Question: The question is about firm value, equity value and WACC please write the detailed progress F305 Intermediate Corporate Finance Problem Set 3 Professor Jun Wu

The question is about firm value, equity value and WACC

please write the detailed progress

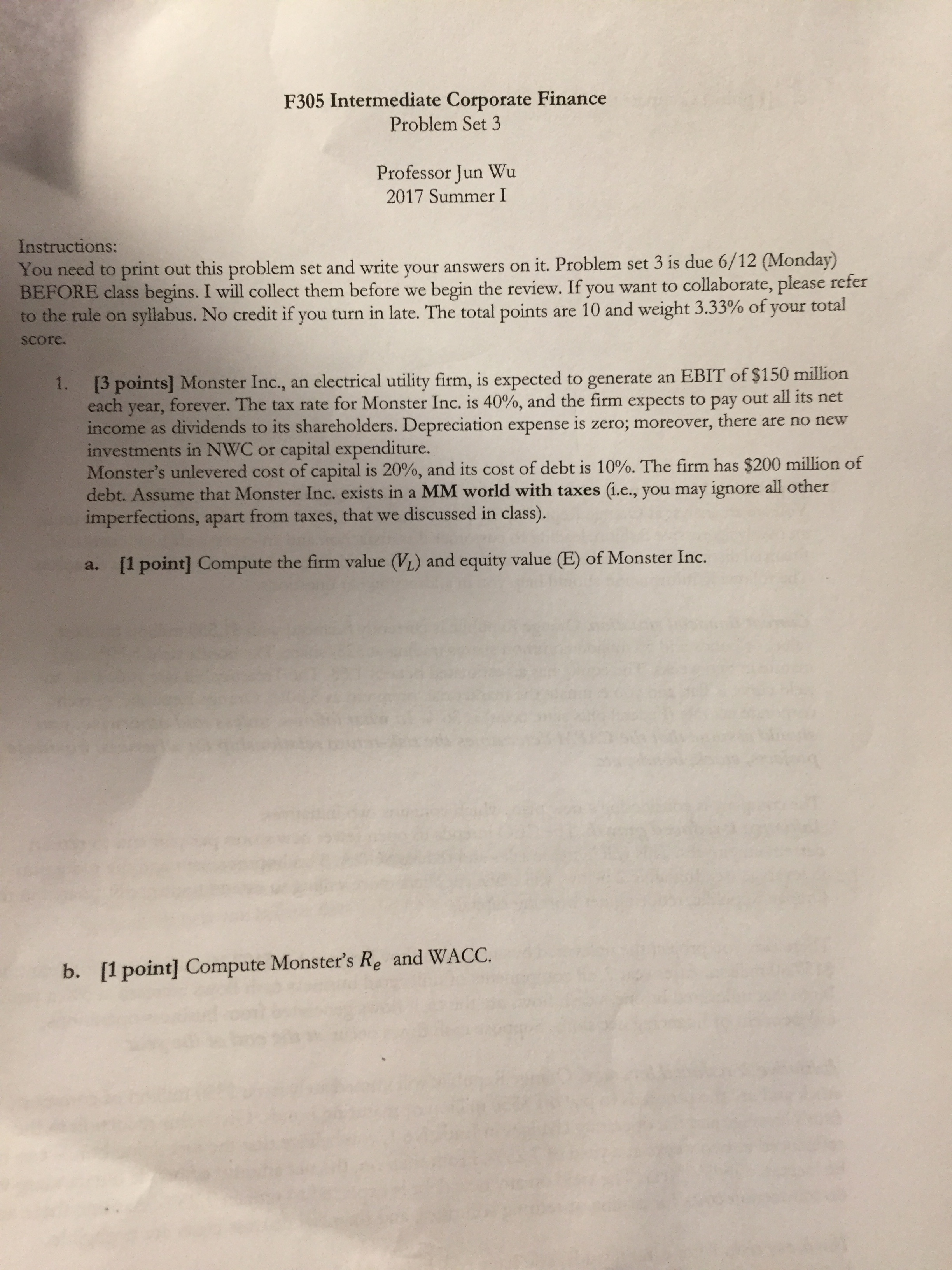

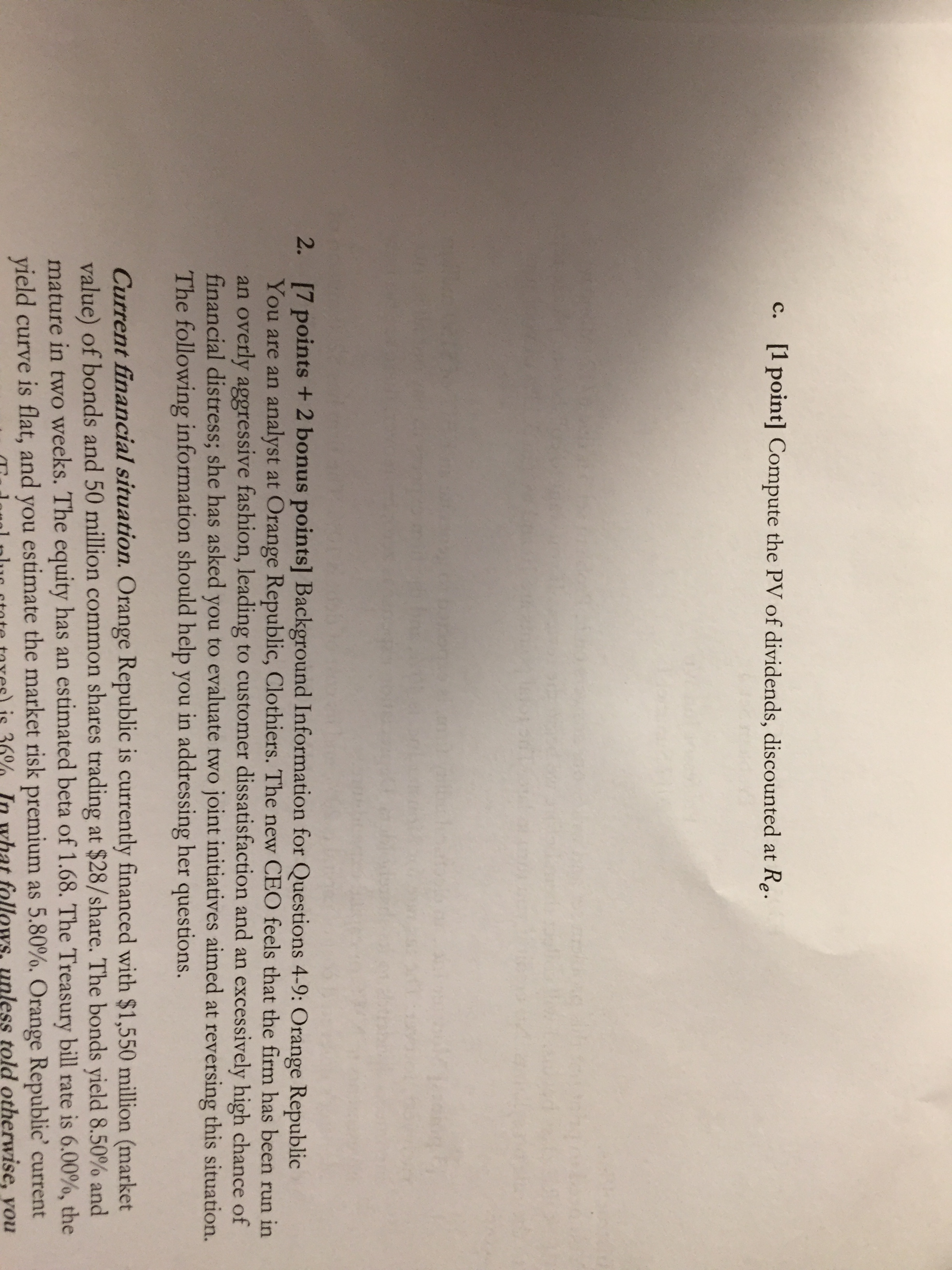

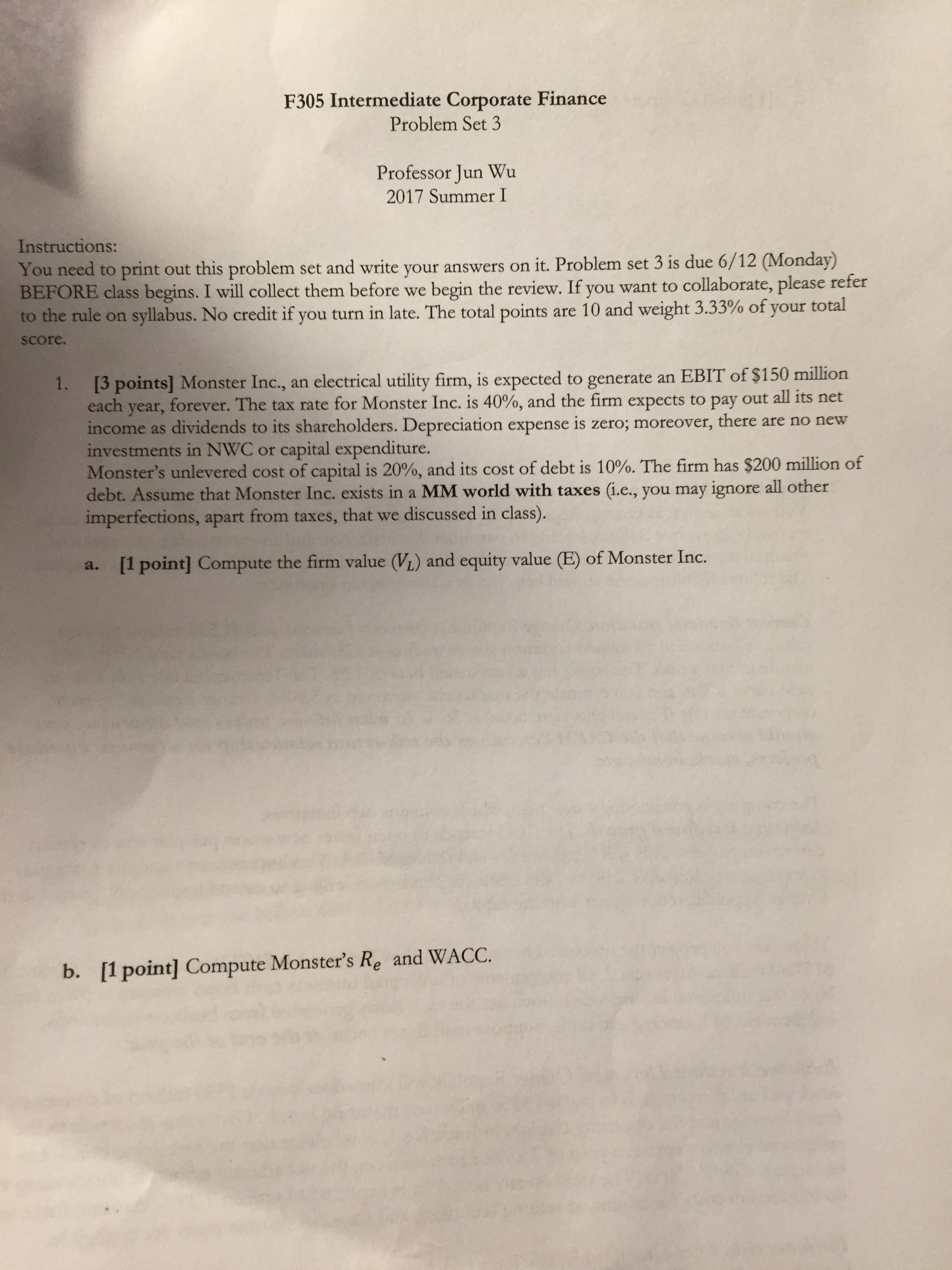

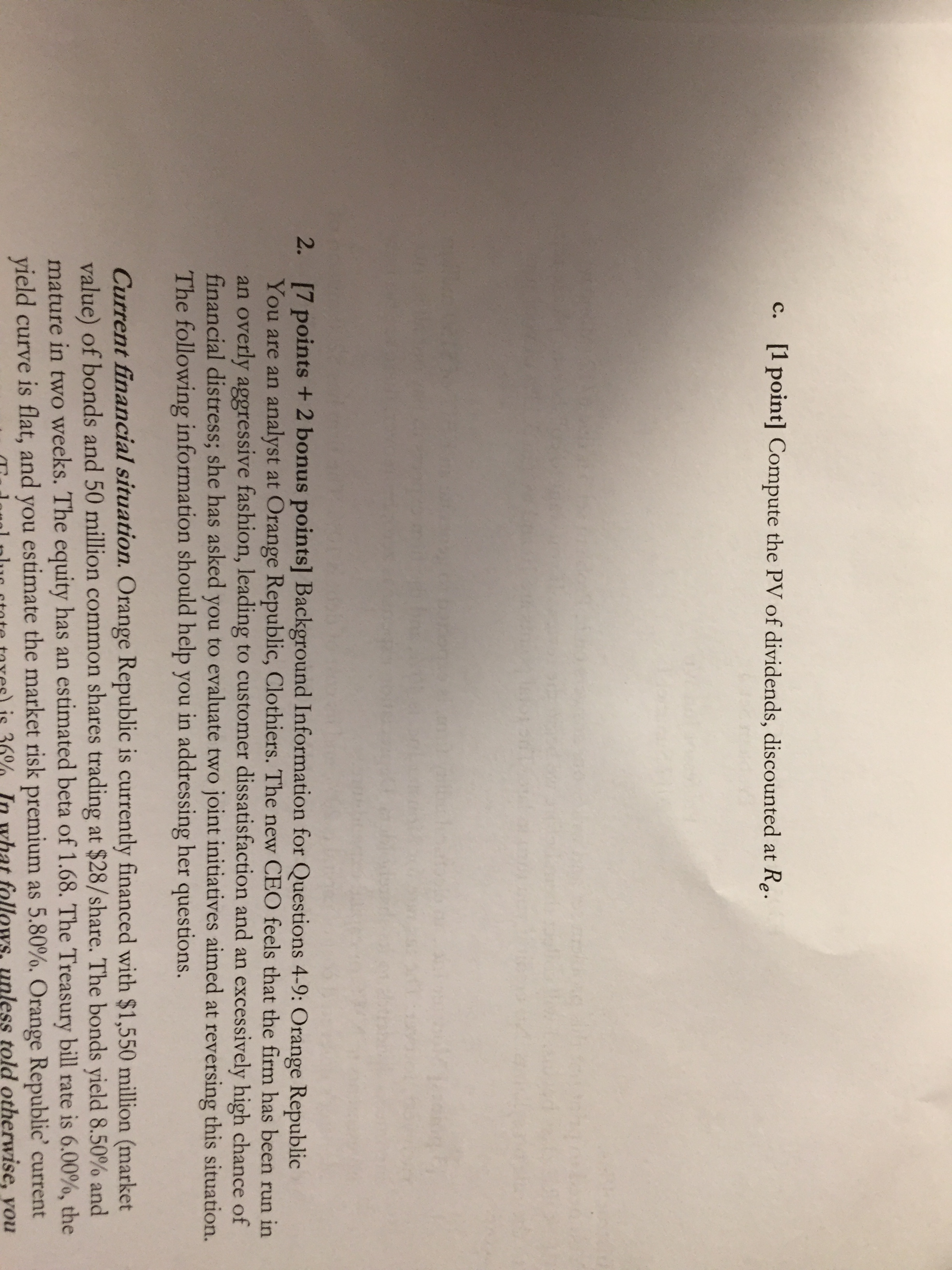

F305 Intermediate Corporate Finance Problem Set 3 Professor Jun Wu 2017 Summer I Instructions: You need to print out this problem set and write your answers on it. Problem set 3 is due 6/12 (Monday) BEFORE class begins. I will collect them before we begin the review. If you want to collaborate, please refer to the rule on syllabus. No credit if you turn in late. The total points are 10 and weight 3.33% of your total score. [3 points] Monster Inc., an electrical utility firm, is expected to generate an EBIT of $150 million 1. each year, forever. The tax rate for Monster Inc. is 40%, and the firm expects to pay out all its net income as dividends to its shareholders. Depreciation expense is zero; moreover, there are no new investments in NWC or capital expenditure. Monster's unlevered cost of capital is 20%, and its cost of debt is 100/0. The firm has $200 million of debt. Assume that Monster Inc. exists in a MM world with taxes (i.e., you may ignore all other imperfections, apart from taxes, that we discussed in class). a. [1 pointl Compute the firm value (VD and equity value (E) of Monster Inc. b. [1 point] Compute Monster's Re and WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts