Question: The problems are already worked out, I just need the why and how questions answered on a conceptual basis. | Apple (AAPL) Underlying stock price

The problems are already worked out, I just need the "why" and "how" questions answered on a conceptual basis.

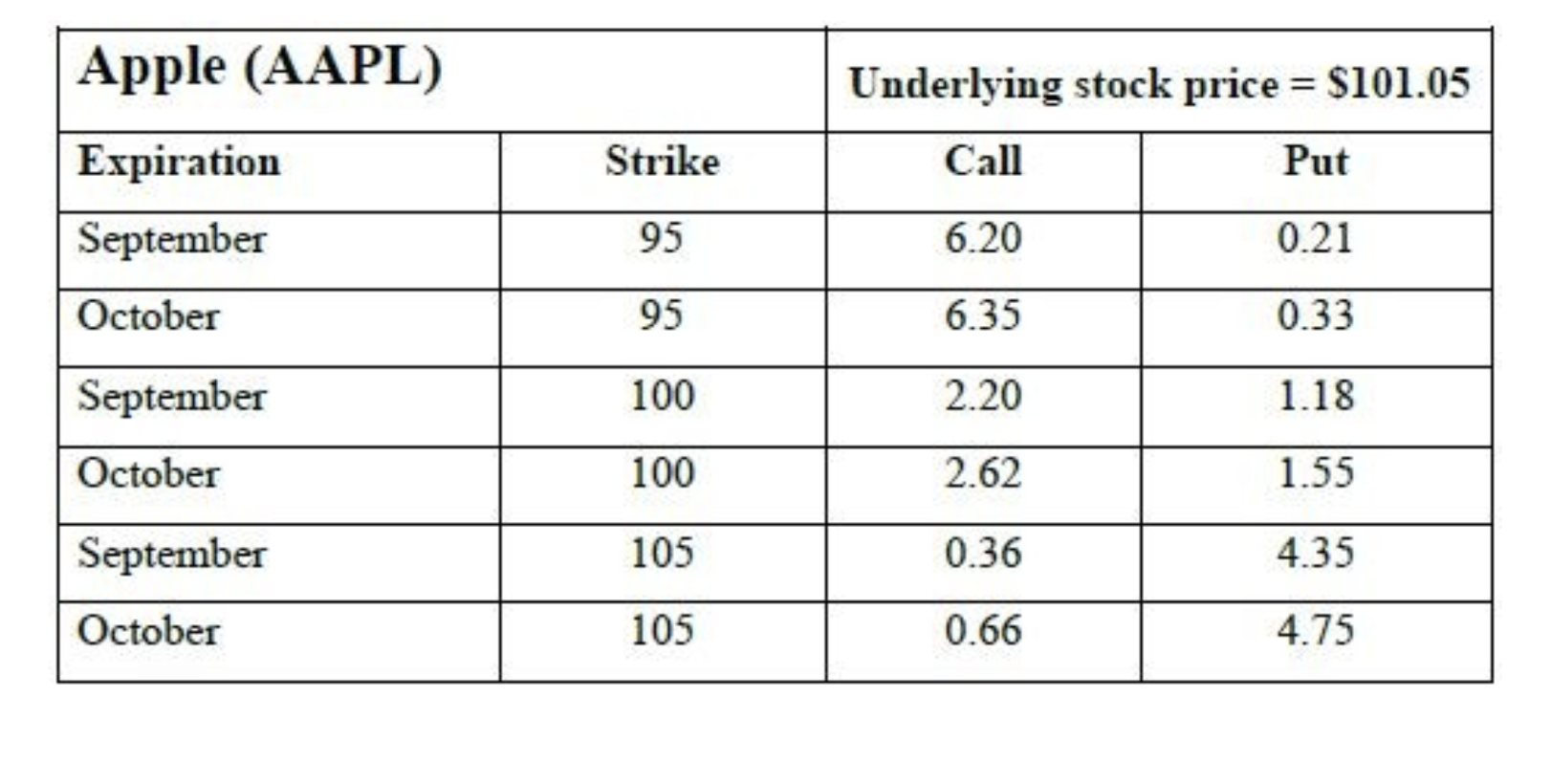

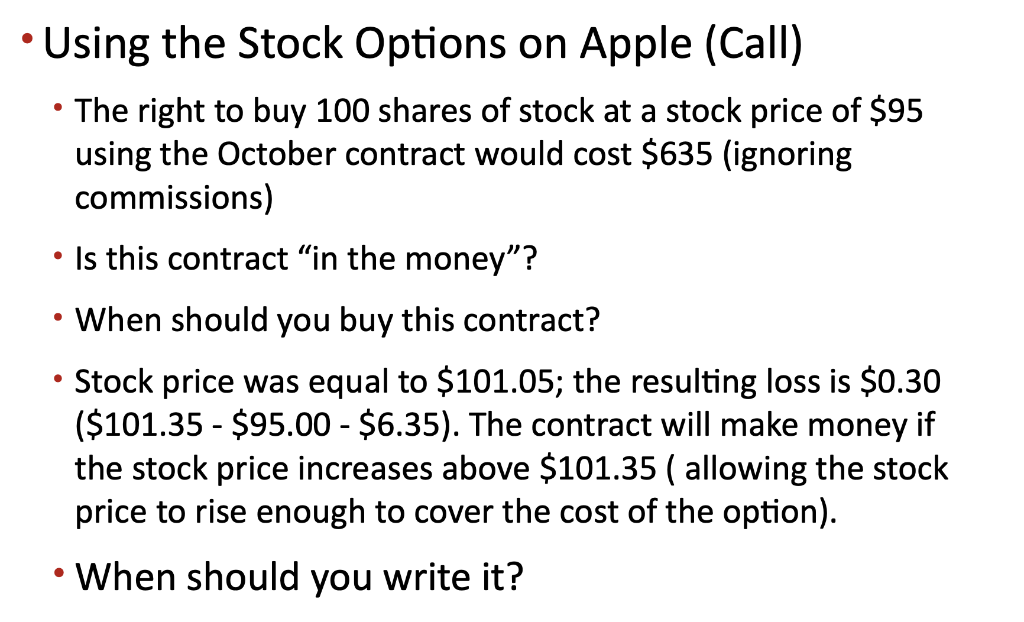

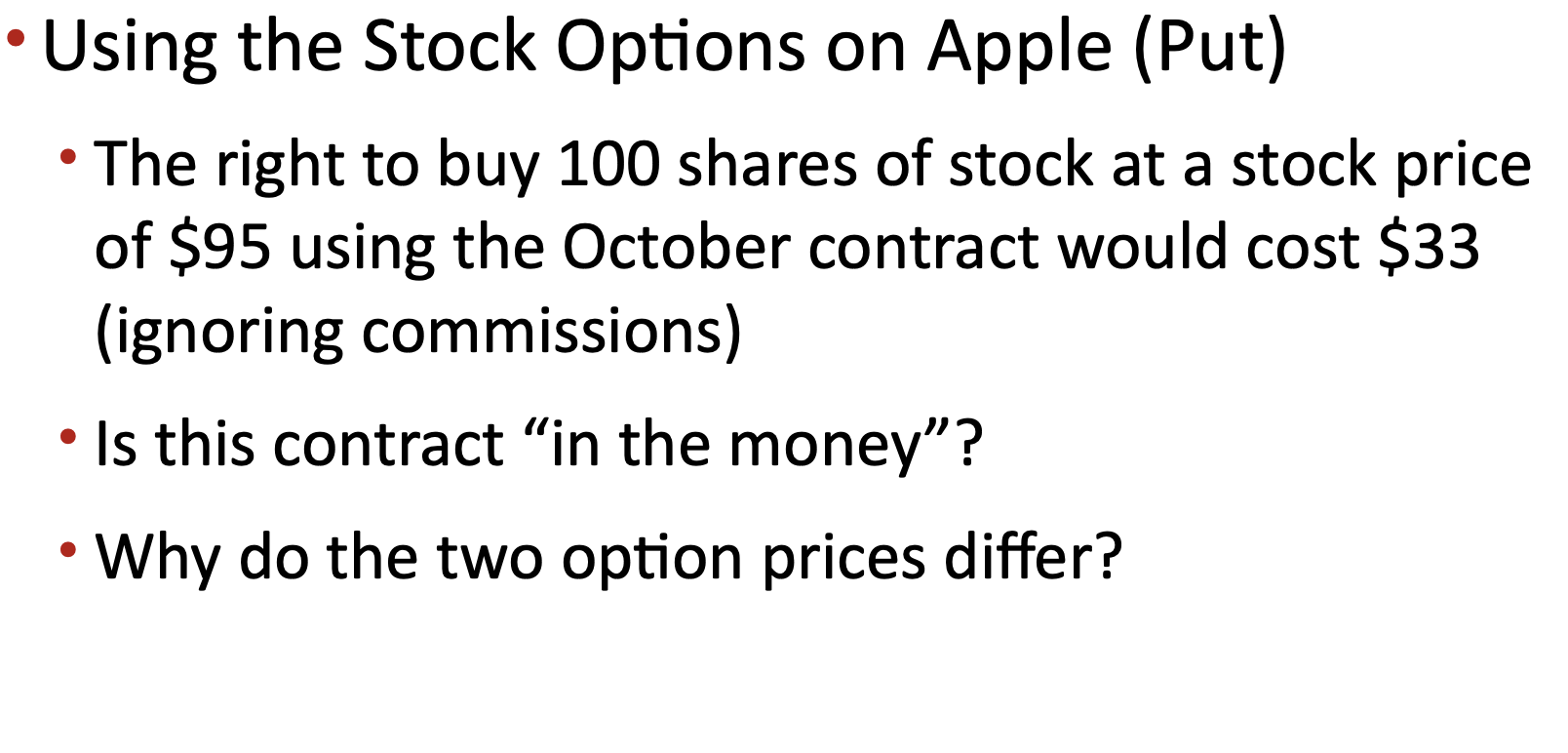

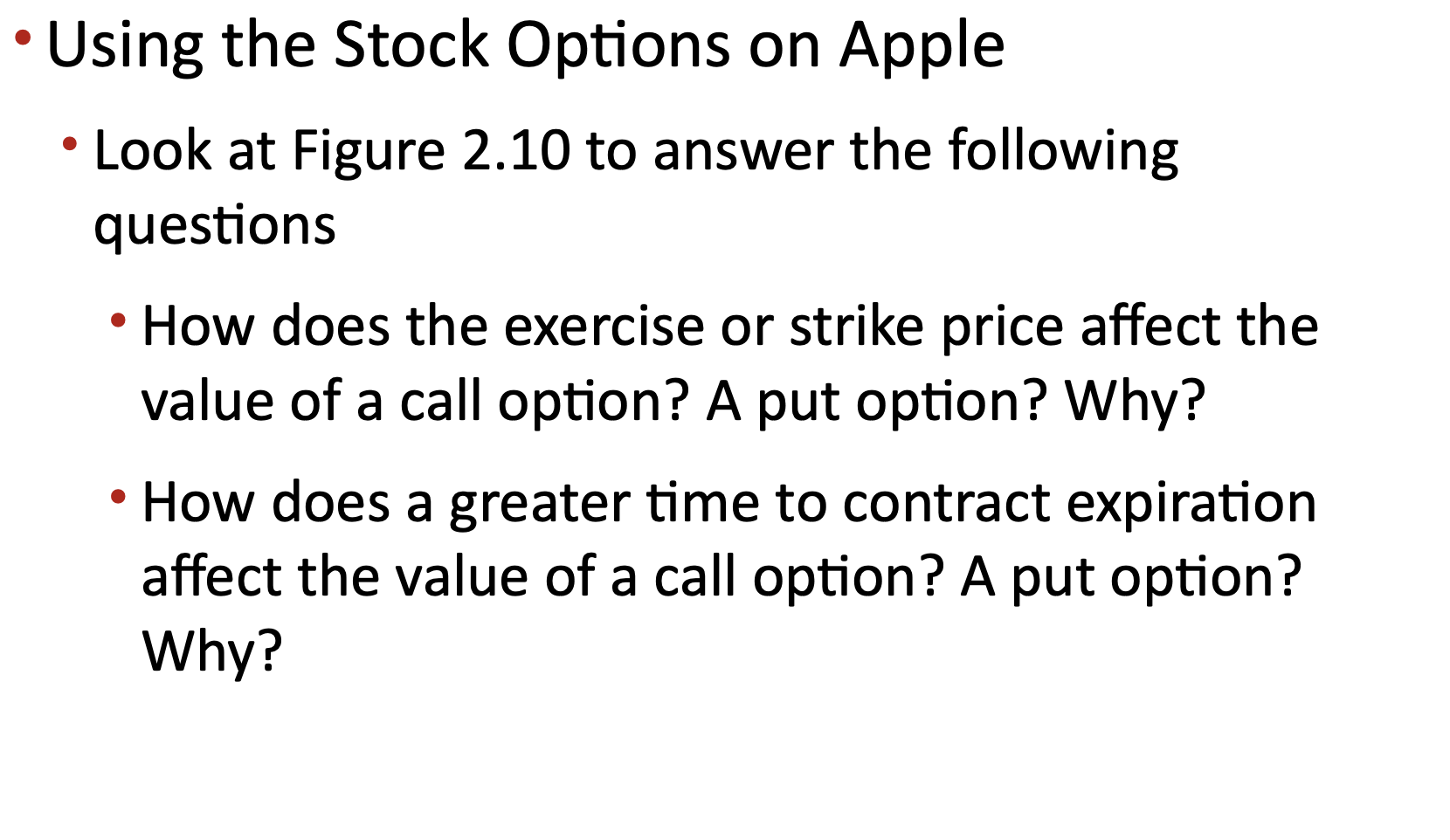

| Apple (AAPL) Underlying stock price $101.05 Expiration Call Strike Put 95 September 6.20 0.21 October 95 6.35 0.33 September 100 2.20 1.18 October 100 2.62 1.55 September 105 0.36 4.35 October 105 0.66 4.75 Using the Stock Options on Apple (Call) The right to buy 100 shares of stock at a stock price of $95 using the October contract would cost $635 (ignoring commissions) Is this contract "in the money"? When should you buy this contract? Stock price was equal to $101.05; the resulting loss is $0.30 ($101.35 - $95.00 - $6.35). The contract will make money if the stock price increases above $101.35 ( allowing the stock price to rise enough to cover the cost of the option) When should you write it? Using the Stock Options on Apple (Put) The right to buy 100 shares of stock at a stock price of $95 using the October contract would cost $33 (ignoring commissions) Is this contract "in the money"? Why do the two option prices differ? Using the Stock Options on Apple Look at Figure 2.10 to answer the following questions How does the exercise or strike price affect the value of a call option? A put option? Why? How does a greater time to contract expiration affect the value of a call option? A put option? Why? | Apple (AAPL) Underlying stock price $101.05 Expiration Call Strike Put 95 September 6.20 0.21 October 95 6.35 0.33 September 100 2.20 1.18 October 100 2.62 1.55 September 105 0.36 4.35 October 105 0.66 4.75 Using the Stock Options on Apple (Call) The right to buy 100 shares of stock at a stock price of $95 using the October contract would cost $635 (ignoring commissions) Is this contract "in the money"? When should you buy this contract? Stock price was equal to $101.05; the resulting loss is $0.30 ($101.35 - $95.00 - $6.35). The contract will make money if the stock price increases above $101.35 ( allowing the stock price to rise enough to cover the cost of the option) When should you write it? Using the Stock Options on Apple (Put) The right to buy 100 shares of stock at a stock price of $95 using the October contract would cost $33 (ignoring commissions) Is this contract "in the money"? Why do the two option prices differ? Using the Stock Options on Apple Look at Figure 2.10 to answer the following questions How does the exercise or strike price affect the value of a call option? A put option? Why? How does a greater time to contract expiration affect the value of a call option? A put option? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts