Question: The question below includes actual dates that must be used to determine the appropriate tax treatment of the transaction. The following information applies to a

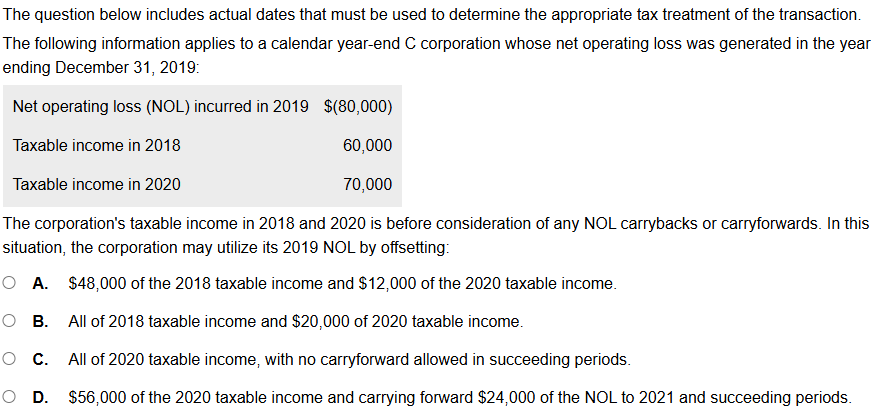

The question below includes actual dates that must be used to determine the appropriate tax treatment of the transaction.

The following information applies to a calendar yearend C corporation whose net operating loss was generated in the year ending December :

The corporation's taxable income in and is before consideration of any NOL carrybacks or carryforwards. In this situation, the corporation may utilize its NOL by offsetting:

A$ of the taxable income and $ of the taxable income.

B All of taxable income and $ of taxable income.

C All of taxable income, with no carryforward allowed in succeeding periods.

D$ of the taxable income and carrying forward $ of the NOL to and succeeding periods.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock