Question: The problem is BELOW the example!!! 3. Prices for a nondividend-paying stock are modeled with a 1-period binomial tree. You are given the following information:

The problem is BELOW the example!!!

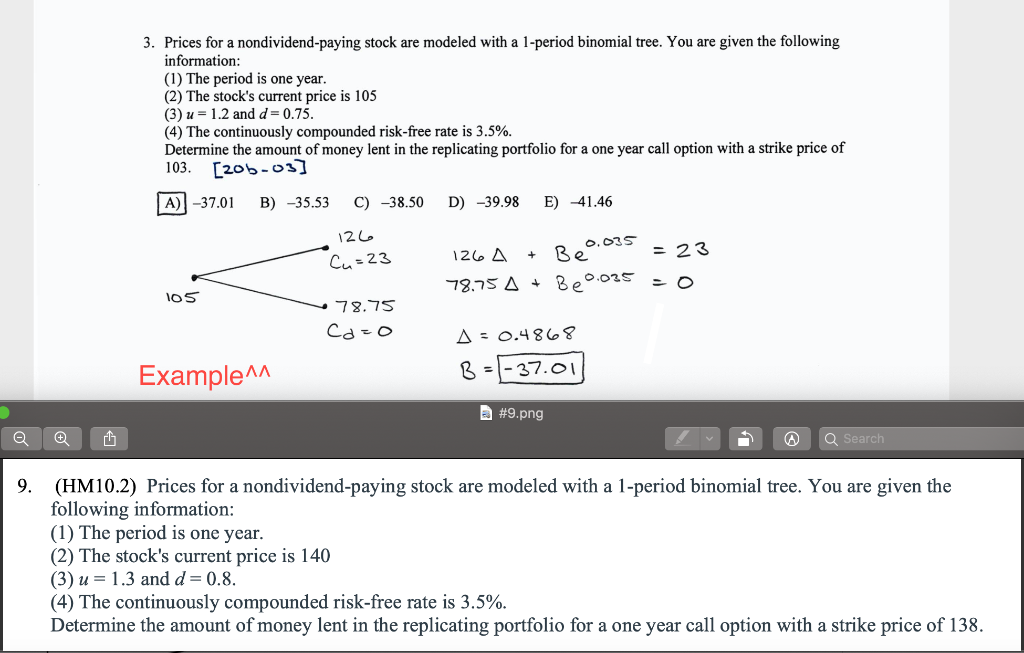

3. Prices for a nondividend-paying stock are modeled with a 1-period binomial tree. You are given the following information: (1) The period is one year. (2) The stock's current price is 105 (3) u = 1.2 and d= 0.75. (4) The continuously compounded risk-free rate is 3.5%. Determine the amount of money lent in the replicating portfolio for a one year call option with a strike price of 103. [205-03] A) -37.01 B) -35.53 C) -38.50 D) -39.98 E) 41.46 126 "Cu=23 126A + Be.035 = 23 78.75 A + Be0.035 =0 105 -78.75 ca=o A = 0.4868 B = -37.01 Example #9.png w Search 9. (HM10.2) Prices for a nondividend-paying stock are modeled with a 1-period binomial tree. You are given the following information: (1) The period is one year. (2) The stock's current price is 140 (3) u= 1.3 and d= 0.8. (4) The continuously compounded risk-free rate is 3.5%. Determine the amount of money lent in the replicating portfolio for a one year call option with a strike price of 138

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts