Question: The Question is already listed as Chapter 3 44PB in Horngrens Accounting, but there are no solutions posted. Problem Understanding the alternative treatment of prepaid

The Question is already listed as Chapter 3 44PB in Horngrens Accounting, but there are no solutions posted.

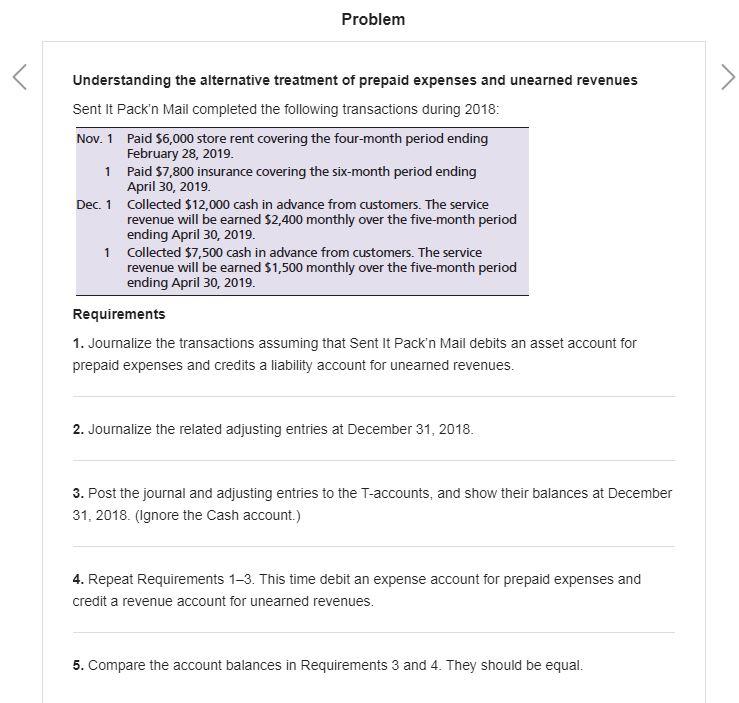

Problem Understanding the alternative treatment of prepaid expenses and unearned revenues Sent It Pack'n Mail completed the following transactions during 2018: Nov. 1 Paid $6,000 store rent covering the four-month period ending February 28, 2019. 1 Paid 57,800 insurance covering the six-month period ending April 30, 2019 Dec. 1 Collected $12,000 cash in advance from customers. The service revenue will be earned $2,400 monthly over the five-month period ending April 30, 2019. 1 Collected $7,500 cash in advance from customers. The service revenue will be earned $1,500 monthly over the five-month period ending April 30, 2019. Requirements 1. Journalize the transactions assuming that Sent It Pack'n Mail debits an asset account for prepaid expenses and credits a liability account for unearned revenues. 2. Journalize the related adjusting entries at December 31, 2018. 3. Post the journal and adjusting entries to the T-accounts, and show their balances at December 31, 2018. (Ignore the Cash account.) 4. Repeat Requirements 1-3. This time debit an expense account for prepaid expenses and credit a revenue account for unearned revenues. 5. Compare the account balances in Requirements 3 and 4. They should be equal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts