Question: the question formulas NPV > 0 = Accept Project NPV = 0 = > No Profit or no loss NPV reject project example Net Present

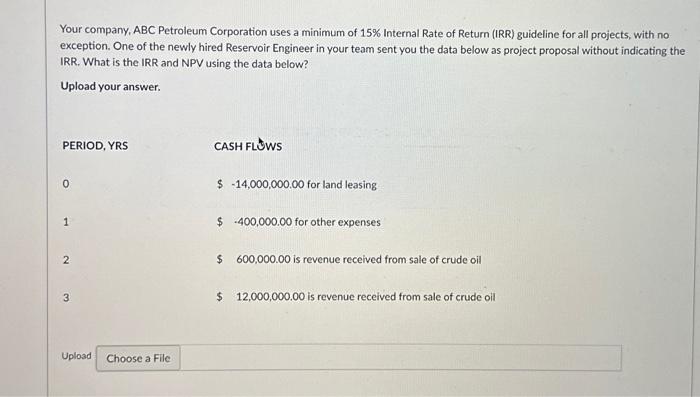

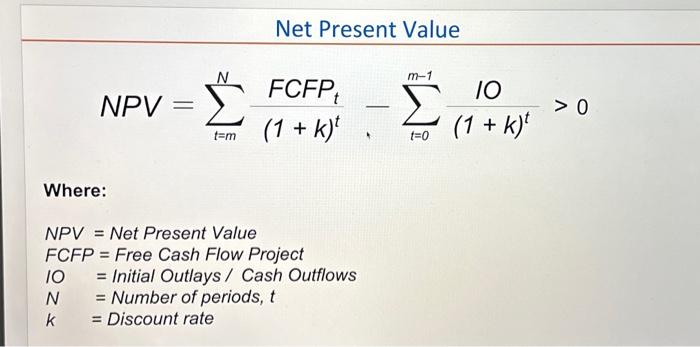

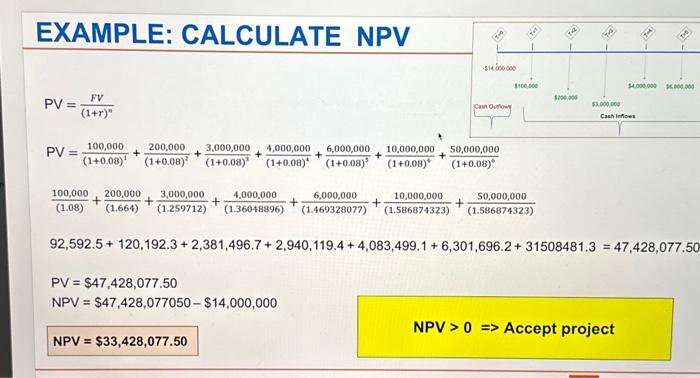

Net Present Value NPV=t=mN(1+k)tFCFPtt=0m1(1+k)t10>0 Where: NPV=NetPresentValueFCFP=FreeCashFlowProject10=InitialOutlays/CashOutflows PV=(1+r)17FVPV=(1+0.08)1100,000+(1+0.08)2200,000+(1+0.08)23,000,000+(1+0.08)44,000,000+(1+0.08)36,000,000+(1+0.08)610,000,000+(1+0.08)650,000,000(1.08)100,000+(1.664)200,000+(1.259712)3,000,000+(1.36048896)4,000,000+(1.469328077)6,000,000+(1.586874323)10,000,000+(1.586874323)50,000,00092,592.5+120,192.3+2,381,496.7+2,940,119.4+4,083,499.1+6,301,696.2+31508481.3=47,428,077PV=$47,428,077.50NPV=$47,428,077050$14,000,000 Your company, ABC Petroleum Corporation uses a minimum of 15% Internal Rate of Return (IRR) guideline for all projects, with no exception. One of the newly hired Reservoir Engineer in your team sent you the data below as project proposal without indicating the IRR. What is the IRR and NPV using the data below? Upload your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts