Question: ( The question is exactly the same as I posted there is no other data or dollar amount) Tableau DA 1-3: Mini-Case, Preparing an income

(The question is exactly the same as I posted there is no other data or dollar amount)

Tableau DA 1-3: Mini-Case, Preparing an income statement LO A1, P2

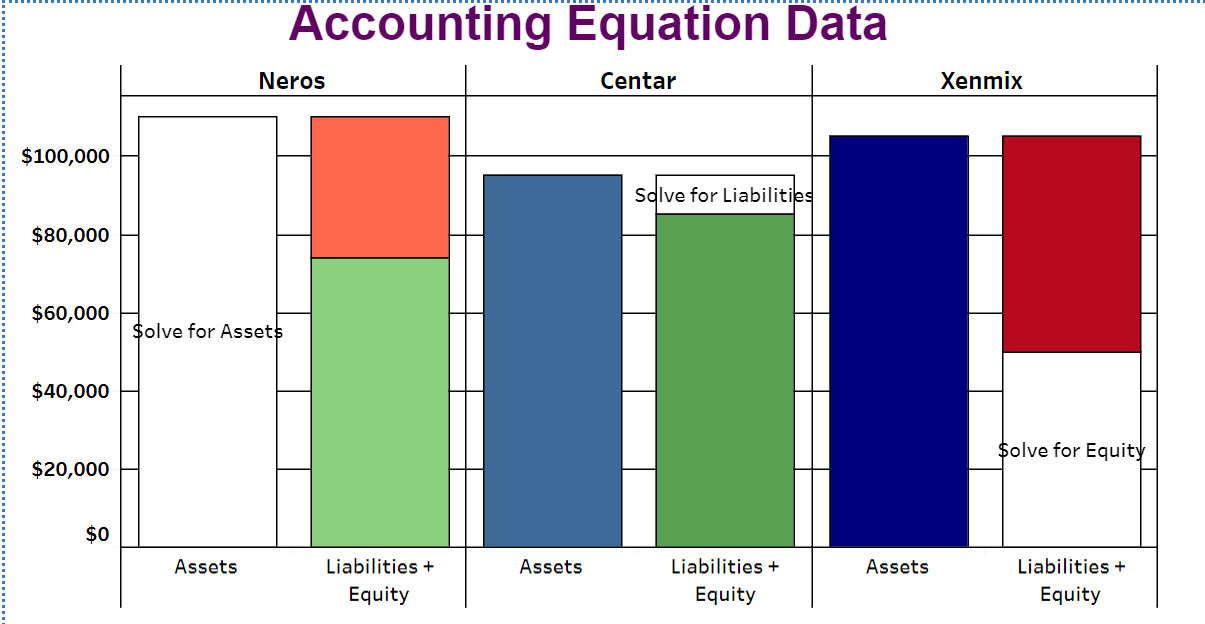

The owner of Neros company has hired you to analyze her companys performance and financial position, as well as the positions of its competitors, Centar and Xenmix. However, the data Neros obtained is incomplete and is shown in the following Tableau Dashboard.

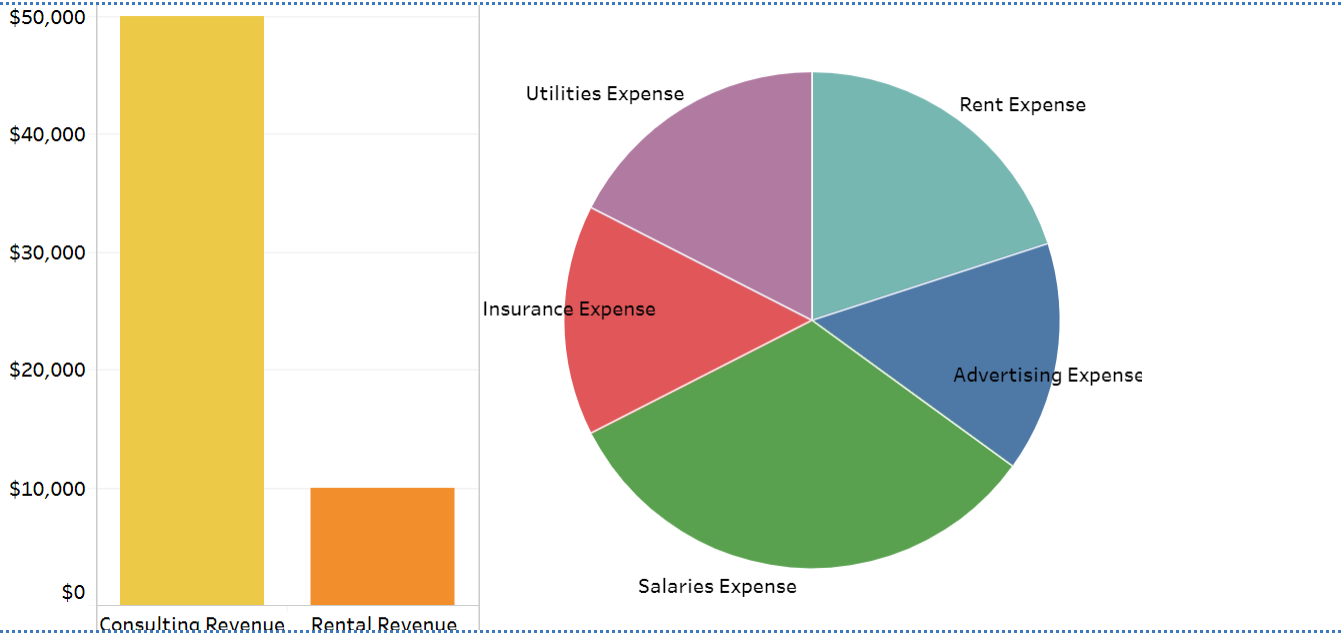

Neros Income Statement Data

Neros Revenue Accounts Neros Expense Accounts

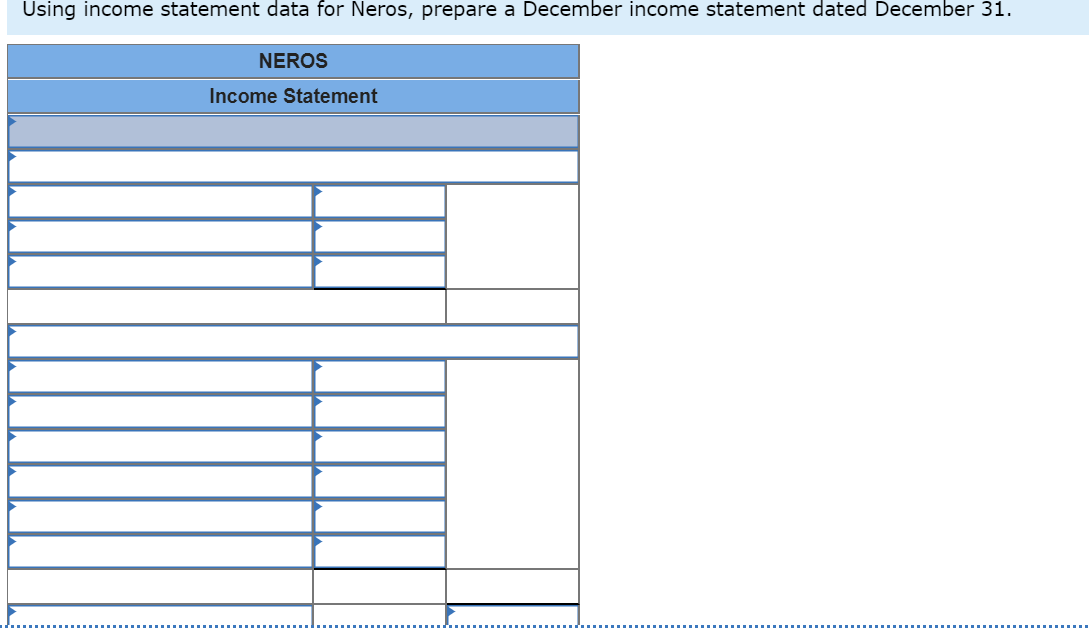

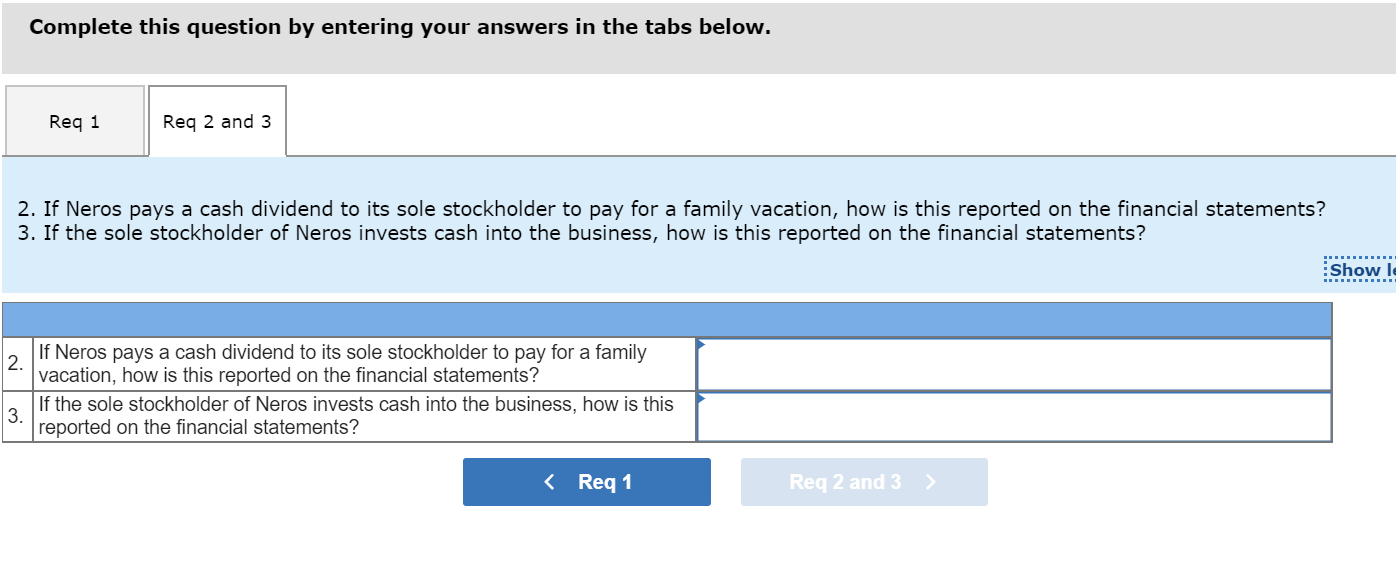

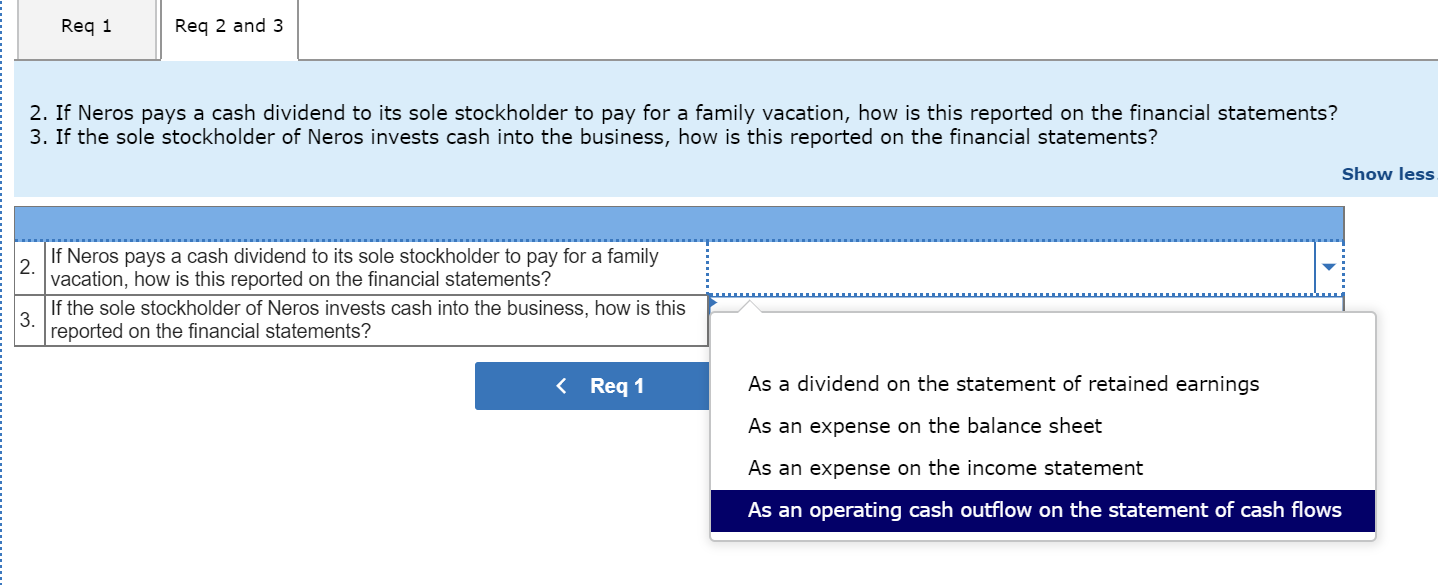

1. Using income statement data for Neros, prepare a December income statement dated December 31. 2. If Neros pays a cash dividend to its sole stockholder to pay for a family vacation, how is this reported on the financial statements? 3. If the sole stockholder of Neros invests cash into the business, how is this reported on the financial statements?

1. Using income statement data for Neros, prepare a December income statement dated December 31. 2. If Neros pays a cash dividend to its sole stockholder to pay for a family vacation, how is this reported on the financial statements? 3. If the sole stockholder of Neros invests cash into the business, how is this reported on the financial statements?

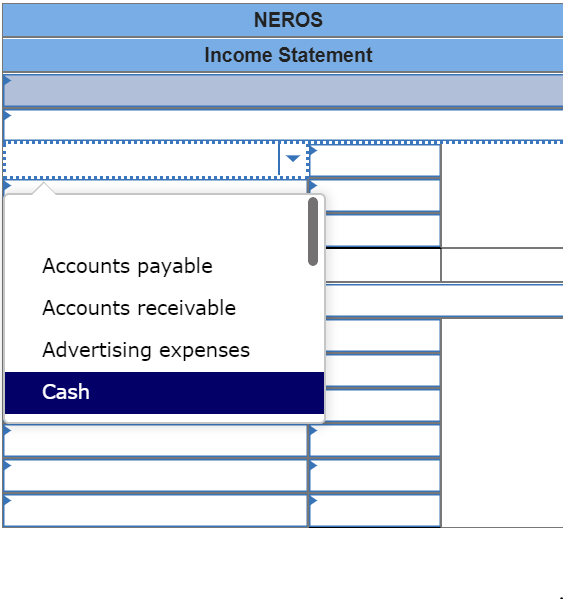

These are the options for the columns of the first table

These are the options for the second table

These are the options for the second table

Accounting Equation Data Neros Centar Xenmix $100,000 Salve for Liabilities $80,000 $60,000 $olve for Assets $40,000 $olve for Equity $20,000 Assets Assets Assets Liabilities + Equity Liabilities + Equity Liabilities + Equity $50,000 Utilities Expense Rent Expense $40,000 $30,000 Insurance Expense $20,000 Advertising Expense $10,000 $0 Salaries Expense ...........Sonsulting Revenue.... Rental Revenue...... Using income statement data for Neros, prepare a December income statement dated December 31. NEROS Income Statement NEROS Income Statement Accounts payable Accounts receivable Advertising expenses Cash Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 2. If Neros pays a cash dividend to its sole stockholder to pay for a family vacation, how is this reported on the financial statements? 3. If the sole stockholder of Neros invests cash into the business, how is this reported on the financial statements? Show le If Neros pays a cash dividend to its sole stockholder to pay for a family vacation, how is this reported on the financial statements? If the sole stockholder of Neros invests cash into the business, how is this reported on the financial statements? Req 1 Req: Req 2 and 3 Reg 2 and 3 2. If Neros pays a cash dividend to its sole stockholder to pay for a family vacation, how is this reported on the financial statements? 3. If the sole stockholder of Neros invests cash into the business, how is this reported on the financial statements? Show less If Neros pays a cash dividend to its sole stockholder to pay for a family vacation, how is this reported on the financial statements? If the sole stockholder of Neros invests cash into the business, how is this reported on the financial statements? Req1 As a dividend on the statement of retained earnings As an expense on the balance sheet As an expense on the income statement As an operating cash outflow on the statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts