Question: the Q 28 the option D is wrong . I have taken the exam Question 28 of 75. All of the following types of Income

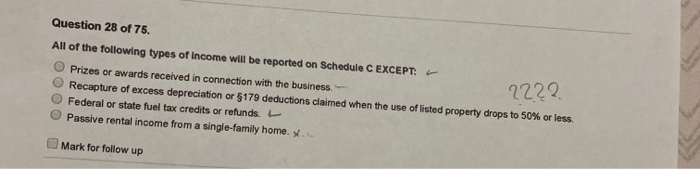

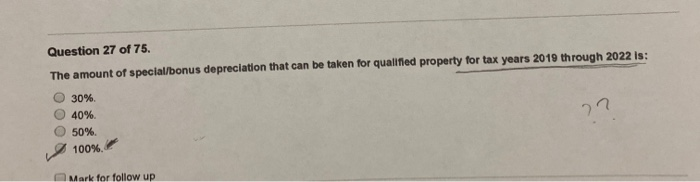

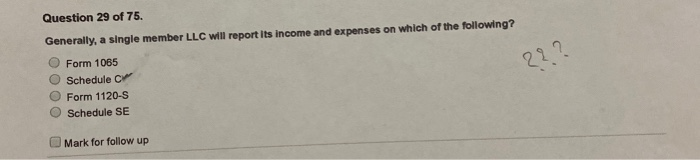

Question 28 of 75. All of the following types of Income will be reported on Schedule C EXCEPT: Prizes or awards received in connection with the business. Recapture of excess depreciation or 5179 deductions claimed when the use of listed property drops to 50% or less Federal or state fuel tax credits or refunds. O Passive rental income from a single-family home. 2222 Mark for follow up Question 27 of 75. The amount of special/bonus depreciation that can be taken for qualified property for tax years 2019 through 2022 is: 30% 40%. 50%. 100% Mark for follow up Question 29 of 75. Generally, a single member LLC will report its income and expenses on which of the following? Form 1065 Schedule C Form 1120-5 Schedule SE 22.? Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts