Question: The question is in the below 4. A risk-ee one-year bond has a price equal to p, = 1 and a constant payoff equal to

The question is in the below

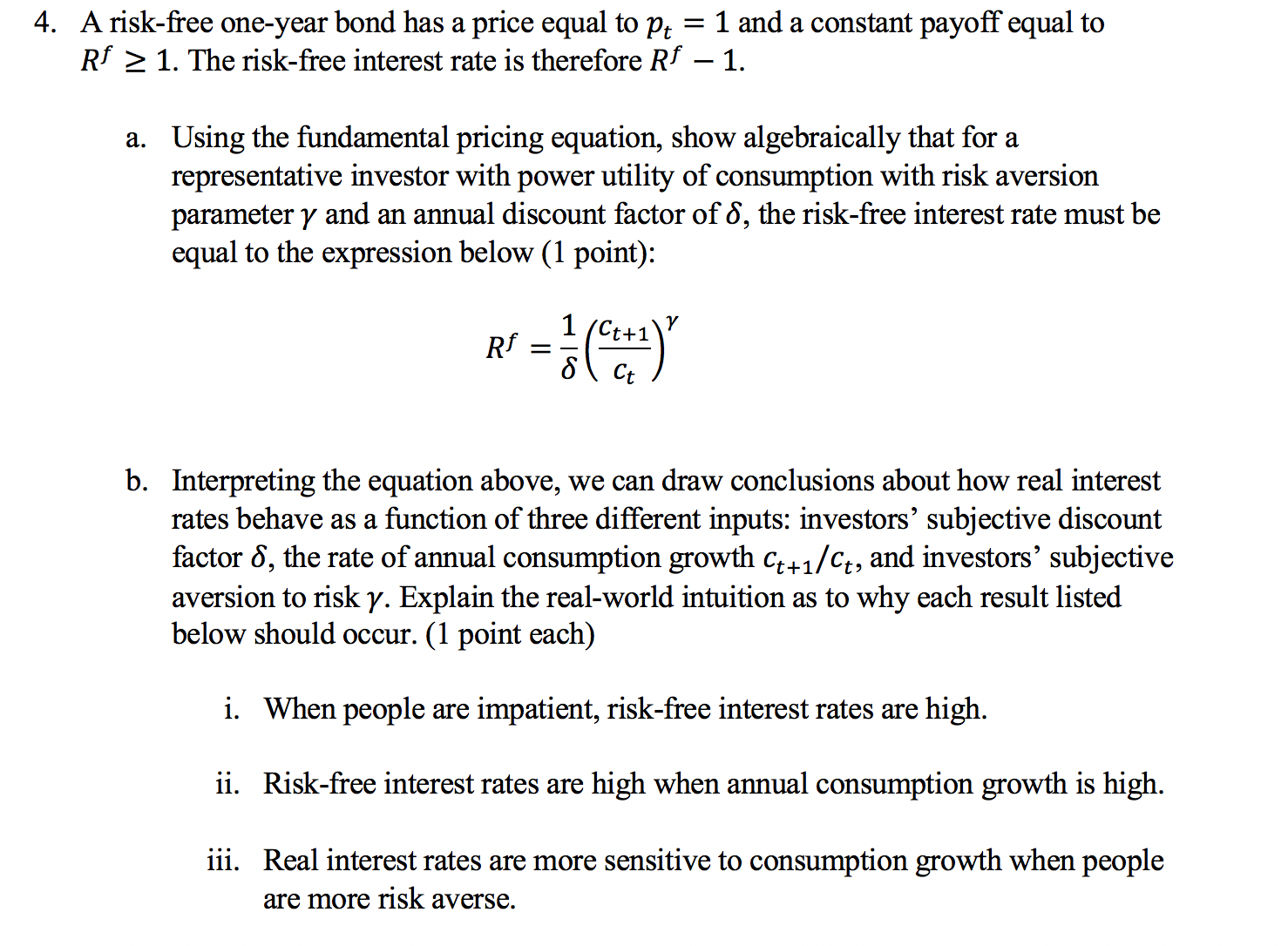

4. A risk-ee one-year bond has a price equal to p, = 1 and a constant payoff equal to Rf 2 1. The riskfree interest rate is therefore Rf 1. a. Using the fundamental pricing equation, show algebraically that for a representative investor with power utility of consumption with risk aversion parameter 1/ and an annual discount factor of 6, the riskfree interest rate must be equal to the expression below (1 point): Rf = 1(a)? 6 ct b. Interpreting the equation above, we can draw conclusions about how real interest rates behave as a function of three dierent inputs: investors' subjective discount factor 6, the rate of annual consumption grth CH1/Ct, and investors' subjective aversion to risk 1/. Explain the realworld intuition as to why each result listed below should occur. (1 point each) i. When people are impatient, risk-free interest rates are high. ii. Risk-free interest rates are high when annual consumption grth is high. iii. Real interest rates are more sensitive to consumption growth when people are more risk averse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts