Question: the question is attached in the file below please include the explanation thank you IConsider the following covariance and expected returns matrix for Apple, Microsoft

the question is attached in the file below please include the explanation thank you

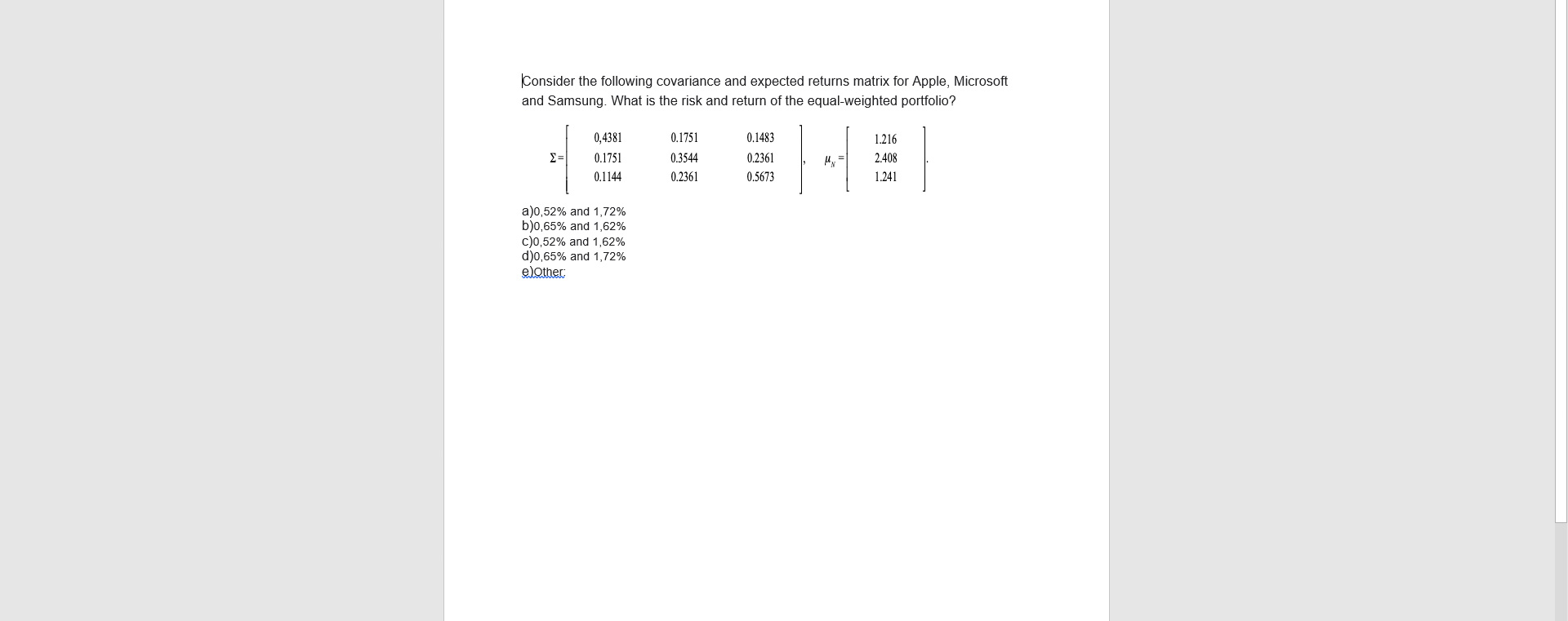

IConsider the following covariance and expected returns matrix for Apple, Microsoft and Samsung. What is the risk and return of the equal-weighted portfolio? 0,4381 0.1751 0.1483 1.216 0.1751 0.3544 0.2361 2.408 0.1144 0.2361 0.5673 1.241 a)0,52% and 1,72% b)0,65% and 1,62% c)0,52% and 1,62% d)0,65% and 1,72% elother

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts