounting. B) controlling. C) analytical accounting. D) inside reporting. A variable cost is a cost that A) varies per unit at every level of activity. B) occurs at various times during the year. C) vanes in total in proportion to changes in the level of activity. D) may or may not be incurred, depending on management's discretion. A fixed cost is a cost which A) varies in total with changes in the level of activity. B) remains constant per unit with changes in the level of activity. C) varies inversely in total with changes in the level of activity. D) remains constant in total with changes in the level of activity. A mixed cost contains A) a variable element and a fixed element. B) both selling and administrative costs. C) both retailing and manufacturing costs. D) both operating and nonoperating costs. In using the high-low method, the fixed cost A) is determined by subtracting the total cost at the high level of activity from the total cost at the low activity level. B) is determined by adding the total variable cost to the total cost at the low activity level. C) is determined before the total variable cost. D) may be determined by subtracting the total variable cost from either the total cost the low or high activity level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts