Question: The question I have to do is E6-12 but it is based off of E6-11. Could you please help? Exercise 6-11 Perpetual: Inventory costing methods-FIFO

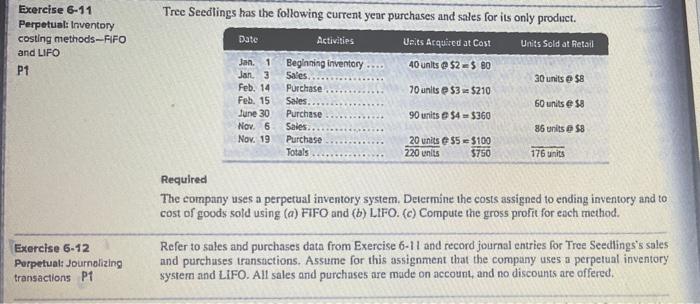

Exercise 6-11 Perpetual: Inventory costing methods-FIFO and LIFO P1 Exercise 6-12 Perpetual: Journalizing transactions P1 Tree Seedlings has the following current year purchases and sales for its only product. Activities Units Acquired at Cost Units Sold at Retail 40 units @ $2-$ 80 70 units @ $3= $210 90 units 20 units 220 units Date Jan. 1 Jan. 3 Feb. 14 Feb. 15 June 30 Nov. 6 Nov. 19 Beginning inventory.... Sales. Purchase Sales Purchase Sales. Purchase Totals $4=$360 $5-$100 $750 30 units @ $8 60 units @ $8 86 units $8 176 units Required The company uses a perpetual inventory system. Determine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. (c) Compute the gross profit for each method. Refer to sales and purchases data from Exercise 6-11 and record journal entries for Tree Seedlings's sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and LIFO. All sales and purchases are made on account, and no discounts are offered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts