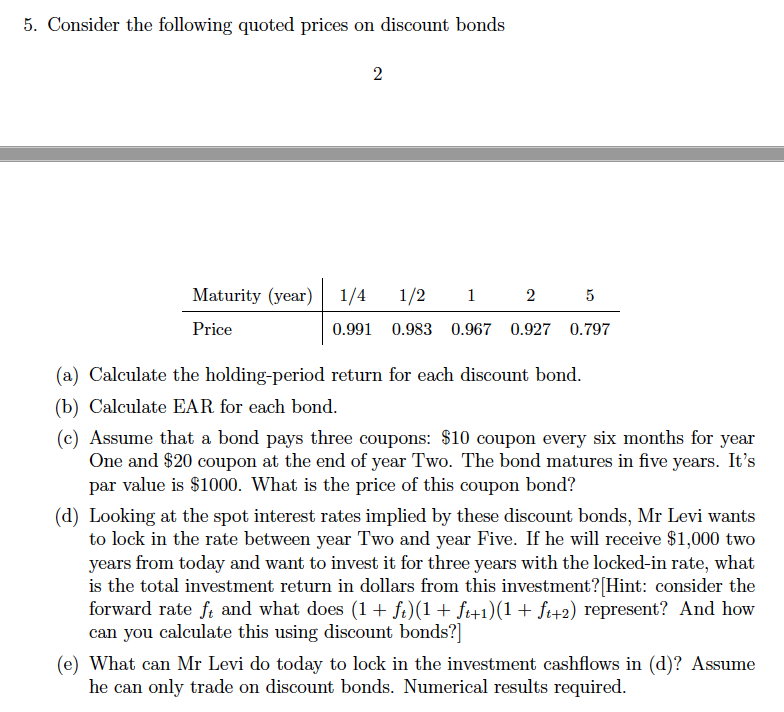

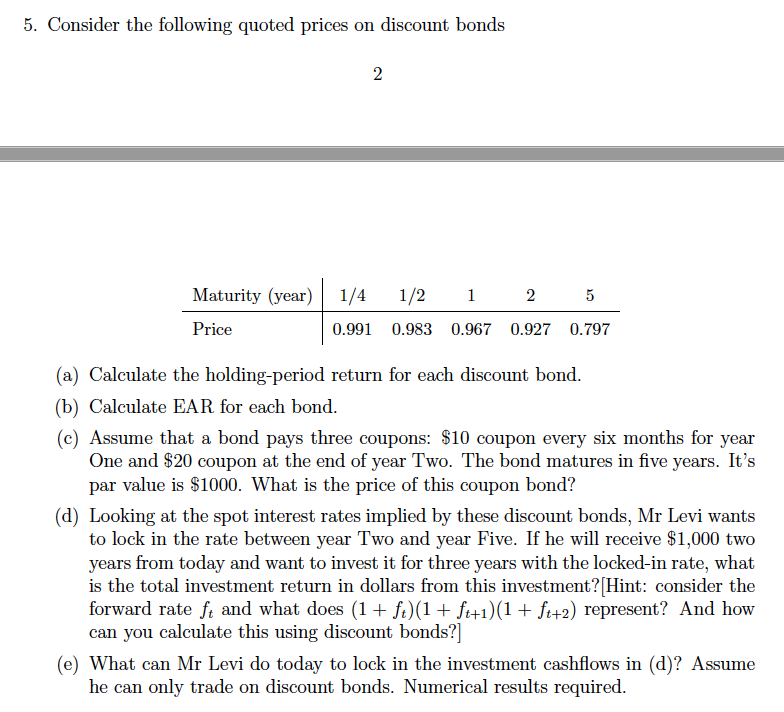

Question: the question is on the screen shot thx 5. Consider the following quoted prices on discount bonds (8) (b) (C) (d) (e) 2 Maturity (ye-ax)'

the question is on the screen shot thx

5. Consider the following quoted prices on discount bonds (8) (b) (C) (d) (e) 2 Maturity (ye-ax)' 1/4 1/2 1 2 5 Price '0391 0.933 0.967 0.927 0.797 Calculate the holdingperiod return for each discount bond. Calculate EAR for each bond. Assume that a bond pays three coupons: $10 coupon every six months for year One and $20 coupon at the end of year Two. The bond matures in ve years. It's par value is $1000. What is the price of this coupon bond? Looking at the spot interest rates implied by these discount bonds1 Mr Levi wants to lock in the rate between year rI'wo and year Five. If he will receive $1,000 two years from today and want to invest it for three years with the lockedin rate, what is the total investment return in dollars from this investment? [Hintz consider the forward rate ft and what does (1 + ft)(1 + ft+1](1 + 1}") represent? And how can you calculate this using discount bonds?] What can Mr Levi do today to lock in the investment cashows in (d)? Aliume he can only trade on discount bonds. Numerical results required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts