Question: The program is saying that this question is incomplete. What am i missing? The Polaris Company uses a job-order costing system. The following transactions occurred

The program is saying that this question is incomplete. What am i missing?

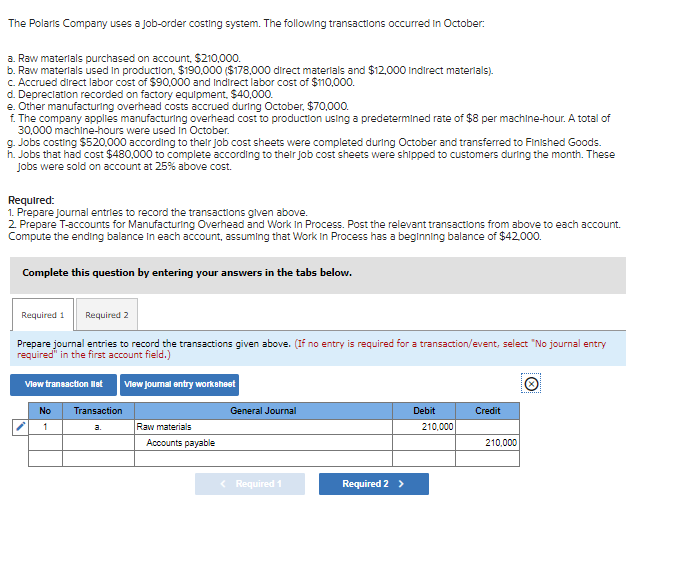

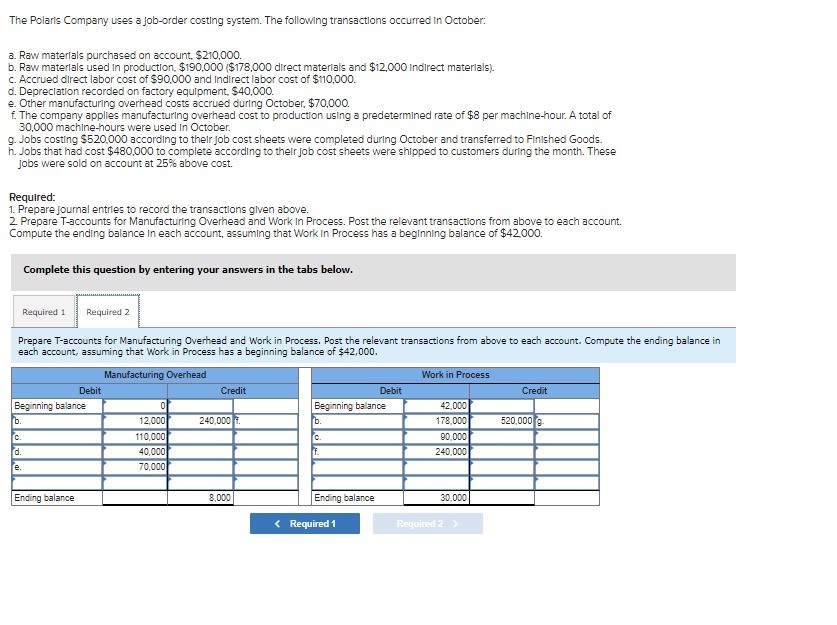

The Polaris Company uses a job-order costing system. The following transactions occurred in October: a. Raw materials purchased on account, $210,000. b. Raw materials used in production. $190.000 ($178,000 direct materials and $12,000 Indirect materials). c. Accrued direct labor cost of $90,000 and Indirect labor cost of $110,000. d. Depreciation recorded on factory equipment, $40,000. e. Other manufacturing overhead costs accrued during October, $70,000. 1. The company applies manufacturing overhead cost to production using a predetermined rate of $8 per machine-hour. A total of 30,000 machine-hours were used in October. 9. Jobs costing $520,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $480,000 to complete according to their job cost sheets were shipped to customers during the month. These Jobs were sold on account at 25% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2 Prepare T-accounts for Manufacturing Overhead and Work In Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work In Process has a beginning balance of $42.000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the transactions given above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction llat View journal entry worksheet Transaction General Journal Credit No 1 Debit 210,000 a. Raw materials Accounts payable 210,000 The Polaris Company uses a job-order costing system. The following transactions occurred in October a. Raw materials purchased on account, $210,000. b. Raw materials used in production. $190.000 ($178.000 direct materials and $12,000 Indirect materials). c. Accrued direct labor cost of $90,000 and Indirect labor cost of $110,000. d. Depreciation recorded on factory equipment. $40,000. e. Other manufacturing overhead costs accrued during October, $70,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $8 per machine-hour. A total of 30,000 machine-hours were used in October. 9. Jobs costing $520.000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $480,000 to complete according to their job cost sheets were shipped to customers during the month. These Jobs were sold on account at 25% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work In Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work In Process has a beginning balance of $42000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $42,000. Manufacturing Overhead Work in Process Debit Credit Debit Credit Beginning balance 0 Beginning balance 42.000 12.000 240,000 178,000 520,000 9 c. 110,000 c. 90.000 d. 40.000 f. 240,000 70,000 b. b. e. Ending balance 8.000 30.000 Ending balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts