Question: The project is somewhat riskier than a typical project for DH, primarily because the plant is being located overseas. Therefore the project will increase the

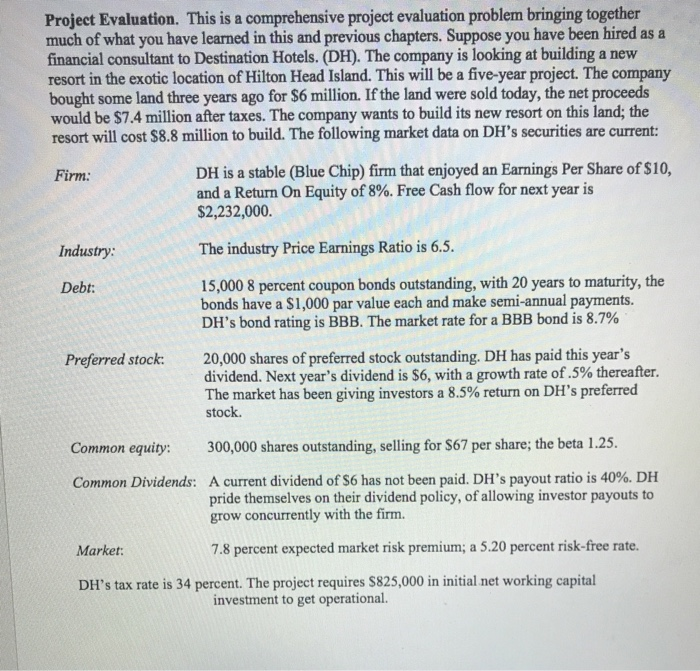

Project Evaluation. This is a comprehensive project evaluation problem bringing together much of what you have learned in this and previous chapters. Suppose you have been hired as a financial consultant to Destination Hotels. (DH). The company is looking at building a new resort in the exotic location of Hilton Head Island. This will be a five-year project. The company bought some land three years ago for $6 million. If the land were sold today, the net proceeds would be $7.4 million after taxes. The company wants to build its new resort on this land; the resort will cost $8.8 million to build. The following market data on DH's securities are current: Firm: DH is a stable (Blue Chip) firm that enjoyed an Earnings Per Share of $10, and a Return On Equity of 8%. Free Cash flow for next year is $2,232,000. Industry: The industry Price Earnings Ratio is 6.5. Debt: 15,000 8 percent coupon bonds outstanding, with 20 years to maturity, the bonds have a $1,000 par value each and make semi-annual payments. DH's bond rating is BBB. The market rate for a BBB bond is 8.7% Preferred stock: 20,000 shares of preferred stock outstanding. DH has paid this year's dividend. Next year's dividend is $6, with a growth rate of .5% thereafter. The market has been giving investors a 8.5% return on DH's preferred stock Common equity: 300,000 shares outstanding, selling for $67 per share; the beta 1.25. Common Dividends: A current dividend of $6 has not been paid. DH's payout ratio is 40%. DH pride themselves on their dividend policy, of allowing investor payouts to grow concurrently with the firm. Market: 7.8 percent expected market risk premium; a 5.20 percent risk-free rate. DH's tax rate is 34 percent. The project requires $825,000 in initial net working capital investment to get operational Project Evaluation. This is a comprehensive project evaluation problem bringing together much of what you have learned in this and previous chapters. Suppose you have been hired as a financial consultant to Destination Hotels. (DH). The company is looking at building a new resort in the exotic location of Hilton Head Island. This will be a five-year project. The company bought some land three years ago for $6 million. If the land were sold today, the net proceeds would be $7.4 million after taxes. The company wants to build its new resort on this land; the resort will cost $8.8 million to build. The following market data on DH's securities are current: Firm: DH is a stable (Blue Chip) firm that enjoyed an Earnings Per Share of $10, and a Return On Equity of 8%. Free Cash flow for next year is $2,232,000. Industry: The industry Price Earnings Ratio is 6.5. Debt: 15,000 8 percent coupon bonds outstanding, with 20 years to maturity, the bonds have a $1,000 par value each and make semi-annual payments. DH's bond rating is BBB. The market rate for a BBB bond is 8.7% Preferred stock: 20,000 shares of preferred stock outstanding. DH has paid this year's dividend. Next year's dividend is $6, with a growth rate of .5% thereafter. The market has been giving investors a 8.5% return on DH's preferred stock Common equity: 300,000 shares outstanding, selling for $67 per share; the beta 1.25. Common Dividends: A current dividend of $6 has not been paid. DH's payout ratio is 40%. DH pride themselves on their dividend policy, of allowing investor payouts to grow concurrently with the firm. Market: 7.8 percent expected market risk premium; a 5.20 percent risk-free rate. DH's tax rate is 34 percent. The project requires $825,000 in initial net working capital investment to get operational

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts