Question: The question is based on the Durbin Watson test 2. Consider the following model for Bitcoin return equation: BTC = Bo+B, TSX,+ B, GSP C,+

The question is based on the Durbin Watson test

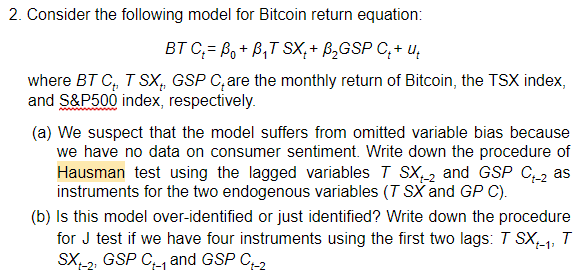

2. Consider the following model for Bitcoin return equation: BTC = Bo+B, TSX,+ B, GSP C,+ u where BT CE, T SX, GSP C, are the monthly return of Bitcoin, the TSX index, and S&P500 index, respectively. (a) We suspect that the model suffers from omitted variable bias because we have no data on consumer sentiment. Write down the procedure of Hausman test using the lagged variables T SX-2 and GSP C4-2 as instruments for the two endogenous variables (T SX and GP C). (b) Is this model over-identified or just identified? Write down the procedure for J test if we have four instruments using the first two lags: T SX:-1, T SX:-2, GSP Ct- and GSP C4-2 2. Consider the following model for Bitcoin return equation: BTC = Bo+B, TSX,+ B, GSP C,+ u where BT CE, T SX, GSP C, are the monthly return of Bitcoin, the TSX index, and S&P500 index, respectively. (a) We suspect that the model suffers from omitted variable bias because we have no data on consumer sentiment. Write down the procedure of Hausman test using the lagged variables T SX-2 and GSP C4-2 as instruments for the two endogenous variables (T SX and GP C). (b) Is this model over-identified or just identified? Write down the procedure for J test if we have four instruments using the first two lags: T SX:-1, T SX:-2, GSP Ct- and GSP C4-2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts