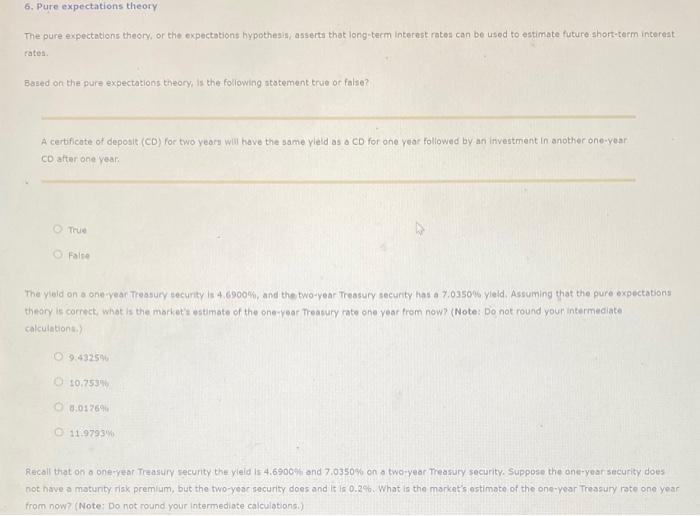

Question: The pure expectations theory, or the expectations hypothesis, asserts that long-tecm interest rates can be used to estimate future ishort-term intereat rates. Based on the

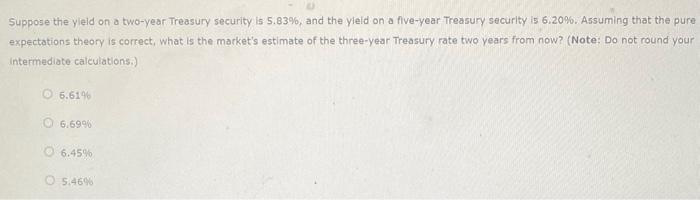

The pure expectations theory, or the expectations hypothesis, asserts that long-tecm interest rates can be used to estimate future ishort-term intereat rates. Based on the pure expectations theory is the following statement true or false? A certificote of deposit (CD) for two yeary will have the same yleld as a CD for one year folliowed by an investment in another one-year co after one year. True False The yleid on a one iyean Treasury security is 4.6900%, and the two-year Treasury security has a 7.035006 yleld. Assuming that the pure expectations theary is correct, what is the market? estimate of the one-year Treasury rate ohe year from now? (Note: Do not round your intermediate calculationsin Recall that on a oneryear Treasury security the yela is 4.6900 hi and 7.0350% on a two-year Treasury security. Suppose the one-year security does not have a matunty risk premium, but the two-year security does and it is 0.2f. What is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculationsi) Suppose the yleld on a two-year Treasury security is 5.83%, and the yleid on a five-year Treasury security is 6.20%. Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not round your intermediate calculations.) 6.614% 6.6998 6.45% 5.4600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts