Question: The purpose of this program is to use functions to calculate the state and county taxes to be charged on a purchase: A function should

The purpose of this program is to use functions to calculate the state and county taxes to be charged on a purchase: A function should be created that takes as arguments the current state tax rate and the amount of a sale. It should calculate the state tax owed on the purchase and return it. A function should be created that takes as arguments the current county tax rate and the amount of a sale. It should calculate the county tax owed on the purchase and return it. The state tax rate is currently 5.1%. The county tax rate is currently 2.4%. The program should print the purchase price, state tax, county tax and total cost

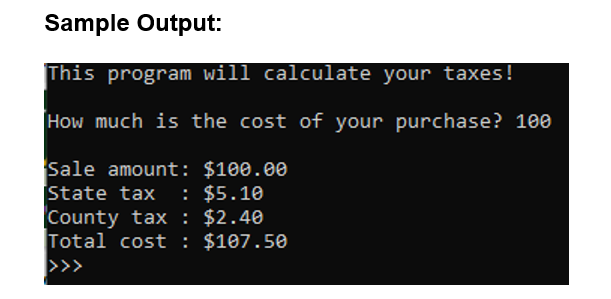

Sample Output: This program will calculate your taxes! How much is the cost of your purchase? 100 Sale amount: $100.00 State tax : $5.10 County tax : $2.40 Total cost : $107.50 Sample Output: This program will calculate your taxes! How much is the cost of your purchase? 100 Sale amount: $100.00 State tax : $5.10 County tax : $2.40 Total cost : $107.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts