Question: The probability that actual sales will be expected calculated value plus or minus one standard deviation, assuming the distribution of possible future sales values is

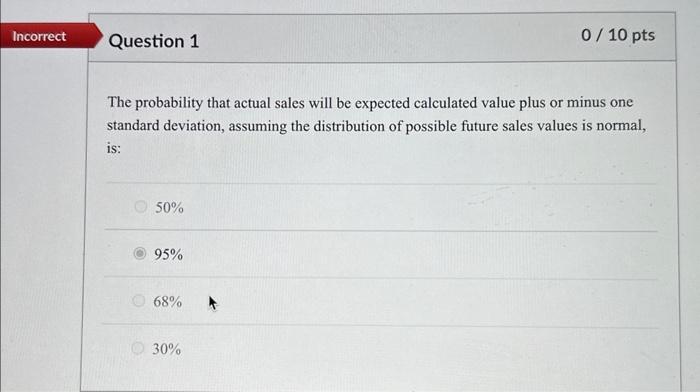

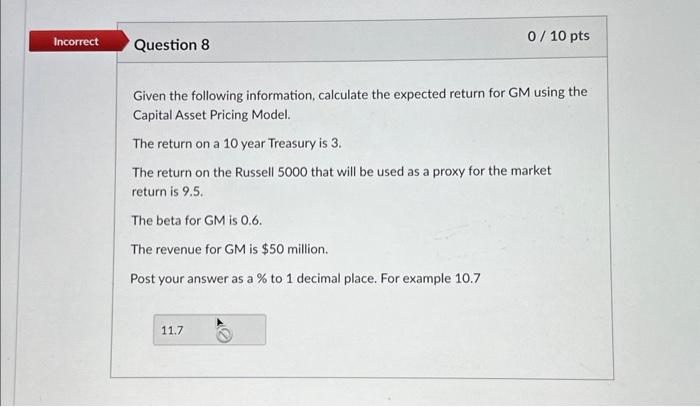

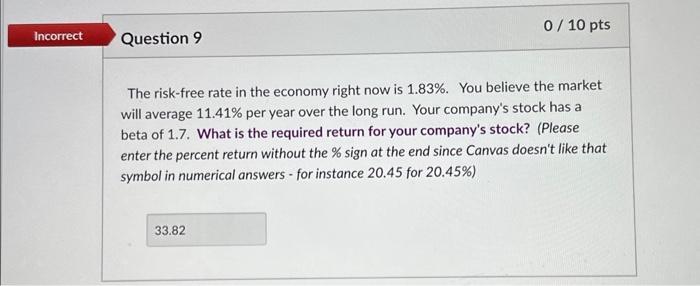

The probability that actual sales will be expected calculated value plus or minus one standard deviation, assuming the distribution of possible future sales values is normal, is: 50% 95% 68% 30% Given the following information, calculate the expected return for GM using the Capital Asset Pricing Model. The return on a 10 year Treasury is 3. The return on the Russell 5000 that will be used as a proxy for the market return is 9.5 . The beta for GM is 0.6 . The revenue for GM is $50 million. Post your answer as a \% to 1 decimal place. For example 10.7 The risk-free rate in the economy right now is 1.83%. You believe the market will average 11.41% per year over the long run. Your company's stock has a beta of 1.7. What is the required return for your company's stock? (Please enter the percent return without the \% sign at the end since Canvas doesn't like that symbol in numerical answers - for instance 20.45 for 20.45\%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts