Question: The problem is present in solutions to OPTIONS FUTURES & OTHER DERIVATIVES 8th ed Chapter 20 p 10 but the photo of the binomial tree

The problem is present in solutions to OPTIONS FUTURES & OTHER DERIVATIVES 8th ed Chapter 20 p 10 but the photo of the binomial tree is corrupt (zoomed in). Please help with the tree! Thanks

The problem is present in solutions to OPTIONS FUTURES & OTHER DERIVATIVES 8th ed Chapter 20 p 10 but the photo of the binomial tree is corrupt (zoomed in). Please help with the tree! Thanks

here is the link to the sols https://www.chegg.com/homework-help/9-month-american-put-option-non-dividend-paying-stock-strike-chapter-20-problem-10PQ-solution-9780132980449-exc

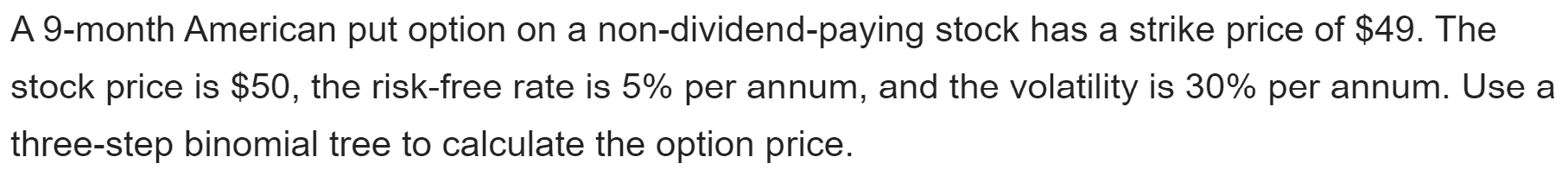

A 9-month American put option on a non-dividend-paying stock has a strike price of $49. The stock price is $50, the risk-free rate is 5% per annum, and the volatility is 30% per annum. Use a three-step binomial tree to calculate the option price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock