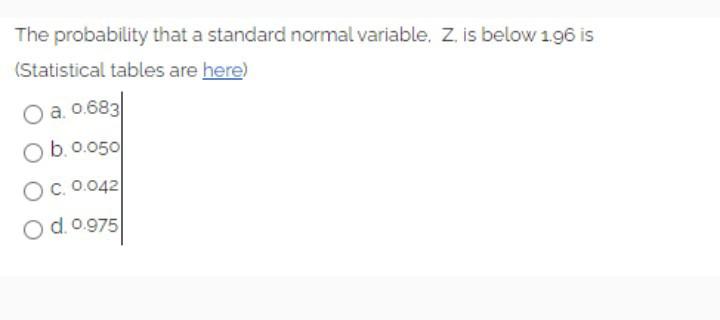

Question: The probability that a standard normal variable, Z, is below 1.96 is (Statistical tables are here) a 0.683) b. 0.050 O a O C 0.042

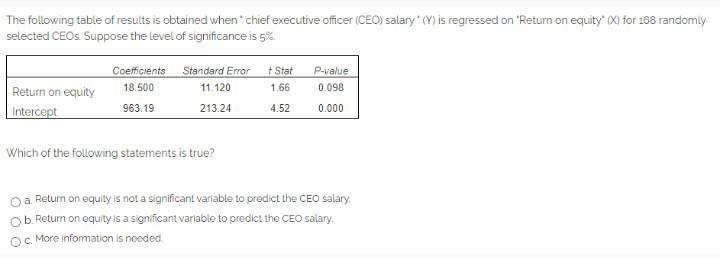

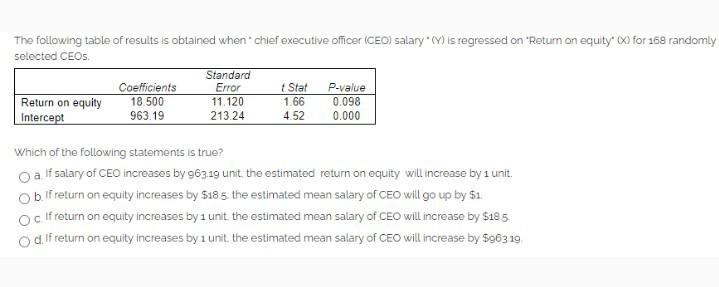

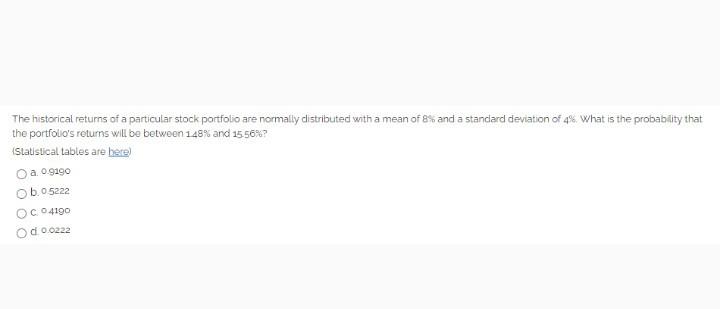

The probability that a standard normal variable, Z, is below 1.96 is (Statistical tables are here) a 0.683) b. 0.050 O a O C 0.042 O d. 0.975 . The following table of results is obtained when chief executive Officer (CEO) salary (7) is regressed on "Return on equity) for 168 randomly selected CEOs Standard Coefficients Error Stat P-value Return on equity 18.500 11.120 1.66 0.098 Intercept 963.19 213.24 4.52 0.000 Which of the following statements is true? alf salary of CEO increases by 963.19 unt, the estimated return on equity will increase by 1 unit. bifreturn on equity increases by $185 the estimated mean salary of CEO will go up by $1. cifreturn on equity increases by 1 unit the estimated mean salary of CEO will increase by $185 od. If return on equity increases by 1 unit. the estimated mean salary of CEO will increase by $963 19 The historical returns of a particular stock portfolio are normally distributed with a mean of 8% and a standard deviation of 4% What is the probability that the portfolio's returns will be between 148% and 155647 Statistical tables are bere a 0.9190 Ob 05222 OC 04190 Od 0.0222

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock