Question: the quation start from here Appendix 1 -Tasks 1-4 Task 1 - Preparing deposit facility and lodging flows Background You are employed as a part-time

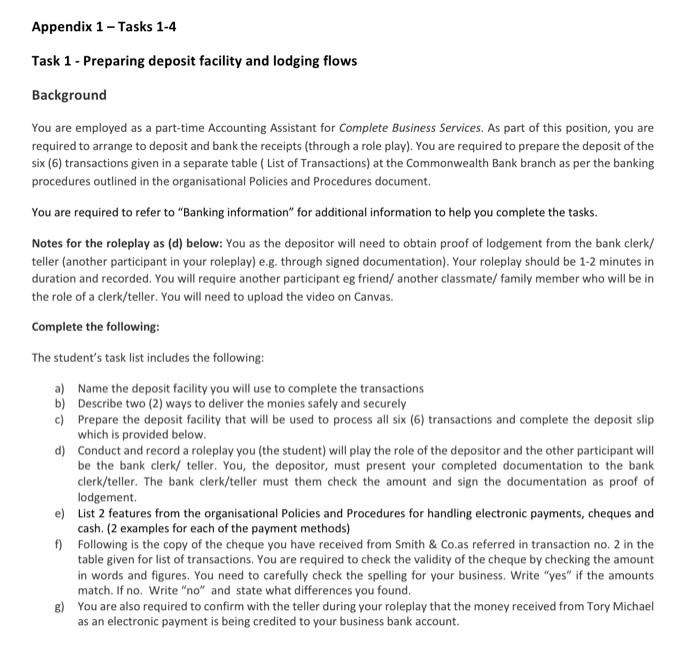

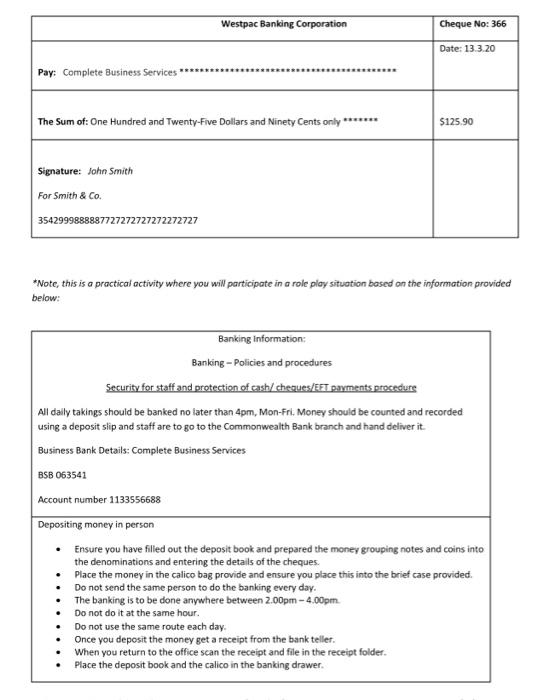

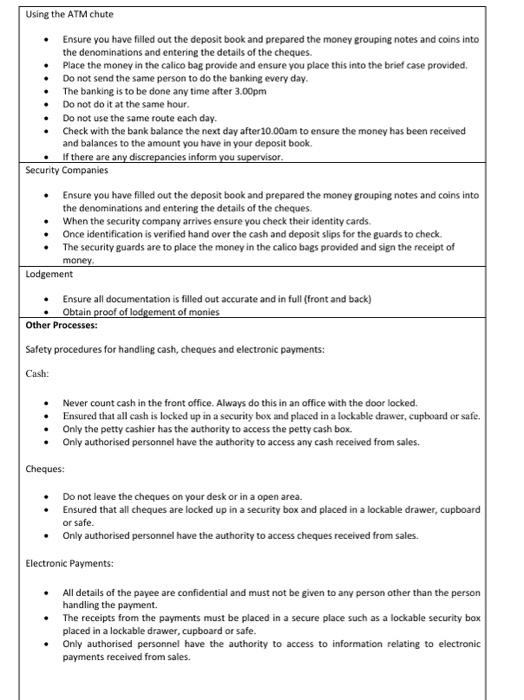

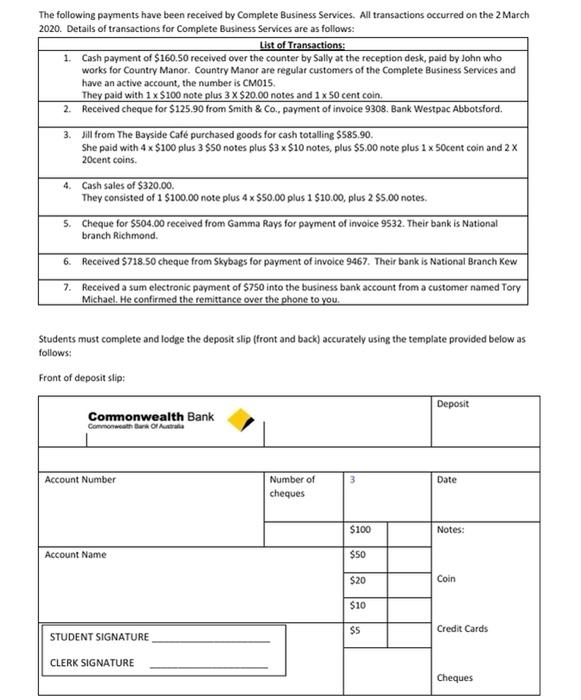

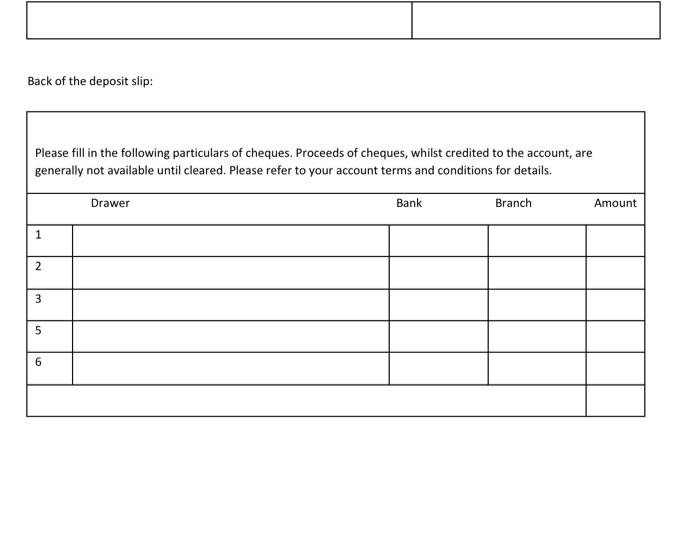

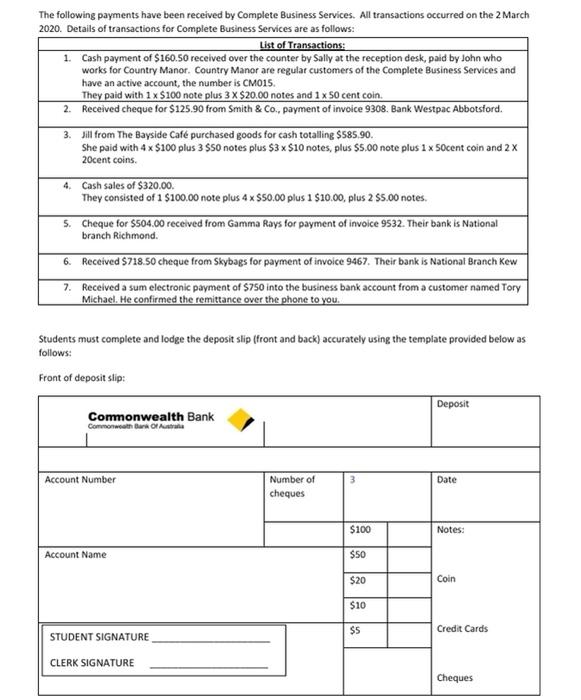

Appendix 1 -Tasks 1-4 Task 1 - Preparing deposit facility and lodging flows Background You are employed as a part-time Accounting Assistant for Complete Business Services. As part of this position, you are required to arrange to deposit and bank the receipts (through a role play). You are required to prepare the deposit of the six (6) transactions given in a separate table ( List of Transactions) at the Commonwealth Bank branch as per the banking procedures outlined in the organisational Policies and Procedures document. You are required to refer to "Banking information for additional information to help you complete the tasks. Notes for the roleplay as (d) below: You as the depositor will need to obtain proof of lodgement from the bank clerk/ teller (another participant in your roleplay) e.g. through signed documentation). Your roleplay should be 1-2 minutes in duration and recorded. You will require another participant eg friend/ another classmate/ family member who will be in the role of a clerk/teller. You will need to upload the video on Canvas. Complete the following: The student's task list includes the following: a) Name the deposit facility you will use to complete the transactions b) Describe two (2) ways to deliver the monies safely and securely c) Prepare the deposit facility that will be used to process all six (6) transactions and complete the deposit slip which is provided below. d) Conduct and record a roleplay you (the student) will play the role of the depositor and the other participant will be the bank clerk/ teller. You, the depositor, must present your completed documentation to the bank clerk/teller. The bank clerk/teller must them check the amount and sign the documentation as proof of lodgement e) List 2 features from the organisational Policies and Procedures for handling electronic payments, cheques and cash. (2 examples for each of the payment methods) 1) Following is the copy of the cheque you have received from Smith & Co.as referred in transaction no. 2 in the table given for list of transactions. You are required to check the validity of the cheque by checking the amount in words and figures. You need to carefully check the spelling for your business. Write "yes" if the amounts match. If no. Write "no" and state what differences you found. 6) You are also required to confirm with the teller during your roleplay that the money received from Tory Michael as an electronic payment is being credited to your business bank account. Westpac Banking Corporation Cheque No: 366 Date: 13.3.20 Pay: Complete Business Services *********** The Sum of: One Hundred and Twenty-Five Dollars and Ninety Cents only ******* $125.90 Signature: John Smith For Smith & Co. 3542999888887727272727272272727 *Note, this is a practical activity where you will participate in a role play situation based on the information provided below: Banking Information: Banking - Policies and procedures Security for staff and protection of cash/cheques/EFT payments procedure All daily takings should be banked no later than 4pm, Mon-Fri: Money should be counted and recorded using a deposit slip and staff are to go to the Commonwealth Bank branch and hand deliver it Business Bank Details: Complete Business Services BSB 063541 Account number 1133556588 Depositing money in person Ensure you have filled out the deposit book and prepared the money grouping notes and coins into the denominations and entering the details of the cheques. Place the money in the calico bag provide and ensure you place this into the brief case provided. Do not send the same person to do the banking every day. The banking is to be done anywhere between 2.00pm - 4.00pm Do not do it at the same hour. Do not use the same route each day. Once you deposit the money get a receipt from the bank teller. When you return to the office scan the receipt and file in the receipt folder. Place the deposit book and the calico in the banking drawer. Using the ATM chute Ensure you have filled out the deposit book and prepared the money grouping notes and coins into the denominations and entering the details of the cheques. Place the money in the calico bag provide and ensure you place this into the brief case provided Do not send the same person to do the banking every day. The banking is to be done any time after 3.00pm Do not do it at the same hour. Do not use the same route each day. Check with the bank balance the next day after 10.00am to ensure the money has been received and balances to the amount you have in your deposit book. If there are any discrepancies inform you supervisor Security Companies Ensure you have filled out the deposit book and prepared the money grouping notes and coins into the denominations and entering the details of the cheques. When the security company arrives ensure you check their identity cards Once identification is verified hand over the cash and deposit slips for the guards to check The security guards are to place the money in the calico bags provided and sign the receipt of Lodgement Ensure all documentation is filled out accurate and in full (front and back) Obtain proof of lodgement of monies Other Processes: Safety procedures for handling cash, cheques and electronic payments: money. Cash: Never count cash in the front office. Always do this in an office with the door locked. Ensured that all cash is locked up in a security box and placed in a lockable drawer, cupboard or safe. Only the petty cashier has the authority to access the petty cash box Only authorised personnel have the authority to access any cash received from sales. Cheques: Do not leave the cheques on your desk or in a open area. Ensured that all cheques are locked up in a security box and placed in a lockable drawer, cupboard or safe. Only authorised personnel have the authority to access cheques received from sales. Electronic Payments: All details of the payee are confidential and must not be given to any person other than the person handling the payment. The receipts from the payments must be placed in a secure place such as a lockable security box placed in a lockable drawer, cupboard or safe. Only authorised personnel have the authority to access to information relating to electronic payments received from sales. . The following payments have been received by Complete Business Services. All transactions occurred on the 2 March 2020. Details of transactions for Complete Business Services are as follows: List of Transactions 1. Cash payment of $160.50 received over the counter by Sally at the reception desk, paid by John who works for Country Manor. Country Manor are regular customers of the Complete Business Services and have an active account, the number is CMO1S. They paid with 1 x $100 note plus 3 X $20.00 notes and 1 x 50 cent coin. 2. Received cheque for $125.90 from Smith & Co., payment of invoice 9308. Bank Westpac Abbotsford. 3. Jill from The Bayside Caf purchased goods for cash totalling $585.90. She paid with 4 x $100 plus 3 $50 notes plus $3 x $10 notes, plus 55.00 note plus 1 x 50cent coin and 2 X 20cent coins. 4. Cash sales of $320.00 They consisted of 1 $100.00 note plus 4 x $50.00 plus 1 $10.00, plus 2 $5.00 notes 5. Cheque for $504.00 received from Gamma Rays for payment of invoice 9532. Their bank is National branch Richmond. 6. Received $718.50 cheque from Skybags for payment of invoice 9467. Their bank is National Branch Kew 7. Received a sum electronic payment of S750 into the business bank account from a customer named Tory Michael. He confirmed the remittance over the phone to you. Students must complete and lodge the deposit slip (front and back) accurately using the template provided below as follows: Front of deposit slip: Deposit Commonwealth Bank Commonwealth Bank of Australia Account Number Date Number of cheques $100 Notes: Account Name $50 $20 Coin $10 $5 Credit Cards STUDENT SIGNATURE CLERK SIGNATURE Cheques Back of the deposit slip: Please fill in the following particulars of cheques. Proceeds of cheques, whilst credited to the account, are generally not available until cleared. Please refer to your account terms and conditions for details. Drawer Bank Branch Amount 1 N 3 5 6 The following payments have been received by Complete Business Services. All transactions occurred on the 2 March 2020. Details of transactions for complete Business Services are as follows: List of Transactions 1. Cash payment of $160.50 received over the counter by Sally at the reception desk, paid by John who works for Country Manor. Country Manor are regular customers of the Complete Business Services and have an active account, the number is CM015. They paid with 1 x $100 note plus 3 X $20.00 notes and 1 x 50 cent coin. 2. Received cheque for $125.90 from Smith & Co., payment of invoice 9308. Bank Westpac Abbotsford. 3. Jill from The Bayside Caf purchased goods for cash totalling $585.90. She paid with 4 x $100 plus 3 $50 notes plus $3 x $10 notes, plus $5.00 note plus 1 x 50cent coin and 2 X 20cent coins. 4. Cash sales of $320.00 They consisted of 1 $100.00 note plus 4 x $50.00 plus 1 $10.00, plus 2 $5.00 notes 5. Cheque for $504.00 received from Gamma Rays for payment of invoice 9532. Their bank is National branch Richmond. 6. Received $718.50 cheque from Skybags for payment of invoice 9467. Their bank is National Branch Kew 7. Received a sum electronic payment of S750 into the business bank account from a customer named Tory Michael. He confirmed the remittance over the phone to you. Students must complete and lodge the deposit slip (front and back) accurately using the template provided below as follows: Front of deposit slip: Deposit Commonwealth Bank Commonwealth Bank of Australia Account Number Date Number of cheques $100 Notes: Account Name $50 $20 Coin $10 $5 Credit Cards STUDENT SIGNATURE CLERK SIGNATURE Cheques Appendix 1 -Tasks 1-4 Task 1 - Preparing deposit facility and lodging flows Background You are employed as a part-time Accounting Assistant for Complete Business Services. As part of this position, you are required to arrange to deposit and bank the receipts (through a role play). You are required to prepare the deposit of the six (6) transactions given in a separate table ( List of Transactions) at the Commonwealth Bank branch as per the banking procedures outlined in the organisational Policies and Procedures document. You are required to refer to "Banking information for additional information to help you complete the tasks. Notes for the roleplay as (d) below: You as the depositor will need to obtain proof of lodgement from the bank clerk/ teller (another participant in your roleplay) e.g. through signed documentation). Your roleplay should be 1-2 minutes in duration and recorded. You will require another participant eg friend/ another classmate/ family member who will be in the role of a clerk/teller. You will need to upload the video on Canvas. Complete the following: The student's task list includes the following: a) Name the deposit facility you will use to complete the transactions b) Describe two (2) ways to deliver the monies safely and securely c) Prepare the deposit facility that will be used to process all six (6) transactions and complete the deposit slip which is provided below. d) Conduct and record a roleplay you (the student) will play the role of the depositor and the other participant will be the bank clerk/ teller. You, the depositor, must present your completed documentation to the bank clerk/teller. The bank clerk/teller must them check the amount and sign the documentation as proof of lodgement e) List 2 features from the organisational Policies and Procedures for handling electronic payments, cheques and cash. (2 examples for each of the payment methods) 1) Following is the copy of the cheque you have received from Smith & Co.as referred in transaction no. 2 in the table given for list of transactions. You are required to check the validity of the cheque by checking the amount in words and figures. You need to carefully check the spelling for your business. Write "yes" if the amounts match. If no. Write "no" and state what differences you found. 6) You are also required to confirm with the teller during your roleplay that the money received from Tory Michael as an electronic payment is being credited to your business bank account. Westpac Banking Corporation Cheque No: 366 Date: 13.3.20 Pay: Complete Business Services *********** The Sum of: One Hundred and Twenty-Five Dollars and Ninety Cents only ******* $125.90 Signature: John Smith For Smith & Co. 3542999888887727272727272272727 *Note, this is a practical activity where you will participate in a role play situation based on the information provided below: Banking Information: Banking - Policies and procedures Security for staff and protection of cash/cheques/EFT payments procedure All daily takings should be banked no later than 4pm, Mon-Fri: Money should be counted and recorded using a deposit slip and staff are to go to the Commonwealth Bank branch and hand deliver it Business Bank Details: Complete Business Services BSB 063541 Account number 1133556588 Depositing money in person Ensure you have filled out the deposit book and prepared the money grouping notes and coins into the denominations and entering the details of the cheques. Place the money in the calico bag provide and ensure you place this into the brief case provided. Do not send the same person to do the banking every day. The banking is to be done anywhere between 2.00pm - 4.00pm Do not do it at the same hour. Do not use the same route each day. Once you deposit the money get a receipt from the bank teller. When you return to the office scan the receipt and file in the receipt folder. Place the deposit book and the calico in the banking drawer. Using the ATM chute Ensure you have filled out the deposit book and prepared the money grouping notes and coins into the denominations and entering the details of the cheques. Place the money in the calico bag provide and ensure you place this into the brief case provided Do not send the same person to do the banking every day. The banking is to be done any time after 3.00pm Do not do it at the same hour. Do not use the same route each day. Check with the bank balance the next day after 10.00am to ensure the money has been received and balances to the amount you have in your deposit book. If there are any discrepancies inform you supervisor Security Companies Ensure you have filled out the deposit book and prepared the money grouping notes and coins into the denominations and entering the details of the cheques. When the security company arrives ensure you check their identity cards Once identification is verified hand over the cash and deposit slips for the guards to check The security guards are to place the money in the calico bags provided and sign the receipt of Lodgement Ensure all documentation is filled out accurate and in full (front and back) Obtain proof of lodgement of monies Other Processes: Safety procedures for handling cash, cheques and electronic payments: money. Cash: Never count cash in the front office. Always do this in an office with the door locked. Ensured that all cash is locked up in a security box and placed in a lockable drawer, cupboard or safe. Only the petty cashier has the authority to access the petty cash box Only authorised personnel have the authority to access any cash received from sales. Cheques: Do not leave the cheques on your desk or in a open area. Ensured that all cheques are locked up in a security box and placed in a lockable drawer, cupboard or safe. Only authorised personnel have the authority to access cheques received from sales. Electronic Payments: All details of the payee are confidential and must not be given to any person other than the person handling the payment. The receipts from the payments must be placed in a secure place such as a lockable security box placed in a lockable drawer, cupboard or safe. Only authorised personnel have the authority to access to information relating to electronic payments received from sales. . The following payments have been received by Complete Business Services. All transactions occurred on the 2 March 2020. Details of transactions for Complete Business Services are as follows: List of Transactions 1. Cash payment of $160.50 received over the counter by Sally at the reception desk, paid by John who works for Country Manor. Country Manor are regular customers of the Complete Business Services and have an active account, the number is CMO1S. They paid with 1 x $100 note plus 3 X $20.00 notes and 1 x 50 cent coin. 2. Received cheque for $125.90 from Smith & Co., payment of invoice 9308. Bank Westpac Abbotsford. 3. Jill from The Bayside Caf purchased goods for cash totalling $585.90. She paid with 4 x $100 plus 3 $50 notes plus $3 x $10 notes, plus 55.00 note plus 1 x 50cent coin and 2 X 20cent coins. 4. Cash sales of $320.00 They consisted of 1 $100.00 note plus 4 x $50.00 plus 1 $10.00, plus 2 $5.00 notes 5. Cheque for $504.00 received from Gamma Rays for payment of invoice 9532. Their bank is National branch Richmond. 6. Received $718.50 cheque from Skybags for payment of invoice 9467. Their bank is National Branch Kew 7. Received a sum electronic payment of S750 into the business bank account from a customer named Tory Michael. He confirmed the remittance over the phone to you. Students must complete and lodge the deposit slip (front and back) accurately using the template provided below as follows: Front of deposit slip: Deposit Commonwealth Bank Commonwealth Bank of Australia Account Number Date Number of cheques $100 Notes: Account Name $50 $20 Coin $10 $5 Credit Cards STUDENT SIGNATURE CLERK SIGNATURE Cheques Back of the deposit slip: Please fill in the following particulars of cheques. Proceeds of cheques, whilst credited to the account, are generally not available until cleared. Please refer to your account terms and conditions for details. Drawer Bank Branch Amount 1 N 3 5 6 The following payments have been received by Complete Business Services. All transactions occurred on the 2 March 2020. Details of transactions for complete Business Services are as follows: List of Transactions 1. Cash payment of $160.50 received over the counter by Sally at the reception desk, paid by John who works for Country Manor. Country Manor are regular customers of the Complete Business Services and have an active account, the number is CM015. They paid with 1 x $100 note plus 3 X $20.00 notes and 1 x 50 cent coin. 2. Received cheque for $125.90 from Smith & Co., payment of invoice 9308. Bank Westpac Abbotsford. 3. Jill from The Bayside Caf purchased goods for cash totalling $585.90. She paid with 4 x $100 plus 3 $50 notes plus $3 x $10 notes, plus $5.00 note plus 1 x 50cent coin and 2 X 20cent coins. 4. Cash sales of $320.00 They consisted of 1 $100.00 note plus 4 x $50.00 plus 1 $10.00, plus 2 $5.00 notes 5. Cheque for $504.00 received from Gamma Rays for payment of invoice 9532. Their bank is National branch Richmond. 6. Received $718.50 cheque from Skybags for payment of invoice 9467. Their bank is National Branch Kew 7. Received a sum electronic payment of S750 into the business bank account from a customer named Tory Michael. He confirmed the remittance over the phone to you. Students must complete and lodge the deposit slip (front and back) accurately using the template provided below as follows: Front of deposit slip: Deposit Commonwealth Bank Commonwealth Bank of Australia Account Number Date Number of cheques $100 Notes: Account Name $50 $20 Coin $10 $5 Credit Cards STUDENT SIGNATURE CLERK SIGNATURE Cheques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts