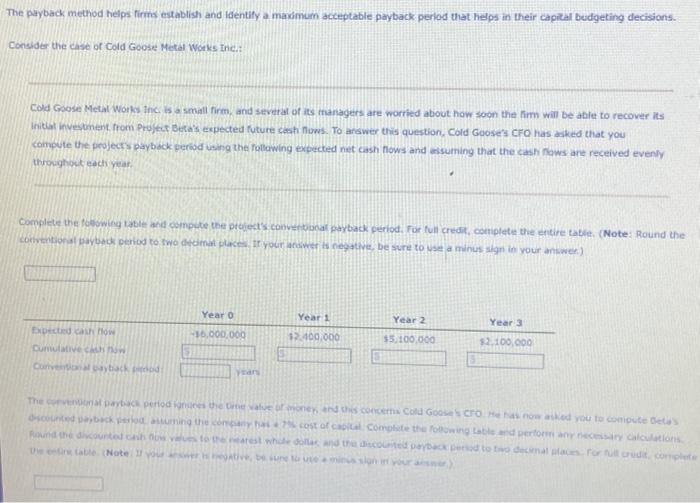

Question: The puyback method helps firms establish and ldentify a maximum acceptable payback perlod that helps in their capital bedgeting decisions. Consider the case of Cold

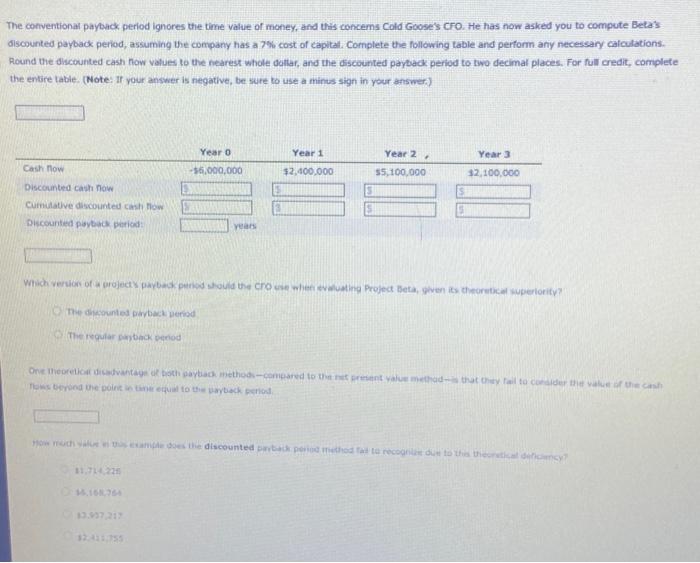

The puyback method helps firms establish and ldentify a maximum acceptable payback perlod that helps in their capital bedgeting decisions. Consider the case of Cold Geose Metal Works inc.: Cold Coose Metal Works Znc. is a small firm. and stivetal of its iflargats are wortied about how soon the fimm will be able to recover its initiat invesonent, from Profte befais expected future cesh fows. To ardwer this question, Cold Goose's cro has asked that you comple the projects paybock perbod using the following expected net cash flows and aksuming that the cash nows ane received evenly throcithest eacts yer, The conventional payback period ignores the time value of money, and this concems Cold Geose's cFO. He has nom asked you to compute Beta's discounted payback period, assuming the company has a 7 \% cost of capital. Cornplete the following table and pertorm any mectessary calculotions. Round the discounted cash flow values to the nearest whole dattar, and the discounted parback period to bvo decimal places. For full credit, complete the ensire latble. (Note: If your answer is negathe, be sure to use a minus sign in your answer.) The defkonatos parybek period The requiar pimbank pecriod fows bering whe point in tine equal to thie waytack, forlical. 11,724274 15,164254 17,577212 12+4375

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts