Question: The question has two parts, but its only one question please answer all A developer has two mutually exclusive investment opportunities. One in Ohio and

The question has two parts, but its only one question please answer all

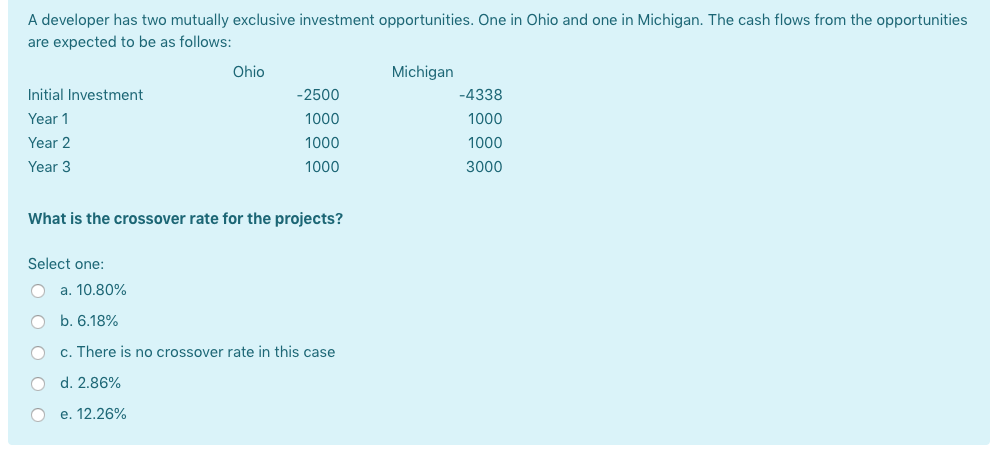

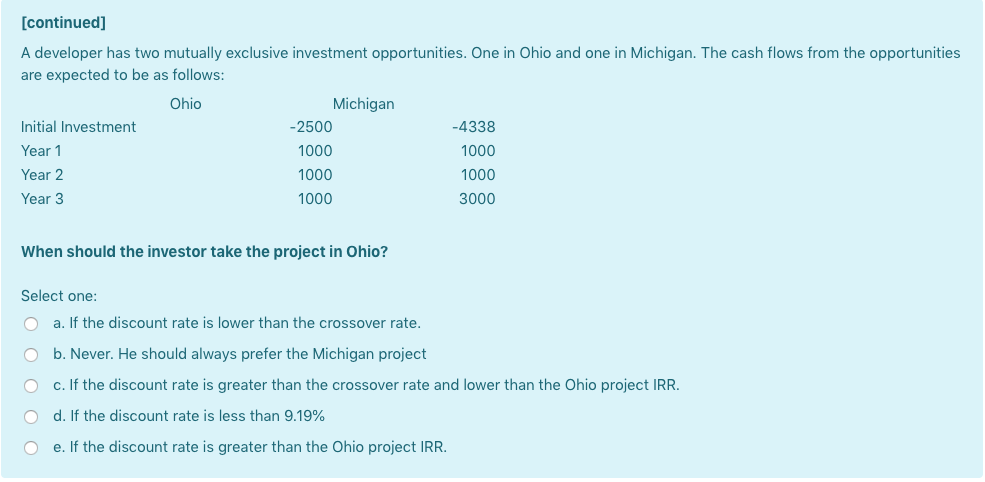

A developer has two mutually exclusive investment opportunities. One in Ohio and one in Michigan. The cash flows from the opportunities are expected to be as follows: Ohio Michigan -4338 1000 Initial Investment Year 1 Year 2 Year 3 -2500 1000 1000 1000 1000 3000 What is the crossover rate for the projects? Select one: o a. 10.80% O O O O b. 6.18% c. There is no crossover rate in this case d. 2.86% e. 12.26% [continued] A developer has two mutually exclusive investment opportunities. One in Ohio and one in Michigan. The cash flows from the opportunities are expected to be as follows: Ohio Michigan Initial Investment -2500 -4338 Year 1 1000 Year 2 1000 Year 3 1000 3000 1000 1000 When should the investor take the project in Ohio? Select one: O a. If the discount rate is lower than the crossover rate. O b. Never. He should always prefer the Michigan project O c. If the discount rate is greater than the crossover rate and lower than the Ohio project IRR. O d. If the discount rate is less than 9.19% O e. If the discount rate is greater than the Ohio project IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts