Question: The question must be done considering ' Average Receivables' and comparing 'the cost of discounting' with the 'cost of financing'. b) Fine Lace Co is

The question must be done considering ' Average Receivables' and comparing 'the cost of discounting' with the 'cost of financing'.

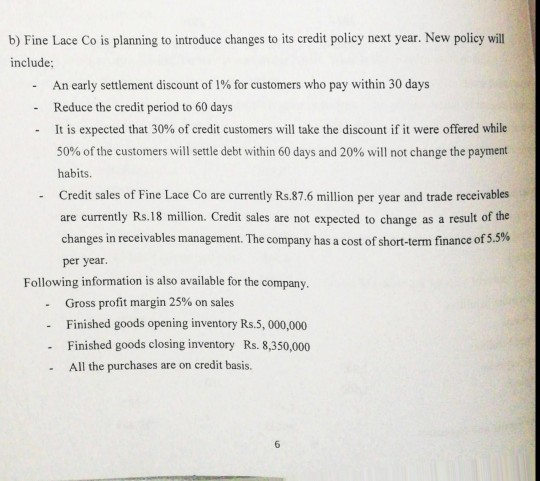

b) Fine Lace Co is planning to introduce changes to its credit policy next year. New policy will include: - An early settlement discount of 1% for customers who pay within 30 days Reduce the credit period to 60 days It is expected that 30% of credit customers will take the discount if it were offered while 50% of the customers will settle debt within 60 days and 20% will not change the payment habits. Credit sales of Fine Lace Co are currently Rs.87.6 million per year and trade receivables are currently Rs.18 million. Credit sales are not expected to change as a result of the changes in receivables management. The company has a cost of short-term finance of 5.5% per year. Following information is also available for the company. Gross profit margin 25% on sales Finished goods opening inventory Rs.5,000,000 Finished goods closing inventory Rs. 8,350,000 All the purchases are on credit basis. 6 wie Okulate the net benefit er eest of the proposed changes in trade receivables policy and comment (05 Marks) on your findings 106 Marks) (Total 30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts