Question: The purpose of this exercise is to construct a typical pro formal financial projection for a startup, and to consider the financial implications for the

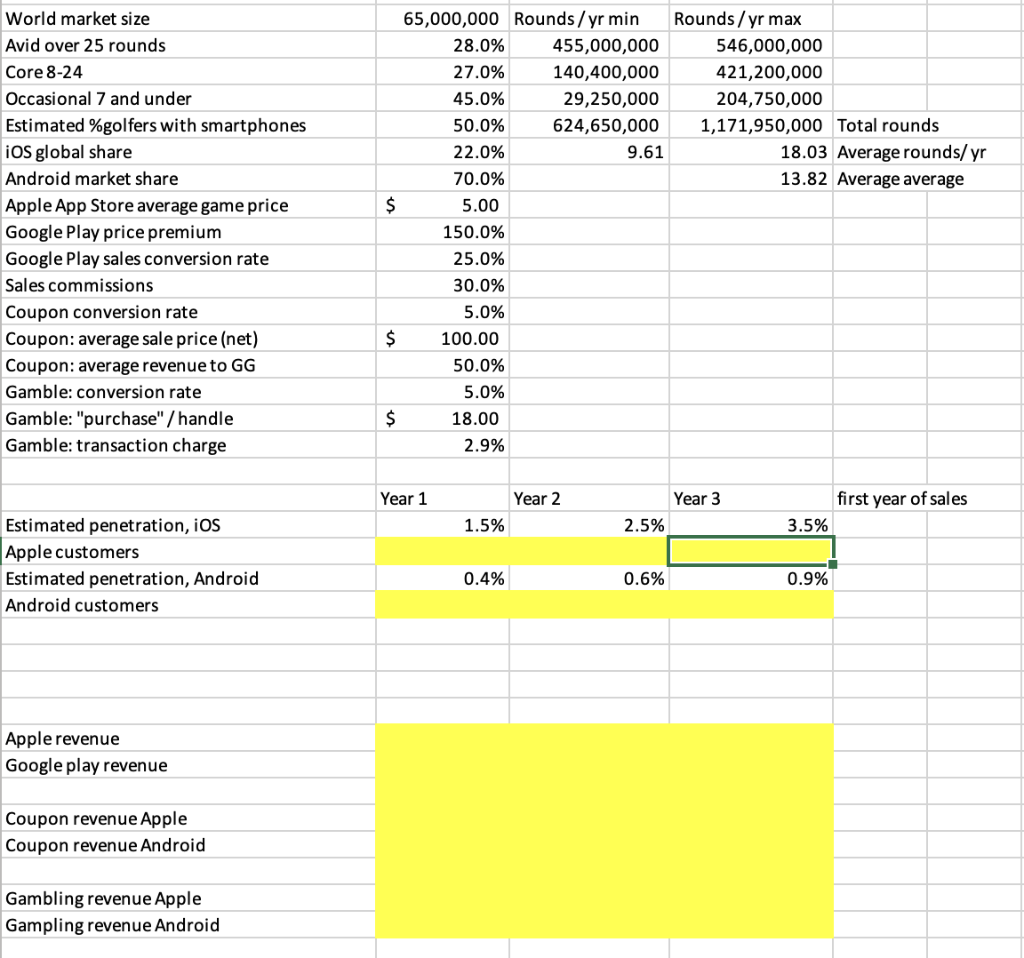

The purpose of this exercise is to construct a typical pro formal financial projection for a startup, and to consider the financial implications for the venture. Your tasks are as follows: 1. Complete the spreadsheet by filling in numbers and computations (the yellow area). Do not change the structure (columns, rows, headings, sheets). Note that you are working in months on the cost sheet, annuals on the revenues sheet, and the P&L sheet. Year O is initial upfront investment; Y1 represents development time; Y2-Y4 represent years that the app sells. Three years is the desired time horizon. Do not include taxes or financial expenses (loan interest, stock dividends). Do not add lines to the spreadsheet. The goal is to reach a conclusion regarding likely cash flow from the venture on an ongoing basis. Be prepared to submit your spreadsheet. 2. Please answer the following questions on a separate sheet of paper submitted through Canvas: ? What are the projected cash flows for the five years of the venture? State the final line from the P&L sheet and the cash flow line, for five years. State the final year's profit or loss. 2). These calculations embed significant assumptions. What risks do you see to the venture reaching the financial numbers you project? No more than two please. One to two sentences should suffice for each risk. ? What key measures would you watch to monitor those risks as the venture is launched? Why? No more than two please. One to two sentences should suffice for each measure. Rounds/yr max 546,000,000 421,200,000 204,750,000 1,171,950,000 Total rounds 18.03 Average rounds/yr 13.82 Average average World market size Avid over 25 rounds Core 8-24 Occasional 7 and under Estimated %golfers with smartphones ios global share Android market share Apple App Store average game price Google Play price premium Google Play sales conversion rate Sales commissions Coupon conversion rate Coupon: average sale price (net) Coupon: average revenue to GG Gamble: conversion rate Gamble: "purchase" /handle Gamble: transaction charge 65,000,000 Rounds/yr min 28.0% 455,000,000 27.0% 140,400,000 45.0% 29,250,000 50.0% 624,650,000 22.0% 9.61 70.0% $ 5.00 150.0% 25.0% 30.0% 5.0% $ 100.00 50.0% 5.0% $ 18.00 2.9% Year 1 Year 2 1.5% Year 3 2.5% first year of sales 3.5% Estimated penetration, iOS Apple customers Estimated penetration, Android Android customers 0.4% 0.6% 0.9% Apple revenue Google play revenue Coupon revenue Apple Coupon revenue Android Gambling revenue Apple Gampling revenue Android The purpose of this exercise is to construct a typical pro formal financial projection for a startup, and to consider the financial implications for the venture. Your tasks are as follows: 1. Complete the spreadsheet by filling in numbers and computations (the yellow area). Do not change the structure (columns, rows, headings, sheets). Note that you are working in months on the cost sheet, annuals on the revenues sheet, and the P&L sheet. Year O is initial upfront investment; Y1 represents development time; Y2-Y4 represent years that the app sells. Three years is the desired time horizon. Do not include taxes or financial expenses (loan interest, stock dividends). Do not add lines to the spreadsheet. The goal is to reach a conclusion regarding likely cash flow from the venture on an ongoing basis. Be prepared to submit your spreadsheet. 2. Please answer the following questions on a separate sheet of paper submitted through Canvas: ? What are the projected cash flows for the five years of the venture? State the final line from the P&L sheet and the cash flow line, for five years. State the final year's profit or loss. 2). These calculations embed significant assumptions. What risks do you see to the venture reaching the financial numbers you project? No more than two please. One to two sentences should suffice for each risk. ? What key measures would you watch to monitor those risks as the venture is launched? Why? No more than two please. One to two sentences should suffice for each measure. Rounds/yr max 546,000,000 421,200,000 204,750,000 1,171,950,000 Total rounds 18.03 Average rounds/yr 13.82 Average average World market size Avid over 25 rounds Core 8-24 Occasional 7 and under Estimated %golfers with smartphones ios global share Android market share Apple App Store average game price Google Play price premium Google Play sales conversion rate Sales commissions Coupon conversion rate Coupon: average sale price (net) Coupon: average revenue to GG Gamble: conversion rate Gamble: "purchase" /handle Gamble: transaction charge 65,000,000 Rounds/yr min 28.0% 455,000,000 27.0% 140,400,000 45.0% 29,250,000 50.0% 624,650,000 22.0% 9.61 70.0% $ 5.00 150.0% 25.0% 30.0% 5.0% $ 100.00 50.0% 5.0% $ 18.00 2.9% Year 1 Year 2 1.5% Year 3 2.5% first year of sales 3.5% Estimated penetration, iOS Apple customers Estimated penetration, Android Android customers 0.4% 0.6% 0.9% Apple revenue Google play revenue Coupon revenue Apple Coupon revenue Android Gambling revenue Apple Gampling revenue Android

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts