Question: THE QUESTION WILL BE ON FILE PLEASE. ITS mostly about filling up the blanck space See Figure 1 above to answer the following questions: With

THE QUESTION WILL BE ON FILE PLEASE. ITS mostly about filling up the blanck space

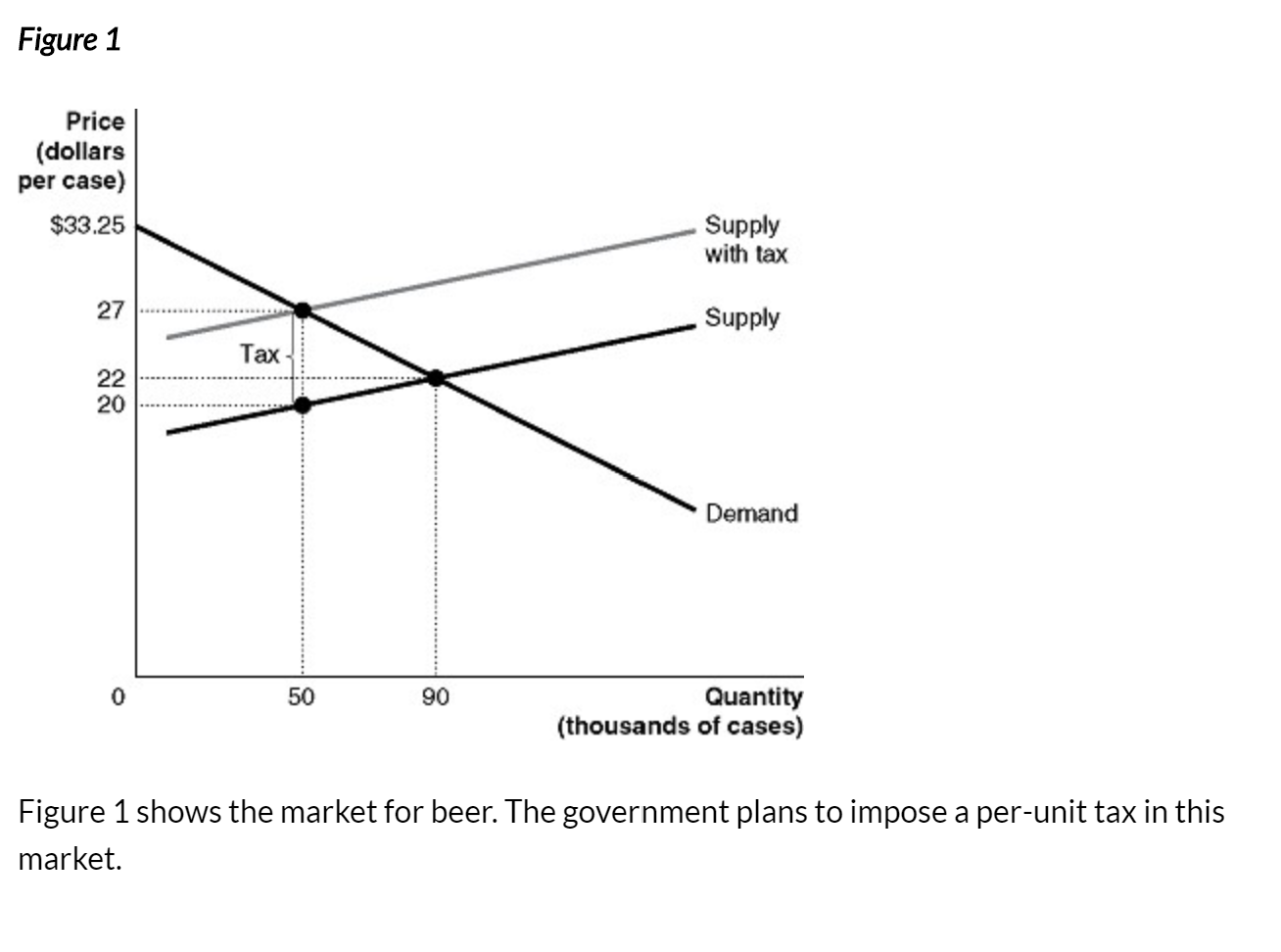

See Figure 1 above to answer the following questions: With no tax imposed, what is the equilibrium price of a case of beer? $ With no tax imposed, how many cases of beers will be bought and sold? If the government imposes the tax in the gure, what is the size of the peru nit tax? 35 Is this tax imposed on producers or consumers? In other words, who bears the statutory tax incidence? How many cases of beer will be sold after the tax is imposed? What price will consumers pay for each case of beer after the tax is imposed? $ How much will producers get per case after the tax is imposed? $ How much of the tax is paid by consumers? $ How much of the tax is paid by producers? $ Suppose the price of gasoline in July 2017 averaged $2.35 a gallon and 15 million gallons a day were sold. In October 2017, the price averaged $3.05 a gallon and 14 million gallons were sold. If the demand for gasoline did not shift between these two months, use the midpoint formula to calculate the price elasticity of demand. Show your work. Indicate whether demand was elastic or inelastic. 12pt V Paragraph BI U A & V T V . . .TRU E/FALSE EXPLAIN. Determine whether the following statement is true or false and explain why. All the points awarded for this question come from your explanation. If the best surgeon in town is also the best at cleaning swimming pools, then, according to economic reasoning, this person should split her time evenly between being a surgeon and cleaning swimming pools. 12pt V Paragraph V B I 9 V g V T2 V Figure 1 Price (dollars per case) $33.25 0 50 90 Quantity (thousands of cases) Figure 1 shows the market for beer. The government plans to impose a perunit tax in this market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts